Developers Woo Retail Tenants With Tallest-Ever Warehouses

22 Janvier 2019 - 3:29PM

Dow Jones News

By Esther Fung and Keiko Morris

Developers across the U.S. are racing to build larger and more

sophisticated warehouses, aiming to capitalize on retailers' desire

for ever-faster deliveries.

Property owners are competing for industrial space where

companies can sort packages closer to urban consumers and deliver

them more rapidly. To attract tenants, developers are offering a

wide range amenities, like more loading docks, higher ceilings,

hundreds of parking spaces, and stronger structures to support the

movement of large volumes of goods.

They are also building warehouses higher than ever. Less than a

year after Prologis Inc. opened the country's first three-story

warehouse in Seattle -- a 589,615 square-foot facility that has

ramps to the second-floor and a freight elevator to the third floor

-- developers in New York, North Carolina and Wisconsin are

building the first ones with four stories.

"I think when it's done, it will be an iconic building," said

Dov Hertz, president of DH Property, referring to a planned

four-story Brooklyn warehouse in Sunset Industrial Park along the

Gowanus Canal.

His firm and Bridge Development Partners LLC recently purchased

an 18-acre site where they plan to demolish existing buildings to

build a four-story, approximately 1.2 million-square-foot

distribution center.

The first two stories of the planned warehouse will have a

height of 32 feet each, and the upper two stories will be 28 feet

each, making the facility as tall as a 12-story building.

Development is expected to start by the end of 2020. DH Property is

also building a three-story warehouse in Brooklyn.

In the Bronx, Innovo Property Group is demolishing a movie

theater to make way for a ramped, two-story warehouse with 863

parking spaces -- an enormous capacity in New York City but

necessary for modern, functional facilities -- said the firm's

chief executive, Andrew Chung.

Brokers say it's a coup for developers to secure large sites in

New York, because they offer tenants faster access to households in

Brooklyn and Queens than do existing New Jersey warehouses.

But some analysts say these state-of-the-art warehouses are

risky bets. Developers are paying for expensive land, usually

without a committed tenant. Most retail tenants commit only after

they see steel going up. Multi-story warehouses are also more

costly to build, with a rule of thumb that the cost per square foot

is doubled for every floor added, real estate executives say.

There are also questions about the depth of demand and whether

these new warehouses will address the needs of tenants that may

change during the next few years.

"Is there demand for such a luxury good? That's the

billion-dollar question," said Eric Frankel, an analyst with Green

Street Advisors.

On Staten Island, warehouse developer Matrix Development Group,

which counts furniture chain IKEA and Amazon.com Inc. as tenants,

is not planning to build any multistory projects.

For us, "much less expensive spaces is the better-end of the

market," said Matrix's Chief Executive Officer Joe Taylor, adding

that suburban facilities do offer flexibility for tenants catering

to New York City.

Still, some said these higher expenses are justified. If tenants

can save on labor and transportation costs, which account for more

of the expenses in supply chains, they will be willing to pay

higher rents. Parking space for trucks is also in high demand,

especially in New York.

"There's a lot of value to fleet parking," said Brad Cohen,

senior vice president at property consultancy CBRE.

In New York City, warehouse rents averaged $20.89 per square

foot in the fourth quarter last year, up 4.5% from a year earlier,

according to data from CoStar Group. Rents in the rest of the New

York metro area rose 4.9% to $10.43 per square foot over the same

period.

"Are we slightly above market rents? Yes, but we can't be too

far out of whack," said Jeff Milanaik, partner for Bridge

Development Partners' Northeast region. He estimated that rents

could be around the mid-$30s per square foot.

Write to Esther Fung at esther.fung@wsj.com and Keiko Morris at

Keiko.Morris@wsj.com

(END) Dow Jones Newswires

January 22, 2019 09:14 ET (14:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

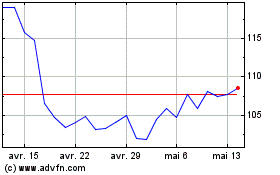

Prologis (NYSE:PLD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Prologis (NYSE:PLD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024