Danone Shares Fall After 3Q Sales, Lowered 2019 Views Disappoint -- Update

18 Octobre 2019 - 10:49AM

Dow Jones News

By Cristina Roca

--Shares in Danone fell sharply Friday after the food company

adjusted its guidance to lower sales growth expectations

--Danone reported an acceleration in 3Q like-for-like sales

growth, but analysts said the result was disappointing

--While nutrition surprised positively sales in the waters

division fell, while Danone's largest division was challenged

Shares in Danone SA (BN.FR) fell sharply Friday after the French

food company said it was adjusting its guidance to lower

expectations for its like-for-like sales growth in 2019, despite it

accelerating in the third quarter from the previous quarter.

Danone said sales came to 6.42 billion euros ($7.13 billion), up

from EUR6.19 billion the year previous and better than analysts'

consensus expectations of EUR6.37 billion.

On a like-for-like basis, sales rose 3%, Danone said.

Despite its sales growth accelerating compared with the previous

quarter, Danone widened its guidance of full-year like-for-like

sales growth toward the lower end. It now sees like-for-like sales

growing 2.5%-3%, compared with previous guidance of 3%. For the

first nine months of the year, like-for-like sales grew 2.1%, the

maker of Activia and Alpro said.

Some of the headwinds Danone had flagged during second-quarter

reporting didn't ease in the third quarter, management said during

a conference call Friday morning. Danone cited tough comparison

bases in Europe for its waters business in particular.

At 0816 GMT, shares in Danone traded 6.7% lower at EUR73.34.

"This print is a disappointment, in the sense that it shows a

return of one of legacy issues at Danone, i.e. its unbalanced

growth profile," Citi analysts said.

Danone's essential dairy and plant-based products division, or

EDP, which accounts for roughly half of the group's sales, was weak

across the board, J.P. Morgan analysts said. EDP like-for-like

sales rose 0.7% in the third quarter, dragged down by falling sales

in Russia and weakness in yogurts in the U.S., Danone said.

"While 2020 targets were maintained, the deterioration of EDP

should cast doubt on such objectives," the bank's analysts

said.

Danone's nutrition division was a bright spot with 9.8%

like-for-like sales growth, which was above expectations and could

help mitigate worries around next year's margin target, Citi

said.

Danone backed its target of having a recurring operating margin

above 15% for 2019.

For the fourth quarter, the company said it expects its

like-for-like sales growth to speed up compared to the previous

quarters, led by China and southeast Asia. Regained distribution in

yogurts in the U.S. as well as further expansion in its plant-based

products should also help achieve this, Danone management said

during a call.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

October 18, 2019 04:34 ET (08:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

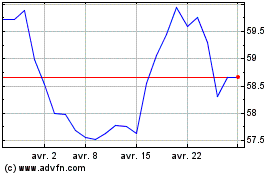

Danone (EU:BN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Danone (EU:BN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024