Dollar Sell-off Accelerates On Heightened U.S.-Iran Tensions

06 Janvier 2020 - 9:43AM

RTTF2

The U.S. dollar began the week on the back foot as geopolitical

tensions between Iran and the U.S. flared up after Iran vowed to

retaliate against Suleimani's death, and Donald Trump threatened to

strike back in a disproportionate manner.

Tensions escalated over the weekend after Iran vowed to

retaliate against U.S air strike last week and said that it will

not abide by the uranium enrichment limits under the 2015 nuclear

deal.

Trump also threatened sanctions against Iraq after its

parliament called on U.S. forces to leave the country, amid a

growing backlash over the U.S. killing of a top Iranian military

commander.

He said that the United States will strike back in a

disproportionate manner, if Iran strikes any U.S. person or

target.

Global markets fell, while safe-haven assets such as gold and

the yen climbed on concerns that Middle East tensions will hurt

growth.

On the economic front, the IHS Markit will release the U.S.

services PMI for December later in the day.

The currency showed mixed trading against its major counterparts

in the Asian session. While it fell against the yen and the pound,

it held steady against the franc and the euro.

The greenback declined to a 4-day low of 0.9684 against the

franc from last week's closing value of 0.9722. The next possible

support for the greenback is seen around the 0.95 mark.

The greenback weakened to 4-day lows of 1.1206 against the euro

and 1.3175 against the pound, reversing from its early highs of

1.1157 and 1.3064, respectively. The greenback is likely to face

support around 1.14 against the euro and 1.34 against the

pound.

Pulling away from an early high of 1.2990 against the loonie,

the greenback edged lower to 1.2964. If the currency drops further,

it may challenge support around the 1.28 level.

The greenback came off from an early high of 0.6644 against the

kiwi and fell to 0.6680. The greenback is seen finding support

around the 0.68 level.

The U.S. currency was trading at 0.6947 a aussie, following an

advance to 0.6932 in the previous session. The greenback is poised

to find support around the 0.71 level.

In contrast, the greenback was trading at 108.11 versus the yen,

after falling to 107.77 in the previous session, which was its

weakest since October 10. The pair had ended last week's deals at

108.08.

The latest survey from Nikkei showed that Japan's manufacturing

sector continued to contract in December, and at a faster rate,

with a manufacturing PMI score of 48.4.

That's down from 48.9 in November and it moves further beneath

the boom-or-bust line of 50 that separates expansion from

contraction.

Looking ahead, Markit's U.S. final services PMI for December is

set for release in the New York session.

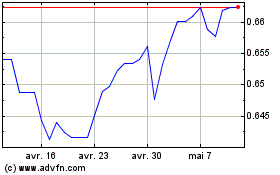

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

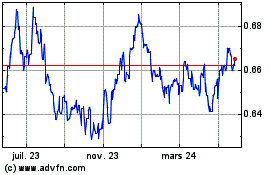

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024