Crisis impacts mitigated and a solid level

of liquidity: Elior stays the course and is focused on the

future

Regulatory News:

Elior Group (Paris:ELIOR) (Euronext Paris – ISIN: FR

0011950732), one of the world’s leading operators in catering and

support services, announces its revenue for the first nine months

of 2019-20, ended June 30, 2020.

Revenue reflect the impact of Covid-19, notably in the third

quarter

- Nine-month 2019-20 revenue came to €3.131 billion, down 19.3%

like-for-like compared with a year earlier.

- Third-quarter revenue came to €672 million, down 46.4%

like-for-like compared with a year earlier.

- Excluding Covid-19 impact, strikes in France and voluntary

contract exits from the prior year, organic growth for the first

nine months of fiscal 2019-20 was 1.6% and 1.8% for the third

quarter.

Elior has shown resilience and agility

- Available liquidity amounted to €709 million at June 30, 2020,

vs. €917 million at March 31, 2020, after dividend payment, buyout

of US minority shareholders and the temporary dip in the

securitization program.

- Retention rate stood at 92% at June 30, 2020, an increase in

comparison with 90% at end June 2019

- New protocols and health norms were rapidly put in place: Aenor

certification in Spain, deployment of prevention Guide Covid-19

Elior certified by an occupational doctor and audited by the

Eurofins laboratory in France, Safe Café label in the United

States…

- In France, Elior Services maintained 80% of its business during

the containment period, notably thanks to its strong presence in

the healthcare sector (hospitals, clinics and care homes).

- Elior accelerates the deployment of its innovations: modified

atmosphere production at our Italian central kitchens and

enrichment of digital applications functionalities.

Elior now anticipates an impact on EBITA adjusted for the

loss of revenue (drop-through) for the year below 30%.

Philippe Guillemot, Elior Group’s Chief Executive Officer,

said:

“We have withstood the disruptions of recent months by swiftly

adapting our organization, continuing to work for the common good,

and helping our clients with their own continuity and recovery

plans.

The Areas sale has made the group stronger financially. Thanks

to strict cash management in recent months, Elior is in a solid

position even though the health crisis has impacted revenue. The

trust that our clients’ places in us - as witnessed by multiple

contract wins and renewals in the past quarter - is a source of

great resilience.

Building on a robust foundation as a socially responsible

culinary and services group with an exceptionally dedicated

workforce, Elior is staying the course and is focused on the future

by ramping up the execution of ongoing projects within the New

Elior 2024 strategic plan.

We know that this extraordinary period will profoundly change

some of our markets, particularly the business & industry

segment. That is why we are already reinventing the way we

work.

We will meet the challenges to come by, developing and

transforming our company, using our culinary, digital, and

marketing innovations, our ability to quickly invent new offerings

that anticipate the needs of our guests, and our health and safety

expertise.

Tomorrow—even more than today—the purpose that fuels Elior’s

110,000 employees will be to take care of our clients and to

nourish our guests in their schools, care facilities and workplaces

while honoring our three key commitments: to well-being, the

environment, and the pleasure of a good meal.”

Business development

Elior renewed or secured several major new contracts in the

third quarter of 2019-20, which included:

- Orange’s offices in Lyon, Herblay city schools, the Centre

d’Action Sociale of the city of Paris and the central purchasing

agency of Bourgogne Franche Comte (Elior Services) in France;

- Tower Hamlets schools, Rapport Housing and Care, and

HarperCollins Publishers and Baker Hughes in the UK;

- In the US, the Boston Public School District (Massachusetts)

and Madison County Schools (Mississippi) in the K-12 segment;

Middle Georgia State University and Georgia Gwinnett College in

higher education;

- Residencia Feixa Llarga Laia Gonzalez care home and the

Valencian Ministry of Equality and Inclusive Policies in

Spain;

- Residenza Sanitario Assistenziale de Rodolfi care facilities

and a multitude of Food360 contracts in Italy.

The overall retention rate at June 30, 2020, was 92%, an

increase compared to 90% at the end of June 2019.

