Dollar At Multi-day Low Vs Franc After Disappointing U.S. Retail Sales Data

01 Avril 2019 - 11:53AM

RTTF2

The U.S. dollar declined to a multi-day low against the Swiss

franc in the European session on Monday, following a data showing a

modest decrease in U.S. retail sales for February.

Data from the Commerce Department showed that retail sales

dipped by 0.2 percent in February after climbing by an upwardly

revised 0.7 percent in January.

Economists had expected sales to rise by 0.3 percent compared to

the 0.2 percent uptick originally reported for the previous

month.

Excluding a rebound in sales by motor vehicle and parts dealers,

retail sales fell by 0.4 percent in February after jumping by a

revised 1.4 percent in January.

Ex-auto sales had been expected to climb by 0.4 percent compared

to the 0.9 percent increase originally reported for the previous

month.

Investors awaited high-level trade talks between the world's two

largest economies after Washington remarked that the negotiations

were "candid and constructive."

Beijing announced that it would continue to suspend additional

tariffs on U.S. vehicles and auto parts after April 1 as a gesture

after Washington delayed tariff hikes on Chinese imports.

The greenback showed mixed trading against its major

counterparts in the Asian session. While it fell against the euro

and the pound, it held steady against the franc. Against the yen,

it rose.

The greenback that closed Friday's trading at 0.9951 against the

franc fell to a 5-day low of 0.9931. Continuation of the

greenback's downtrend may take it to a support around the 0.98

mark.

Data from the Federal Statistical Office showed that

Switzerland's retail sales fell for the fourth consecutive month in

February.

Retail sales fell a calendar-adjusted 0.2 percent year-on-year

in February, same as in January. In December, retail sales declined

0.5 percent.

The greenback edged down to 110.81 against the yen, from an

early near a 2-week high of 111.19. The greenback is seen

challenging support around the 108.00 region.

The U.S. currency remained lower at 1.3113 against the pound,

down from last week's closing value of 1.3034. On the downside,

1.33 is likely seen as the next support for the greenback.

Survey data from IHS Markit showed that UK manufacturing sector

grew at the fastest pace in over a year in March, as stockpiling by

businesses hit a record as they braced for Brexit disruptions.

The CIPS purchasing managers' index, or PMI, for the

manufacturing sector climbed to a 13-month high of 55.1 from 52.1

in February. Economists had forecast a score of 51.2.

The greenback fell back to 1.1247 against the euro, not far from

a 4-day low of 1.1250 touched at 4:30 am ET. Next key support for

the greenback is likely seen around the 1.14 region.

Preliminary data from the statistical office Eurostat showed

that Eurozone inflation slowed in March, defying expectations for

stability, while the unemployment rate remained unchanged in

February.

Headline inflation slowed to 1.4 percent from 1.5 percent in

February. Economists had expected the inflation rate to remain

unchanged.

The greenback retreated to 0.6836 against the kiwi, a pip short

of a 5-day low of 0.6837 seen at 1:45 am ET. If the greenback

declines further, 0.70 is likely seen as its next support

level.

The greenback pulled back to 0.7129 against the aussie, just few

pips short of a 5-day low of 0.7132 hit at 3:30 am ET. The

greenback is poised to find support around the 0.73 region.

The greenback slipped to 1.3337 against the loonie, its lowest

since March 21. This follows a high of 1.3370 set at 8:30 am ET.

The greenback is likely to challenge support around the 1.31

level.

The U.S. ISM manufacturing index for March, construction

spending for February and business inventories for January are

scheduled for release shortly.

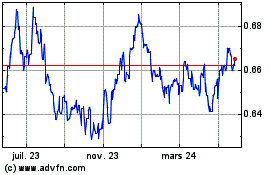

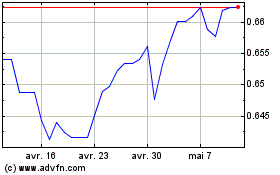

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024