Credit Agricole 4Q Profit Hit by Impairments

11 Février 2021 - 7:44AM

Dow Jones News

By Pietro Lombardi

Credit Agricole SA said Thursday that net profit for the fourth

quarter declined sharply, dragged by impairment at its Italian

business and provisions for bad loans, and that it is taking

further steps to simplify its structure.

France's second-largest listed bank by assets posted an almost

93% fall in net profit for the period, to 124 million euros ($150.3

million). This compares with analysts' expectations of a EUR165

million net loss, according to a consensus forecast provided by

FactSet.

The bank reported a EUR903 million impairment charge against

Credit Agricole Italia, as well as a nearly 59% increase in

provisions for soured loans, which were EUR538 million in the

quarter.

Revenue rose 2.6% to EUR5.25 billion, the company said.

The board will propose a dividend of EUR0.80 a share for 2020,

with a scrip dividend option.

Credit Agricole said it would fully unwind a regulatory

arrangement known as switch by the end of next year. Under the

switch guarantee mechanism, it transfers part of the regulatory

requirements related to its insurance operations to the regional

banks of the group, paying in return a fixed fee. The full

unwinding should boost the bank's net profit and revenue.

Write to Pietro Lombardi at pietro.lombardi@wsj.com;

@pietrolombard10

(END) Dow Jones Newswires

February 11, 2021 01:29 ET (06:29 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

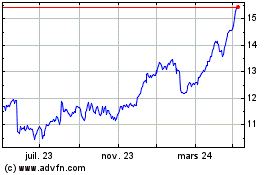

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

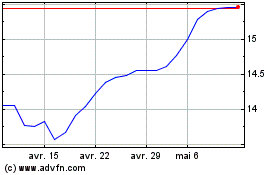

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024