- 3.5% revenue growth (or 4.2% excluding IFRS 15 impact)

- 1.8% organic growth

- Further execution of the Elior Group 2021 plan

- Full-year guidance confirmed

Regulatory News:

Elior Group (Paris:ELIOR) (Euronext Paris – ISIN: FR

0011950732), one of the world's leading operators in the catering

and support services industry, today released its consolidated

revenue figures for the first quarter of fiscal 2018-2019,

corresponding to the three months ended December 31, 2018.

Commenting on the Group's performance, Philippe Guillemot,

Elior Group’s Chief Executive Officer, said: “We had a good

first quarter, with our revenue performance in line with forecasts.

The 1.8% organic growth figure reflects a combination of robust

sales momentum and our stricter approach to selecting and managing

contracts. Our teams are fully committed to executing the Elior

Group 2021 plan, and mobilized, in the first instance, to stabilize

our performance during the fiscal year. Despite the troubled

climate in France I am confident in our ability to meet the

full-year targets we have set ourselves.”

Revenue

(in € millions)

Q1

2018-2019

Q1

2017-2018

Organicgrowth

Reportedgrowth

Contract catering & services 1,314 1,285

0.2% 2.2% Concession catering 440

409 6.7% 7.7% Group total

1,754 1,694 1.8%

3.5%

Business development

Business development since the start of fiscal 2018-2019 has

continued to reflect the more selective approach we have taken

since 2017-2018 to bidding for new contracts and seeking contract

renewals, with the client retention rate for the contract catering

& services business line declining to approximately 91%,

reflecting in particular the Group’s decision not to renew

contracts with the Ministry of Defense and the police in Italy.

Several major contracts were won in first-quarter 2018-2019:

- in contract catering & services

with the Tour Initiale office building at Paris La Défense,

Zenitude hotels, la Croix Saint-Simon and the Enghien-les-Bains

high schools in France, EDUCatt Roma university in Italy, Wiltshire

College and University Centre in the United Kingdom, the VIP

lounges at Palma de Mallorca and Alicante airports in Spain, Ramsey

Solutions in the United States and Hewlett-Packard in India.

- in concession catering with the

Paris-Charles-de-Gaulle, Alicante, Sevilla and Palma de Mallorca

airports.

Revenue

Consolidated revenue totaled €1,754 million for the first

quarter of fiscal 2018-2019. The 3.5% year-on-year increase

reflects (i) organic growth of 1.8%, (ii) 1.8% in acquisition-led

growth, (iii) a favorable 0.6% currency effect, and (iv) a negative

0.7% impact from changes in accounting policies, mainly due to the

first-time application of IFRS 15.

The proportion of revenue generated by international operations

rose to 58% in the first quarter of fiscal 2018-2019 from 57% in

the comparable prior-year period.

Contract catering & services revenue was up

€29 million, or 2.2%, year on year (+3.1% excluding the impact

of IFRS 15), coming in at €1,314 million and representing 75%

of total consolidated revenue.

Organic growth for this business line was 0.2% in the first

quarter of 2018-2019, reflecting the Group’s deliberate strategy

over the past year of exiting low-profitable contracts and taking a

more selective approach to contract bids.

Recent acquisitions1 accounted for €28 million, or 2.2% of total

contract catering & services revenue, and the currency effect

was a positive 0.7%.

Revenue for the international segment rose 3.3% to

€729 million. This segment’s organic growth was a negative

0.7% for the period whereas recent acquisitions and the currency

effect pushed up revenue by 4.0% and 1.2% respectively.

________________1 CBM Managed Services, consolidated since

December 1, 2017; Bateman Community Living, consolidated since

August 1, 2018; and bolt-on acquisitions.

- In Spain, growth was driven by a

favorable calendar effect.

- In the United States, revenue was

driven by the buoyant business development levels seen in

2017-2018.

- In Italy and the United Kingdom,

revenue was down year on year, despite strong momentum at existing

sites, due to the termination of public sector contracts,

particularly with the UK Ministry of Defence.

Revenue generated in France by this business line totaled

€585 million. Organic growth for the quarter was 1.4%. It was

boosted by a slightly favorable calendar effect.

- In the business & industry and

education markets, revenue was buoyed by the positive calendar

effect and good performances delivered by existing sites.

- Revenue in the healthcare market was

spurred by robust business development.

Concession catering revenue advanced 7.7% in the first

three months of 2018-2019 to €440 million, representing 25% of

total consolidated revenue for the period.

Organic growth for the period came to 6.7%. Acquisition-led

growth was 0.5% and changes in exchange rates – notably for the US

dollar and Mexican peso – had a positive 0.4% effect.

