Ecoslops 1st semester 2019: New strong growth in revenue and first

positive group EBITDA

Paris, September 25th, 2019 - 7:45 pm

Ecoslops, the cleantech that brings oil into the circular

economy, announces the results for the first half of the current

financial year, ended June 30, 2019, decided by the Council of

Directors at its meeting of 25 September 2019.

Vincent Favier, CEO of Ecoslops, says:

Ecoslops has achieved a significant milestone in the first half

of 2019 both operationally and financially and strategically.

Firstly, the Portuguese operating subsidiary is showing strong

growth in volumes, sales (+ 74% and x2 in refined products) and

profitability. Then, the rigorous management of the resources

committed to the construction of the Marseille unit and the

development of other projects (Mini P2R, Antwerp, Egypt, etc.) made

it possible to limit the net loss at € 0.5m against € 1.4m at the

same period last year and thus to clear for the first time a

positive Group EBITDA. Finally, the three financial closes bring a

long-term visibility in phase with our needs: entry of the Total

group into the capital of Ecoslops Provence (Marseille), firm

commitment by the BNP, HSBC and BP Med banks to the tune of € 6.5m

(Marseille) and financing from the European Investment Bank up to €

18 million (Marseille, Antwerp, R & D equity). This visibility

makes it possible to consider serenely the next semesters and to

proceed with the recruitments made necessary by a pipeline of

opportunities that continues to grow steadily.

| |

06/30/2019 |

06/30/2018 |

Var. k€ |

| Refined products |

3 595 |

1 697 |

1 898 |

| Seaport services &

Others |

958 |

915 |

43 |

| Total

turnover |

4 553 |

2 612 |

1 941 |

| |

|

|

|

| Operating

income |

5 093 |

2 701 |

2 392 |

| Operating

expenses |

(5 619) |

(4 051) |

(1 568) |

| Operating

profit |

(526) |

(1 350) |

824 |

| |

|

|

|

| Financial

loss |

(113) |

(164) |

51 |

| |

|

|

|

| Net result |

(481) |

(1 374) |

893 |

| Net result attributable

to the parent company |

(465) |

(1374) |

909 |

| |

|

|

|

| EBITDA

GROUPE |

125 |

(710) |

835 |

Strong growth in salesThe group's turnover

reached € 4.6m against € 2.6m in the first half of 2018 (including

€ 3.6mand € 1.7m in sales of refined products respectively). It is

recalled that the P2R unit of Sinès inPortugal had been the subject

of a scheduled shutdown during the first quarter of 2018 in order

to provide technical improvements.Over the semester, 13,360T were

produced (compared to 6,080T in 2018) and 12,000T sold (compared to

5 250T).The increase in Refined Products revenue is therefore the

result of a volume effect (+ 129%)and a decrease in the average

selling price / tonne of 7%, resulting from a fall in the average

price ofBrent by 12% and EUR / $ more favorable by 5%.

Positive Group EBITDA in the first halfFor the

first time, the Group EBITDA becomes positive. Sines unit posted

positive EBITDAjust over € 800,000 (compared with just under €

200,000 in the first half of 2018), whichcover the costs of

structure and holding.

Significantly stronger financial strengthOn

January 30, 2019, IAPMEI notified Ecoslops Portugal that an amount

of € 3,033,000 in a conditional advance became non-refundable in

view of the achievement of the socio-economic criteria of the

project.On March 29, 2019 and in accordance with the commitments

made previously, the Total Group entered up to 25% in the capital

and financing of the subsidiary Ecoslops Provence, which will

operate the Marseille unit.The first half of 2019 also saw the

signing of the announced financing contracts 2018, namely a € 6.5m

financing from BNP, HSBC and Banque Populaire Méditerranée for the

Marseille unit, as well as a € 18m "Corporate" financing from the

Bank European Investment for Marseille, Antwerp and R & D. The

first draws will have place during the second half of 2019.

At June 30, 2019, available cash amounted to € 4,445,000.Gross

debt amounted to € 7,233 thousand and shareholders' equity to €

23,137 thousand (€ 21,903 thousand excluding minority

interests).Net indebtedness at June 30, 2019 was € 2,788,000

compared with net cash of € 42,000 at December 31, 2018, reflecting

the investment period at the Marseille site (€ 3.8 million on the

first half of the year).