Revenue

Consolidated revenue from continuing operations totaled

€3.131 billion for the first nine months of 2019-20. The 18.6%

reported year-on-year decrease reflects a like-for-like decline of

19.3%, (acquisition-led growth added 0.1pp and forex added

0.7pp).

Nine-month revenue include a -€756 million Coronavirus impact,

an -€11 million impact from strikes in France, and a -€36 million

impact from voluntary exits in Italy and scaled back Tesco

contracts in the UK.

Excluding these items, organic revenue growth in the first nine

months 2019-20 was 1.6% and 1.8% for the third quarter.

International revenue represented 56% of the total, compared

with 55% a year earlier.

Revenue by Market:

Business & Industry generated revenue of €1.276 billion, a

like-for-like decline of 26.8% in the first nine months of

2019-20. This reflects the COVID-19 impact in the third

quarter, when revenue declined to €220 million from €581

million a year ago.

Education generated revenue of €949 million in the first nine

months of 2019-20, a like-for-like decline of 19.9%. Because

schools closed in the third quarter, Education revenue were

€161 million, compared with €353 million for the same period year

ago.

Healthcare revenue were €906 million, a like-for-like decline of

4.8% compared with first nine months 2018/19. In the

third quarter the pandemic closed hospital cafeterias,

postponed elective surgeries, drove revenue down to €291 million,

compared with €316 million for the same period year ago.

Revenue by Geographic Region:

International revenue declined to €1.759 billion in the

first nine months of 2019-20. Revenue on a like-for-like basis

declined 17.7%, reflecting the impact of Covid-19 and - to a lesser

extent - the Italian public-sector contracts we chose not to renew

last year and the scaled back Tesco contracts in the UK. Excluding

those items, Elior’s International organic revenue growth was

2.2%.

The US experienced the smallest impact owing to a favorable mix,

particularly thanks to our work for social services

organizations.

Two recent, immaterial acquisitions in the US and Italy added

0.2pp of growth. The currency effect, notably from a stronger US

dollar, added 1.2pp.

Third quarter 2019-20 international revenue totaled €392

million, compared to €684 million a year ago.

Revenue generated in France totaled €1.366 billion in the

first nine months of 2019-20, compared with €1.723 billion

in the same period a year ago, i.e. a 20.7% like-for-like

decline.

Excluding the €11 million impact from strikes and the €369

million impact from Covid-19, organic revenue growth in France was

1.4%.

In France, Elior Services maintained 80% of its business during

the period of containment, thanks in particular to its strong

presence in healthcare (hospitals, clinics and care homes).

The government-mandated lockdown pushed revenue down to €280

million in the third quarter of 2019-20, compared with €559

million a year earlier.

The Corporate & Other segment, which includes the

Group’s remaining concession catering activities not sold with

Areas, generated nearly €6 million in revenue for the first nine

months of 2019-2020, down from the same period last year due to a

complete closure in the third quarter.

Liquidity

Elior’s available liquidity at the end of June 2020 was €709

million compared with €917 million at March 31, 2020. This figure

is after payment of the dividend for the financial year 2018-2019

(€51 million), the payment of the legacy US share-based

compensation plan (€23 million) and the temporary dip in the

securitization program as business and invoicing slowed (€115

million) in the third quarter.

Outlook

In Europe, lockdown measures started to ease in mid-May 2020,

which contributed to a slight improvement in our activities within

the context of reinforced sanitary protocols. Covid-19 continues to

create persistent uncertainty. In contract catering the recovery in

economic activity is expected to be gradual in the fourth quarter

of 2019-20, and at varying rates depending on how the pandemic

plays out in the countries where the Group operates.

Based on all known variables at this point, the assumptions for

fourth quarter 2019-20 that Elior is using to plan and make its

decisions are as follows:

- Business & Industry is expected to remain at a low

level owing to summer vacations. However, business should

accelerate from September onwards. In this context, we are

maintaining a constant dialogue with our clients to adjust our

catering offering as their needs evolve.

- The Education market is likely to rebound significantly

at the start of the new school year in primary, middle and high

schools, which account for the vast majority of Elior’s revenue in

this market. Contracts with higher education institutions are

located mainly in the United States.

