Draghi Warns Of Protectionist Threats After Signaling QE End

14 Juin 2018 - 12:47PM

RTTF2

European Central Bank President Mario Draghi warned on Thursday

that risks from global factors such as protectionism has increased

after the bank signaled that it would end its massive bond-buying

program at the end of this year.

"Uncertainties related to global factors, including the threat

of increased protectionism, have become more prominent," Draghi

said in the introductory statement to his press conference.

"Moreover, the risk of persistent heightened financial market

volatility warrants monitoring."

Earlier on Thursday, the bank announced that it hopes to halve

its monthly bond purchases to EUR 15 billion after September and to

end them in December.

The Governing Council, which held the latest policy session the

Latvian capital Riga, left the key interest rates unchanged. The

bank said interest rates will remain at their present level at

least through the summer of 2019 and beyond, if necessary.

Responding to questions from reporters, Draghi said the latest

policy decision was unanimous, adding that policymakers did not

discuss "if and when" to raise interest rates.

"The interest of our interest rate formulation is to give it a

time dimension, but not a precise one," Draghi said.

The overall result of low interest rates has been vastly

positive, he added.

The general character of the discussion was to remain patient,

prudent and persistent and this was unanimously confirmed, he

said.

Regarding asset purchases, Draghi said they were not

disappearing, but has become a new part of monetary policy and

remains a normal policy instrument.

He also said the collective intention of the Governing Council

was to avoid any unwarranted tightening of financial

conditions.

Replying questions on reinvestment of maturing bonds, Draghi

said it will be discussed at a future meeting and it is an

important discussion.

"We have to be mindful of the excess liquidity conditions," he

noted.

The ECB Chief, himself from Italy, stressed that it was not of

any interest to anybody to discuss the exit of the country from

euro.

"The euro is irreversible because it's strong, because people

want it," Draghi said.

Draghi unveiled the latest set of macroeconomic projections from

the ECB Staff during the press conference.

The Eurozone growth forecast for this year was slashed to 2.1

percent from 2.4 percent, while the projections for the next year

and 2020 were retained at 1.9 percent and 1.7 percent,

respectively.

"The risks surrounding the euro area growth outlook remain

broadly balanced," Draghi said.

He also said that the economic projections do not contain the

impact of trade measures that have not been implemented yet and

their direct consequences have been limited so far.

The euro area inflation outlook for both this year and next was

raised to 1.7 percent from 1.4 percent, mainly due to higher oil

prices. The forecast for 2020 was retained at 1.7 percent.

The progress towards a sustained adjustment in inflation has

been substantial so far and the uncertainty around the inflation

outlook is receding, Draghi said.

The bank expects underlying inflation to pick up towards the end

of the year and thereafter to increase gradually over the medium

term, supported by "monetary policy measures, the continuing

economic expansion, the corresponding absorption of economic slack

and rising wage growth."

Draghi also said that structural reforms in euro area countries

must be stepped up substantially.

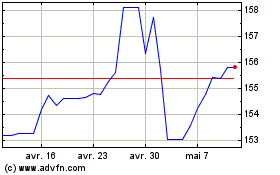

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024