By Joe Flint

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 15, 2019).

Walt Disney Co. moved to take full control over Hulu through a

wide-ranging deal with Comcast Corp., ending years of complicated

ownership of one of the media industry's hot properties.

A streaming-service pioneer, Hulu had four parents when it was

launched in 2008, primarily as a hedge against internet piracy of

TV shows.

It has since emerged from an afterthought in the streaming wars

to a legitimate competitor to Netflix Inc. by expanding into live

television and betting on original shows such as "The Handmaid's

Tale," a critical and commercial success.

Under Tuesday's agreement, Comcast -- Hulu's last remaining

minority stakeholder -- can require Disney to purchase the

one-third stake its NBCUniversal subsidiary owns in Hulu as early

as 2024, the companies said.

Disney can also require NBCUniversal to sell that stake to

Disney for at least $9 billion, under a guarantee that Hulu's

equity value at the time of a deal be at least $27.5 billion. Just

last month, the streaming service was valued at $15 billion, when

another minority shareholder, AT&T Inc., agreed to sell its

stake back to Hulu.

Disney, which is launching its own direct-to-consumer streaming

service called Disney+, has ambitious plans for Hulu. The company

has said its own streaming service would focus on content for

families and children, while Hulu is expected to be an outlet for

shows aimed at adults. After buying most of the entertainment

assets of 21st Century Fox, Disney now owns the Twentieth Century

Fox library, as well as the FX cable channel, the latter of which

is known for edgier fare. At an investor conference Tuesday, Disney

Chief Executive Robert Iger said he could see FX making original

content for Hulu.

Having a clear mission is a major change for Hulu, which has had

multiple owners -- including Comcast, 21st Century Fox, Disney and

Time Warner Inc. -- since its inception as a joint venture. That

often led to conflicts over strategy as each company had different

priorities, and the lack of direction led Hulu to be known in the

industry as "Clown Co."

Hulu's original goal was to be a platform for broadcast

television shows in the hopes that people would stop going to

Google's YouTube or other portals to watch pirated content.

The streaming service managed to grow its subscriber base from 6

million in 2014 to more than 25 million last year by moving

aggressively into both original content and offering a pay-TV

distributor service called Hulu Plus, which is a low-budget

alternative to traditional cable and satellite television.

Hulu's owners have pumped billions of dollars into the company,

which is unprofitable. At an investor conference last month, Disney

said Hulu's operating losses would hit $1.5 billion in fiscal 2019

and a slightly smaller loss in 2020. The company said Hulu's

domestic operations would become profitable in either fiscal 2023

or 2024.

As part of their deal, Disney and Comcast agreed that future

"capital calls" will be funded through a combination of equity and

debt. If Comcast doesn't participate, its stake would be reduced,

though never below 21%.

Comcast on Tuesday said it would give up its three seats on the

Hulu board. For Disney, the arrangement helps clear a path for the

entertainment giant to manage Hulu without having a competitor at

the table to weigh in on strategy. Although Disney already

controlled the Hulu board, the bylaws of the company gave some veto

power to Comcast.

For Comcast, the deal allows it to capitalize financially if

Hulu is successful over the next few years, even as the cable giant

pursues its own path in streaming video. NBCUniversal is launching

a direct-to-consumer service next year that will be free to cable

TV subscribers and available for a subscription fee to

cord-cutters.

Part of Hulu's value for consumers is its ability to show

programming from major networks including ABC, Fox and NBC during

the TV season. As part of the Disney pact, Comcast's current deal

to provide NBCUniversal content can end in three years -- and in

one year, NBCUniversal will be able to put some of that content on

its as-yet unnamed streaming service.

NBCUniversal Chief Executive Steve Burke said the deal is "a

perfect outcome for us," adding that the "extension of the

content-licensing agreement will generate significant cash flow for

us, while giving us maximum flexibility to program and distribute

to our own direct-to-consumer platform."

As part of the arrangement, Disney and Comcast said they would

fund Hulu's recent purchase of AT&T's stake in the streaming

platform. That deal increased Disney's interest in Hulu to 66% and

NBCUniversal's to 33%.

In the past few years, Hulu has become known for its original

programming, as well as for being a place to catch up on shows from

other outlets. The service is launching "Catch-22," a new ambitious

limited series based on the Joseph Heller novel and starring George

Clooney.

Hulu in February cut the price for its least expensive

subscription plan and raised the cost of its live TV offering, in

an effort to bolster its subscriber numbers while increasing the

profit margins on its most expensive plan.

Micah Maidenberg contributed to this article.

Write to Joe Flint at joe.flint@wsj.com

(END) Dow Jones Newswires

May 15, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

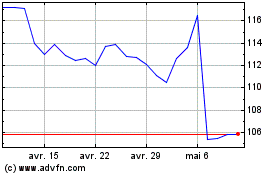

Walt Disney (NYSE:DIS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Walt Disney (NYSE:DIS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024