Dollar Mixed After U.S. Retail Sales Data

16 Avril 2018 - 11:08AM

RTTF2

The U.S. dollar turned mixed against its major counterparts in

the European session on Monday, following the release of a data

showing better than expected U.S. retail sales growth in March.

Data from the Commerce Department showed that retail sales

climbed by 0.6 percent in March after edging down by 0.1 percent in

February. Economists had expected retail sales to rise by 0.4

percent.

Excluding the jump in auto sales, retail sales edged up by 0.2

percent in March, matching the uptick seen in the previous month as

well as economist estimates.

Investors await a new round of economic sanctions against Moscow

for its involvement in Syrian President Bashar al Assad's suspected

chemical weapons attack.

Recent tax cuts and spending hikes by the federal government to

stimulate economic growth have given more confidence in attaining

the inflationary goal soon, Minneapolis Federal Reserve President

Neel Kashkari said.

"It now seems much more likely that we are going to actually

achieve our inflation target in the near future, which would be a

good thing," Kashkari said in an interview with the Wall Street

Journal published today.

The U.S. housing starts and industrial production are due

tomorrow, followed by Fed's Beige Book on Wednesday. Weekly jobless

claims and leading indicators will be out on Thursday.

A raft of Fed speeches are scheduled for this week, which would

give clues regarding whether the Fed will be aggressive in raising

rates. Speeches from Atlanta Fed President Raphael Bostic and

Dallas Fed President Robert Kaplan are due later in the day. San

Francisco Fed President John Williams, Fed governor Randal Quarles,

Philadelphia Fed President Patrick Harker and Chicago Fed President

Charles Evans are due to speak on Tuesday. New York Fed president

Willam Dudley speaks on Wednesday, while Cleveland Fed President

Loretta Mester gives address on Thursday.

The greenback declined against its major rivals in the Asian

session, amid lingering concerns over missile attacks against Syria

by U.S. led coalition.

The greenback bounced off to 107.39 against the yen, from a

4-day low of 107.13 set at 1:30 am ET. The greenback is seen

finding resistance around the 110.00 level.

The Japan government maintained its economic view, saying the

economy is recovering at a moderate pace.

The cabinet office said both private consumption and exports are

picking up, unchanged from March assessment.

The greenback held steady against the Swiss franc, after having

fallen to a 4-day low of 0.9592 at 5:30 am ET. The pair finished

last week's deals at 0.9617.

Data from the Federal Statistical Office showed that

Switzerland's producer and import prices increased in March.

Producer and import prices rose 2 percent year-on-year in

March.

The greenback fell to a 4-day low of 1.2375 against the euro,

following a rise to 1.2322 at 5:00 pm ET. If the greenback falls

further, 1.25 is possibly seen as its support level.

The greenback remained lower at near a 3-month low of 1.4321

against the pound. At Friday's close, the pair was valued at

1.4244.

Data from property tracking website Rightmove showed that the

U.K. house prices rose 0.4 percent on month in April, coming in at

a record 305,732 pounds.

That follows the 1.5 percent spike in March, and it beats the

old mark of 304,943 set in July 2017.

The U.S. NAHB housing market index for April is scheduled for

release shortly.

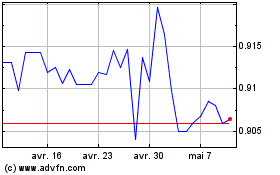

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024