- The Healthcare market should continue to improve

gradually during the fourth quarter after an upturn in June.

In this context, and taking into account the significant efforts

our teams have made, and the group’s performance in recent months,

Elior now anticipates an impact on EBITA adjusted for the loss of

revenue (drop-through) for the year 2019-20 below 30%.

Financial calendar:

- November 25, 2020: Full-year 2019-20 results, Elior will

publish its press release before the start of trading and will host

a conference call

Appendix 1: Revenue by business and geographic region Appendix

2: Revenue by market Appendix 3: Definition of alternative

performance indicators

The English-language version of this document is a free

translation from the original, which was prepared in French. All

possible care has been taken to ensure that the translation is an

accurate representation of the original. However, in all matters of

interpretation of information, views or opinion expressed therein,

the original language version of this document in French takes

precedence over this translation.

About Elior Group

Founded in 1991, Elior Group has grown into one of the world's

leading operators in contract catering and support services has

become a benchmark player in the business & industry,

education, healthcare and leisure markets. With strong positions in

6 countries, the Group generated €4,923 million in revenue in

fiscal 2018-2019. Our 110,000 employees feed over 5 million people

on a daily basis in 23,500 restaurants on three continents, and

offer services on 2,300 sites in France. Innovation and social

responsibility are at the core of our business model. Elior Group

has been a member of the United Nations Global Compact since 2004,

reaching the GC Advanced Level in 2015.

For further information please visit our website at

http://www.eliorgroup.com or follow us on Twitter

(@Elior_Group)

Appendix 1: Revenue by

business and geographic region

Q1

Q1

Organic

Change in scope of

Currency

Total

(in € millions)

2019-2020

2018-2019

growth

consolidation

effect

Growth

France

573

584

-1.9%

0.0%

0.0%

-1.9%

International

731

727

-1.3%

0.1%

1.9%

0.6%

Contract catering & Services

1,304

1,311

-1.6%

0.1%

1.0%

-0.5%

Corporate & Other

4

6

-45.9%

0.0%

0.0%

-45.9%

GROUP TOTAL

1,308

1,317

-1.8%

0.1%

1.0%

-0.7%

Q2

Q2

Organic

Change in scope of

Currency

Total

(in € millions)

2019-2020

2018-2019

growth

consolidation

effect

Growth

France

513

580

-11.4%

0.0%

0.0%

-11.4%

International

636

692

-9.8%

0.2%

1.4%

-8.2%

Contract catering & Services

1,149

1,272

-10.6%

0.1%

0.8%

-9.7%

Corporate & Other

2

5

-58.7%

0.0%

0.0%

-58.7%

GROUP TOTAL

1,151

1,277

-10.8%

0.1%

0.8%

-9.9%

Q3

Q3

Organic

Change in scope of

Currency

Total

(in € millions)

2019-2020

2018-2019

growth

consolidation

effect

Growth

France

280

559

-49.9%

0.0%

0.0%

-49.9%

International

392

684

-43.1%

0.1%

0.2%

-42.7%

Contract catering & Services

672

1,243

-46.1%

0.1%

0.1%

-45.9%

Corporate & Other

0

7

-100.0%

0.0%

0.0%

-100.0%

GROUP TOTAL

672

1,250

-46.4%

0.1%

0.1%

-46.2%

9 months

9 months

Organic

Change in scope of

Currency

Total

(in € millions)

2019-2020

2018-2019

growth

consolidation

effect

Growth

France

1,366

1,723

-20.7%

0.0%

0.0%

-20.7%

International

1,759

2,103

-17.7%

0.2%

1.2%

-16.4%

Contract catering & Services

3,125

3,826

-19.0%

0.1%

0.7%

-18.3%

Corporate & Other

6

18

-69.6%

0.0%

0.0%

-69.6%

GROUP TOTAL

3,131

3,844

-19.3%

0.1%

0.7%

-18,6%

Appendix 2: Revenue by

market

Q1

Q1

Organic

Change in scope of

Currency

Total

(in € millions)

