Dollar Recovers After U.S. GDP Data

26 Janvier 2018 - 10:55AM

RTTF2

The U.S. dollar erased its early losses against its major

counterparts in the European session on Friday, as the U.S.

economic growth steadied in the fourth quarter and the U.S.

President Donald Trump remarked that he favors a strong

currency.

Data from the Commerce Department showed that real gross

domestic product increased by 2.6 percent in the fourth quarter

compared to the 3.2 percent growth seen in the third quarter.

Economists had expected GDP to climb by 3.0 percent.

Data from the Commerce Department showed a substantial increase

in new orders for U.S. manufactured durable goods in the month of

December.

The Commerce Department said durable goods orders spiked by 2.9

percent in December after surging up by an upwardly revised 1.7

percent in November.

The U.S. currency is on track to be stronger and stronger as the

nation is becoming strong again, Trump said in an interview from

the World Economic Forum in Davos, Switzerland.

"Our country is becoming so economically strong again — and

strong in other ways, too, by the way — that the dollar is going to

get stronger and stronger. And ultimately, I want to see a strong

dollar," he told.

The greenback rose back to 109.57 against the yen, off its early

low of 108.91. This may be compared to a 2-day high of 109.77 hit

at 7:15 pm ET. The greenback is seen finding resistance around the

111.00 region.

Data from the Ministry of Internal Affairs and Communications

showed that Japan consumer prices rose 1.0 percent on year in

December.

That was unchanged from the November reading, although it came

in beneath expectations for a gain of 1.1 percent.

The greenback staged a brief recovery to 0.9364 against the

franc, off its prior low of 0.9328. If the greenback rises further,

0.95 is likely seen as its next resistance level.

The greenback bounced off to 1.2422 against the euro, from a low

of 1.2493 hit at 2:45 am ET. The greenback is seen finding

resistance around the 1.23 region.

Survey of Professional Forecasters published by the European

Central Bank showed that the near term inflation is expected to

rise more than previously projected.

Forecasters raised their inflation outlook for 2018 to 1.5

percent from 1.4 percent. Likewise, the outlook for 2019 was lifted

to 1.7 percent from 1.6 percent. Inflation is seen at 1.8 percent

in 2020.

The greenback erased some of its early losses against the pound

with the pair trading at 1.4211. This may be compared to a low of

1.4281 hit at 4:30 am ET. The next possible resistance for the

greenback is seen around the 1.38 level.

The greenback reversed from an early low of 1.2301 against the

loonie, rising to 1.2360. Continuation of the greenback's uptrend

may see it challenging resistance around the 1.26 area.

The greenback recovered to 0.8061 against the aussie and 0.7324

against the kiwi, from its early lows of 0.8097 and 0.7375,

respectively. The currency is thus heading to pierce its multi-day

highs of 0.8005 and 0.7291,respectively hit against the aussie and

the kiwi in the Asian session. On the upside, 0.78 and 0.72 are

possibly seen as the next resistance levels for the greenback

against the aussie and the kiwi, respectively.

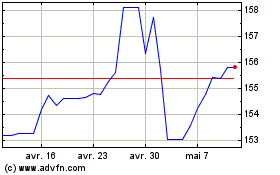

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024