In the international segment, revenue jumped 12.2% to

€285 million. Organic growth was 10.8% and acquisitions and the

currency effect added 1.4% to the revenue figure.

- The motorways market felt the positive

effect of higher traffic volumes in Spain and Portugal, the opening

of new service plazas in Spain and Portugal and the end of

renovation works in the United States.

- The airports market was boosted by

increased traffic volumes, notably in Spain and Portugal, as well

as new points of sale in Spain, the United States, Denmark,

Colombia and Mexico.

Revenue generated by this business line in France totaled

€155 million, more or less unchanged compared with the first

quarter of 2017-2018 despite being slightly weighed down by the

protests seen in the country towards the end of the period.

- The motorways market saw good traffic

volumes, refurbished services plazas and the opening of new points

of sale performed well, but revenue was still hampered by the

termination of certain contracts.

- In the airports market, revenue was

boosted by new points of sale opened at Paris-Charles-de-Gaulle and

Lyon-Saint-Exupéry.

- Revenue in the railway stations, city

sites & leisure market was stable year on year. The negative

impact of the temporary closure of the Lac d’Ailette Center Parcs

village and the permanent closure of points of sale at the Gare

Montparnasse railway station in Paris was offset by the positive

effect of the Paris Motor Show, which is held every two years and

took place in 2018.

Outlook

The Group is standing by its full-year guidance for fiscal

2018-2019 – a year of stabilization – with:

- Organic growth of over 1% based on

comparable accounting methods, including the negative impact of

voluntary contract exits in Italy. Acquisitions carried out to date

should generate additional revenue growth of close to 1%.

- A stable adjusted EBITA margin (based

on a constant scope of consolidation and constant exchange

rates).

- A sharp increase in operating free cash

flow.

Financial calendar:

- March 22, 2019: Annual General Meeting

- May 29, 2019: First-half fiscal 2018-2019 results – issue of

press release before the start of trading and conference call

- July 25, 2019: Revenue for the first nine months of fiscal

2018-2019 – issue of press release before the start of trading

Appendix 1: Revenue by business line and geographic

regionAppendix 2: Revenue by geographic regionAppendix 3: Revenue

by marketAppendix 4: Definition of alternative performance

indicators

The English-language version of this document is a free

translation from the original, which was prepared in French. All

possible care has been taken to ensure that the translation is an

accurate representation of the original. However, in all matters of

interpretation of information, views or opinions expressed therein,

the original language version of the document in French takes

precedence over this translation.

About Elior Group

Founded in 1991, Elior Group has grown into one of the world's

leading operators in contract catering, concession catering and

support services, and has become a benchmark player in the business

& industry, education, healthcare and travel markets. Operating

in 15 countries, the Group generated €6,694 million in revenue

in FY 2017-2018. Our 132,000 employees serve 6 million people

on a daily basis through 25,600 restaurants and points of sale. Our

mission is to feed and take care of each and every one, at every

moment in life. Innovation and social responsibility are at the

core of our business model. Elior Group has been a member of the

United Nations Global Compact since 2004, reaching the GC Advanced

Level in 2015.

For further information please visit our website

(http://www.eliorgroup.com) or follow us on Twitter

(@Elior_Group)

