EUROPE MARKETS: European Stocks Climb As China Cools Trade Tensions And Italy Solves Political Crisis

29 Août 2019 - 12:36PM

Dow Jones News

By Callum Keown

European stocks climbed on Thursday as China eased trade war

tensions and raised hopes of a calm resolution.

The Stoxx 600 and the FTSE 100 both rose 1%, while the German

DAX lifted 1.1% on a strong morning for stocks.

Italy's FTSE MIB led the risers, climbing 1.9% after President

Sergio Mattarella gave Prime Minister Giuseppe Conte a mandate to

form a new government.

What's moving the markets?

China Commerce Ministry spokesman Gao Feng cooled trade-war

tensions on Thursday by saying the country would not immediately

respond to the latest tariffs imposed on it by the U.S.

He added that China remained in contact with Washington and that

discussions should move toward removing tariffs

(http://www.marketwatch.com/story/us-stock-futures-spike-as-china-says-it-wont-immediately-respond-to-tariff-hike-2019-08-29)to

prevent escalation.

The comments, sparking hopes of a calm resolution between the

world's two largest economies, triggered a surge in European

stocks.

David Madden, CMC Markets analyst, said: "The largely hopeful

tones of the update from China has lifted market sentiment, and

that sparked buying this morning.

"US-China relations have been volatile recently, but for now

there is a sense that things are heading in the right direction,

and that has coaxed some traders back into the market."

Italy's FTSE MIB was pushed higher still after President Sergio

Mattarella gave Prime Minister Giuseppe Conte a mandate

(http://www.marketwatch.com/story/conte-asked-to-seek-new-italy-government-aimed-at-foiling-salvini-2019-08-29)

to form a government.

The country's Democratic Party and the populist 5 Star Movement

agreed to form a new coalition on Wednesday, leaving former Deputy

Prime Minister Matteo Salvini on the sidelines.

Germany's minister for economic affairs, Peter Altmaier, said

the country's corporate tax rate could be cut to 25% in a bid to

help smaller businesses amid a gloomy backdrop.

Which stocks are active?

Bouygues (EN.FR) climbed 5.8% as the French conglomerate's

first-half operating profit beat expectations due to strong

performance in its telecoms

(http://www.marketwatch.com/story/bouygues-backs-forecast-as-profit-falls-2019-08-29)

and TV businesses. The group stuck to its full-year guidance

despite weakness in its construction businesses.

Pernod Ricard (RI.FR) rose 3.1% after the Paris-based spirits

company hiked its dividend and announced a share-buyback program

(http://www.marketwatch.com/story/pernod-ricard-hikes-dividend-readies-buybacks-2019-08-29).

The company also agreed a $223 million deal to buy drinks

manufacturer and marketer Castle Brands, adding Jefferson's Bourbon

and Brady's Irish Cream to its portfolio.

Micro Focus (MCRO.LN) shares tumbled 24% after the software

company warned full-year sales could drop 6-8% on last year's, due

to a deteriorating macro environment. The largest UK-based tech

firm had previously forecast a 4-6% revenue drop.

(END) Dow Jones Newswires

August 29, 2019 06:21 ET (10:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

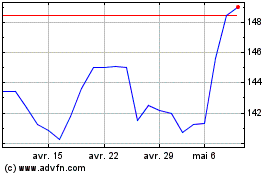

Pernod Ricard (EU:RI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pernod Ricard (EU:RI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024