EU Braces for U.S. Tariffs Over Airbus Dispute -- Update

16 Septembre 2019 - 7:39PM

Dow Jones News

By Emre Peker

BRUSSELS -- The U.S. is poised to impose new tariffs on European

Union exports over the bloc's subsidies to Airbus SE, the EU's

trade chief said Monday, citing the Trump administration's

unwillingness to settle a long-running commercial dispute over

aircraft manufacturers.

The EU expects the World Trade Organization to set the final sum

to which the U.S. is entitled in its successful complaint as soon

as Sept. 30, EU Trade Commissioner Cecilia Malmstrom said.

Washington has said it expects to be able to impose tariffs on $11

billion in annual EU exports.

The EU has filed its own WTO complaint against Boeing Co., but

as the U.S. began its case nine months earlier, Washington will be

able to punish Europe first.

Ms. Malmstrom said that the EU proposed a settlement to the U.S.

in July, also offering to cover its WTO case against Boeing, but

that the U.S. hasn't engaged. Brussels is planning to retaliate

with duties on $12 billion of U.S. exports once the WTO issues its

decision in the Boeing case, expected in early 2020.

Washington's envoy to the EU, Gordon Sondland, said Monday that

the EU didn't respond to U.S. invitations for a negotiated

solution.

"What the United States is seeking is an end to subsidies for

Airbus and the recovery of damages," he said through a

spokeswoman.

President Trump is prepared to act quickly and will resort to

tariffs if the U.S. can't recoup damages and change EU practices

through talks, the ambassador said. He didn't respond to a question

on why the U.S. didn't engage with Brussels's July proposal.

While the final awards in the 15-year-old Airbus and Boeing

cases are likely to be lower than the U.S. and EU claims, they will

still affect billions of dollars' worth of transatlantic trade. A

new round of levies could threaten EU-U.S. efforts to improve trade

relations after Mr. Trump's steel and aluminum duties last year

triggered European retaliation.

"We have enough tariffs in the world as it is," Ms. Malmstrom

said. "So imposing tariffs on each other...would not be a good

solution."

Washington and Brussels have so far kept their WTO fight

separate from broader trade issues. Meanwhile, the longstanding

allies have struggled to deliver on a July 2018 White House

agreement to strike a trade deal on industrial goods, except autos,

and cut red tape to facilitate more commerce.

Ms. Malmstrom said Monday that the parties were making progress

on regulatory cooperation. The trade deal, however, is stuck over

U.S. insistence on including agriculture, which the EU refuses

under the terms of the White House agreement that Brussels says

expressly omitted it.

A decision by Washington to place tariffs on European exports

based on the WTO case could rekindle an EU backlash.

The U.S. published a broad list of European products that it

could target, from food to bicycles and kitchen knives.

Washington's measures would also hit civil aviation products,

potentially denting Airbus sales, as well as the aircraft makers'

supply chains and U.S. production.

"Aviation is a global industry -- no aircraft is coming from one

single country or zone," an Airbus spokeswoman said. "It's a

lose-lose for the whole industry if we move to tariffs."

A Boeing spokesman declined to comment.

European negotiators presented their American counterparts with

a comprehensive proposal to regulate subsidies for the

civil-aircraft industry. EU officials said that plan could also

serve as the blueprint for a global framework. That would not only

settle the Boeing-Airbus feud but also help the EU and U.S.

jet-makers compete more effectively with Russian and Chinese

manufacturers challenging their primacy, according to EU

officials.

The EU suggested a plan that covers subsidies related to

research and development support; financing of large civil

aircraft; repayable launch investments that would qualify as loans;

and tax subsidies. EU officials said the proposal would cover all

the subsidies challenges and WTO rulings in the Airbus and Boeing

cases.

"We could still discipline ourselves even more, and that is what

we propose," Ms. Malmstrom said. "It would be a win-win if we did

that, because otherwise we escalate tariffs."

Write to Emre Peker at emre.peker@wsj.com

(END) Dow Jones Newswires

September 16, 2019 13:24 ET (17:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

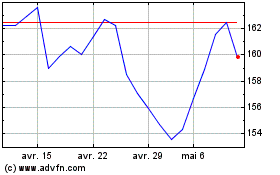

Airbus (EU:AIR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Airbus (EU:AIR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024