Appendix 1: Revenue by business line

and geographic region

Q12018-2019

Q12017-2018

Organicgrowth

Changes inscope

ofconsolidation

Currencyeffect

Change

inaccountingmethod

Totalgrowth

(in € millions) France

585 579 1.4% 0.0% 0.0% -0.5%

0.9% International

729 706 -0.7%

4.0% 1.2% -1.2% 3.3% Contract catering &

services

1,314 1,285 0.2% 2.2%

0.7% -0.9% 2.2% France

155 155 0.2%

0.0% 0.0% 0.0% 0.2% International

285 254

10.8% 0.8% 0.6% 0.0% 12.2%

Concession catering

440 409 6.7%

0.5% 0.4% 0.0% 7.7%

GROUP TOTAL

1,754 1,694 1.8% 1.8% 0.6%

-0.7% 3.5%

Appendix 2: Revenue by geographic

region

Q12018-2019

Q12017-2018

Organicgrowth

Changes inscope

ofconsolidation

Currencyeffect

Change

inaccountingmethod

Totalgrowth

(in € millions) France

740 735 1.1% 0.0% 0.0% -0.4%

0.7% Other European countries

589 585 1.7% 0.0% 0.0% -1.1%

0.6% Rest of the world

425 374 3.2%

8.0% 2.7% -0.5% 13.5%

GROUP

TOTAL 1,754 1,694 1.8% 1.8%

0.6% -0.7% 3.5%

Appendix 3: Revenue by market

Q12018-2019

Q12017-2018

Organicgrowth

Changes inscope

ofconsolidation

Currencyeffect

Change

inaccountingmethod

Totalgrowth

(in € millions) Business & industry

584 569 0.7%

2.2% 0.4% -0.6% 2.8% Education

415 420 -1.0% 0.0% 0.9% -1.1%

-1.2% Healthcare

314 297 1.0%

5.2% 0.8% -1.1% 5.9% Contract catering &

services

1,314 1,285 0.2% 2.2%

0.7% -0.9% 2.2% Motorways

127 125 0.9%

0.0% 0.5% 0.0% 1.4% Airports

214 188 12.0% 1.1% 0.6% 0.0%

13.7% City sites & leisure

100 96

4.0% 0.0% 0.0% 0.0% 4.0% Concession

catering

440 409 6.7% 0.5%

0.4% 0.0% 7.7%

GROUP TOTAL

1,754 1,694 1.8% 1.8% 0.6%

-0.7% 3.5%

Appendix 4: Definition of alternative

performance indicators

Organic growth in consolidated revenue: Growth in

consolidated revenue expressed as a percentage and adjusted for the

impact of (i) changes in exchange rates, using the calculation

method described in Chapter 4, Section 4.1.4.1 of the fiscal

2016-2017 Registration Document, and (ii) change in accounting

policies, notably the first-time application of IFRS 15 in

2018-2019 and (iii) changes in scope of consolidation.

Reported EBITDA: This indicator corresponds to the

following, as recorded in the consolidated income statement:

recurring operating profit reported under IFRS including share of

profit of equity-accounted investees whose activities are the same

or similar to those of the Group, before (i) net depreciation and

amortization expense included in recurring operating profit and

(ii) net additions to provisions included in recurring operating

profit.

Adjusted EBITDA: Reported EBITDA as defined above

adjusted for the impact of share-based compensation expense (stock

options and free shares granted by Group companies).

Adjusted EBITA: Recurring operating profit reported under

IFRS adjusted for the impact of share-based compensation expense

(stock options and free shares granted by Group companies) and

amortization of intangible assets recognized on consolidation.

The Group considers that this indicator best reflects the

operating performance of its businesses as it includes the

depreciation and amortization arising as a result of the capex

inherent to the Group’s business model. It is also the most

commonly used indicator in the industry and therefore permits

comparisons between the Group and its peers.

Adjusted EBITA margin: Adjusted EBITA as a percentage of

consolidated revenue.

Adjusted earnings per share: This indicator is calculated

based on consolidated profit for the period attributable to owners

of the parent excluding (i) non-recurring income and expenses, net,

and exceptional impairment of investments in and loans to

non-consolidated companies, net of the income tax effect calculated

at the Group’s standard tax rate of 34%, and (ii) amortization of

intangible assets recognized on consolidation (mainly customer

relationships).

Operating free cash flow: The sum of the following items

as defined in the fiscal 2016-2017 Registration Document and

recorded either as individual line items or as the sum of several

individual line items in the consolidated cash flow statement:

- Reported EBITDA.

- Net capital expenditure (i.e. amounts

paid as consideration for property, plant and equipment and

intangible assets used in operations less the proceeds received

from sales of these types of assets).

- Change in net operating working

capital.

- Other cash movements, which primarily

comprise cash outflows related to (i) non-recurring items in the

income statement and (ii) provisions recognized for liabilities

resulting from fair value adjustments recognized on the acquisition

of consolidated companies.

This indicator reflects cash generated by operations and is the

indicator used internally for the annual performance appraisals of

the Group’s managers.

Leverage ratio (as defined in the covenants in the Senior

Facilities Agreement and presented for the Group’s debt at a given

period-end): The ratio between (i) the Group’s net debt (at the

given period-end determined based on the definition and covenants

in the Senior Facilities Agreement as described in Chapter 4,

Section 4.7.2 of the fiscal 2016-2017 Registration Document:

“Senior Facilities Agreement”, i.e. excluding unamortized issuance

costs and the fair value of derivative instruments) and (ii)

adjusted EBITDA calculated on a rolling basis for the twelve months

preceding the period-end concerned, further adjusted to exclude the

impacts of acquisitions and divestments of consolidated companies

during the twelve months preceding said period-end.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190123005800/en/

Investor relationsMarie de Scorbiac –

marie.descorbiac@eliorgroup.com – / +33 (0) 1 71 06 70 13Press

contactInes Perrier – ines.perrier@eliorgroup.com / +33 (0)1 71

06 70 60

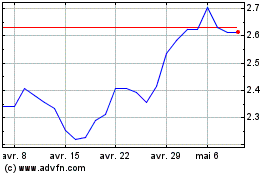

Elior (EU:ELIOR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Elior (EU:ELIOR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024