2019-2020

2018-2019

growth

consolidation

effect

Growth

Business & Industry

570

591

-4.5%

0.0%

0.9%

-3.5%

Education

423

412

1.3%

0.0%

1.2%

2.5%

Healthcare

315

314

-0.9%

0.2%

1.0%

0.3%

GROUP TOTAL

1,308

1,317

-1.8%

0.1%

1.0%

-0.7%

Q2

Q2

Organic

Change in scope of

Currency

Total

(in € millions)

2019-2020

2018-2019

growth

consolidation

effect

Growth

Business & Industry

486

559

-13.7%

0.1%

0.6%

-13.1%

Education

365

406

-11.0%

0.1%

1.0%

-10.0%

Healthcare

300

312

-5.0%

0.2%

0.8%

-3.9%

GROUP TOTAL

1,151

1,277

-10.8%

0.1%

0.8%

-9.9%

Q3

Q3

Organic

Change in scope of

Currency

Total

(in € millions)

2019-2020

2018-2019

growth

consolidation

effect

Growth

Business & Industry

220

581

-61.9%

0.0%

-0.2%

-62.1%

Education

161

353

-54.8%

0.0%

0.3%

-54.5%

Healthcare

291

316

-8.6%

0.2%

0.5%

-7.8%

GROUP TOTAL

672

1,250

-46.4%

0.1%

0.1%

-46.2%

9 months

9 months

Organic

Change in scope of

Currency

Total

(in € millions)

2019-2020

2018-2019

growth

consolidation

effect

Growth

Business & Industry

1,276

1,731

-26.8%

0.0%

0.4%

-26.3%

Education

949

1,171

-19.9%

0.1%

0.8%

-19.0%

Healthcare

906

942

-4.8%

0.2%

0.8%

-3.8%

GROUP TOTAL

3,131

3,844

-19.3%

0.1%

0.7%

-18.6%

Appendix 3: Definition of

Alternative Performance Indicators

Organic growth in consolidated revenue: as described in

Chapter 4, Section 4.1.2.1 of the fiscal 2018-2019 Universal

Registration Document, growth in consolidated revenue expressed as

a percentage and adjusted for the impact of (i) changes in exchange

rates, (ii) changes in accounting policies, notably the first-time

application of IFRS 15 in 2018-2019 and (iii) changes in scope of

consolidation.

Adjusted EBITA: Recurring operating profit reported

including the share of profit of equity-accounted investees

adjusted for the impact of share-based compensation expense (stock

options and performance shares granted by Group companies) and net

amortization of intangible assets recognized on consolidation.

The Group considers that this indicator best reflects the

operating performance of its businesses as it includes the

depreciation and amortization arising as a result of the capex

inherent to the Group’s business model. It is also the most

commonly used indicator in the industry and therefore permits

comparisons between the Group and its peers.

Adjusted EBITA margin: Adjusted EBITA as a percentage of

consolidated revenue.

Revenue loss related to Covid-19: difference between

actual revenue and the forecast made at the end of December 2019,

at constant exchange rates and at constant perimeter, with no price

effect noted at this stage.

Impact of Covid-19 on Ebita: lost revenue less associated

residual costs, net of savings achieved to date (government aid,

renegotiation of supplier contracts, insurance indemnity,

etc.).

Impact of strikes in France: on revenue, it was measured

site-by-site in relation to the normal level of activity in the

weeks preceding the start of the strikes; on Ebita, it corresponds

to the costs that could not be variabilized.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200722005949/en/

Press contacts Inès Perrier: ines.perrier@eliorgroup.com

/ +33 (0)1 71 06 70 60 Thibault Joseph –

Thibault.joseph@eliorgroup.com / +33 (0)1 71 06 70 57 Investor

relations Kimberly Stewart: kimberly.stewart@eliorgroup.com /

+33 (0)1 71 06 70 13

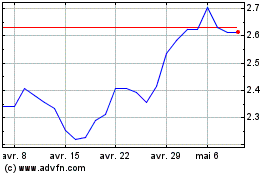

Elior (EU:ELIOR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Elior (EU:ELIOR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024