Elliott Management Calls for EBay to Shed StubHub, Classified Ads Business

22 Janvier 2019 - 3:40PM

Dow Jones News

By Kimberly Chin

Elliott Management Corp. wants eBay Inc. to part ways with

StubHub and its classified ads business, a move the activist

investor said would help eBay focus on its core online retail

marketplace.

In a letter sent Tuesday to eBay's board, Elliott said StubHub,

the online ticket reseller, and eBay's classified ads business is

worth more on its own than as part of the e-commerce company.

Elliott and its affiliates hold a 4% stake in eBay.

"Elliott believes that eBay is worth far more -- but change is

urgently needed to address both public perceptions and real

business issues," the activist hedge fund said in prepared

remarks.

Elliott said eBay could reach a valuation of $55 a share to more

than $63 a share by the end of 2020 if it focuses on its core

business.

Shares of eBay, which have fallen 22% in the past 12 months,

rose 12% to $34.40 in premarket trading.

An eBay representative couldn't immediately be reached for

comment.

Elliott called for eBay to free up capital to invest in

improving its operating efficiency and sales growth. In its letter

Elliott said eBay has misallocated resources, spent wastefully and

operated under an inefficient structure.

Elliott said it would collaborate with management to help it

drive value.

EBay bought StubHub for $310 million in 2007 and has tried to

expand the franchise overseas with the purchase of Spain's

Ticketbis in 2016.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

January 22, 2019 09:25 ET (14:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

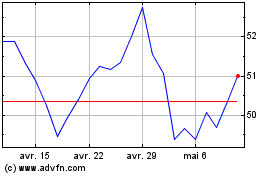

eBay (NASDAQ:EBAY)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

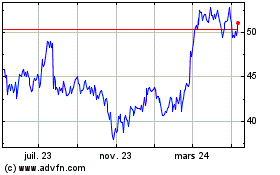

eBay (NASDAQ:EBAY)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024