Current Report Filing (8-k)

30 Août 2019 - 10:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report

(Date of Earliest Event Reported):

August 28, 2019

CAMPBELL SOUP COMPANY

|

|

|

|

|

|

|

|

|

New Jersey

|

|

1-3822

|

|

21-0419870

|

|

State of Incorporation

|

|

Commission File Number

|

|

I.R.S. Employer

Identification No.

|

One Campbell Place

Camden, New Jersey 08103-1799

Principal Executive Offices

Telephone Number: (856) 342-4800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Capital Stock, par value $.0375

|

CPB

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 – Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

On August 28, 2019, the Board of Directors (the “Board”) of Campbell Soup Company (the “Company”) elected Mick Beekhuizen, age 43, as the Company’s Senior Vice President and Chief Financial Officer, effective September 30, 2019.

Mr. Beekhuizen served as Chief Financial Officer of Chobani, LLC since April 2016. From April 2013 until February 2016, Mr. Beekhuizen was the Executive Vice President and Chief Financial Officer of Education Management Corporation.

In connection with his appointment as Chief Financial Officer, Mr. Beekhuizen will receive the following compensation arrangements:

|

|

|

|

(i)

|

base salary of $700,000 per year;

|

|

|

|

|

(ii)

|

target annual bonus for fiscal 2020 under the Company’s Annual Incentive Plan of 90% of base salary, pro rata, payable at the discretion of the Board and subject to the achievement of individual and Company performance goals and objectives; and

|

|

|

|

|

(iii)

|

target long-term incentive award for fiscal 2020 of 250% of base salary under the Company’s 2015 Long-Term Incentive Program.

|

Mr. Beekhuizen will receive his target long-term incentive award for fiscal 2020 on October 1, 2019, which will consist of 60% performance restricted stock units and 40% time-lapse restricted stock units. The performance restricted stock units will vest, if at all, on September 30, 2022 based on the Company’s TSR performance relative to peers. The time-lapse restricted stock units will vest 1/3 per year, over a 3-year period from the date of the grant. In addition, Mr. Beekhuizen will receive a one-time grant of $2,500,000 issued as time-lapse restricted stock units and a one-time cash payment of $700,000 in recognition of his forfeiture of equity awards and an annual bonus from his prior employment.

Mr. Beekhuizen will participate in the Company’s standard employee benefit and retirement programs, and receive $8,000 per quarter under the Personal Choice Program. The Company will also credit Mr. Beekhuizen’s Supplemental Retirement Plan account with an Executive Retirement Contribution equal to 10% of his base salary and annual incentive bonus. The Personal Choice Program and the Executive Retirement Contributions are further described in the Company’s 2018 Proxy Statement.

Mr. Beekhuizen will enter into a Change in Control Severance Protection Agreement in substantially the same form filed as Exhibit 10(m) to the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2011, and as amended by Exhibit 10(o) to the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2016.

There are no family relationships between Mr. Beekhuizen and any directors or executive officers of the Company. There are no transactions in which Mr. Beekhuizen has an interest which would require disclosure by the Company under Item 404(a) of Regulation S-K.

The Company has announced that Anthony P. DiSilvestro, Senior Vice President and Chief Financial Officer, will be leaving his role effective September 30, 2019 and departing the Company on October 15, 2019 to pursue other interests.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

CAMPBELL SOUP COMPANY

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: August 30, 2019

|

By:

|

/s/ Charles A. Brawley, III

|

|

|

|

|

Charles A. Brawley, III

|

|

|

|

|

Vice President, Corporate Secretary and Deputy General Counsel

|

|

|

|

|

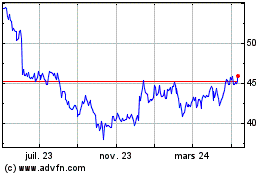

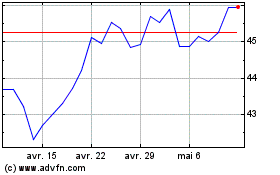

Campbell Soup (NYSE:CPB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Campbell Soup (NYSE:CPB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024