Diversification of trading partners in

SinesAfter the diversification of supply sources in 2018

(geographically qualitatively with the management of low flashpoint

residues), Ecoslops has expanded and diversified during the first

half of 2019, its client portfolio, particularly for Gasoil and

Bitumen light, so that there are several business options available

at any time. For the latter product, a new market for heavy bitumen

fluxing has been found, the European market for bitumen being very

under-loaded in road asphalt.

Development during the semester

Marseille

The Exploitation License was obtained on January 30, 2019.As

indicated above, the Total group entered on March 29, 2019, 25% of

the capital and financing of Ecoslops Provence, the project's

subsidiary.The additional financing (€ 6.5m) was contracted on

April 15, 2019 with a banking pool composed of BNP, HSBC and Banque

Populaire Méditerranée.

The Ecoslops team on site is now composed of 4 people, who

monitor the work. The start of the unit is expected mid-2020 with

delay on the initial planning (end 2019), essentially related to

the complexity of integrating a unit like P2R into a site existing

itself in the modernization phase in 2018 and then starting up in

2019. The six bins of storage, the entire civil engineering and the

furnace will be completed in 2019. The assembly of the P2R unit

will be carried out in the first half of 2020.

Antwerp

Regulatory studies continued and included quality analysis

productions of the unit of Sines by the OVAM, organization in

charge of the approvals in Region Flanders. The results will be

known by the end of the year. The ARA (Antwerp-Rotterdam-Amsterdam)

market is waiting for a solution like the one proposed by Ecoslops.

The Belgium therefore plans to grant product statuses only to

distillation solutions (compared to current conventional

decantation and centrifugation solutions). As a reminder, part of

the EIB financing is intended to finance the share of own funds

needed by the Antwerp unit.

Mini P2R

The pilot of the Mini P2R has been tested on the first semester

at Sines and has proven its ability to separate in commercial oil

cuts the residues generated in medium-sized ports. Discussions are

initiated with several interested partners to host the first unit

and the objective is to contract the first unit by the end of the

year.

Egypt

The preliminary draft is continuing and should be presented to

the Egyptian authorities before the end of the year for decision. A

land was selected in Port Said on which soil studies are in

progress.The potential is linked to the annual traffic passing

through the Suez Canal and the total lack of installation

collection and processing currently. This project provides for the

initial installation ofmeans of collection (barge), reception and

separation water / hydrocarbons. A P2R unit will be installed once

the volumes treated justify it.

New projects

During the semester, new leads with slops collecting companies

were developed in areas with very high potential. These leads

should complete the mesh projects outside Europe, especially in

Asia's strategic zone, the world's largest terms of maritime

traffic and the availability of oil residues.

Outlook and subsequent events

Over the year as a whole, the estimated production in Sinès

should be between 24,000T and 26,000T, compared to 19,200T in 2018.

Under these conditions, the turnover will be up on the full year

compared to last year, despite a lower Brent, last and a second

semester 2018 particularly good.A first draw of € 5m was made on

July 30, 2019 on the financing of the EIB.

Financial agendaFebruary 10th, 2020:

Operational Report and 2019 Turnover

ABOUT ECOSLOPSEcoslops is

listed on Euronext Growth in Paris Code ISIN : FR0011490648 -

Ticker : ALESA / PEA-PME eligible Investor Relations :

info.esa@ecoslops.com - 01 83 64 47 43

Ecoslops is the cleantech that brings oil into circular economy

thanks to an innovative technology allowing the company to upgrade

oil residues into new fuels and light bitumen. The solution

proposed by Ecoslops is based on a unique micro-refining industrial

process that transforms these residues into commercial products

that meet international standards. Ecoslops offers an economic and

ecological solution to port infrastructure, waste collectors and

ship-owners through its processing

plants. www.ecoslops.com

- sept25-19-PRecoslops-S1-2019

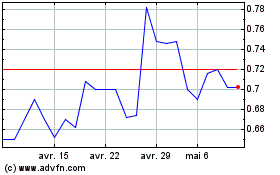

Ecoslops (EU:ALESA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ecoslops (EU:ALESA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024