Eramet: Third-quarter 2020 turnover stable, the sales of the Mining

and Metals division offset the impact of the profound aerospace

crisis

Paris, 28 October 2020, 7:30 a.m.

PRESS RELEASE

Eramet: Third-quarter 2020 turnover

stable, the sales of the Mining and Metals division offset the

impact of the profound aerospace crisis

- Sales of €850m (-5% on third-quarter

2019)

- Significant decline in Aubert & Duval

sales: -18% from 2019, -34% over two years

- Excellent production and sales performance from mining

activities, driven by the rebound in Chinese steel

production in a disrupted market environment:

- Increase in Q3 20 manganese ore volumes produced (+15%) and

sold (+65%)

- Increase in nickel ore volumes produced (+20%) and exported

(+6%), leading to a significant improvement in SLN cash cost to

$5.24/lb in the third quarter

- Swift ramp-up in nickel ferroalloys production at Weda Bay,

with 13 kt Ni since its launch in May

- Increase in mineral sands production (+13%), at a pace of 730

kt per year

- Raw material sales prices sharply down

overall: -26% for manganese ore and -17% for ferronickel;

conversely, very strong growth in the price of nickel ore

(+35%)

- 2020 Outlook:

- Manganese ore production target raised to 5.8 Mt (+22% vs

2019)

- Opening of new mining plateau in Gabon in October, enabling

gradual ramp-up in production towards a capacity of 7 Mt in

manganese ore by 2022

- Nickel ore exports confirmed at 2.5 Mwmt (+54% vs 2019)

- Factoring in the operational improvements, in particular the

increased mining production, forecast EBITDA is

expected to strongly improve in the second half of 2020 compared to

the first half. Nevertheless, it will be significantly lower on a

full-year basis.

Christel Bories, Eramet Group Chairman and

CEO:

" We achieved a remarkable third-quarter

performance in terms of mining production in a still very volatile

economic environment.

Our mining activities pursue their successful

growth momentum, specifically in Gabon, which reported a manganese

ore production at a pace of more than 6 Mt per year. In New

Caledonia, growth in nickel ore exports took on a new dimension, up

by nearly 60%. However, SLN remains fragile and the success of its

rescue plan is now more crucial than ever; we are counting on the

commitment of all stakeholders.

The High-Performance Alloys division was

adversely affected by the collapse of air transport and its impact

across the aerospace supply chain. Drastic cost adjustment measures

have been taken. Moreover, with respect to its strategic review,

the Group is seeking for the best solutions for Aubert &

Duval’s activity, a strategic company for the sector; all options

being considered.

All the Group’s teams manage business as closely

as possible to their markets and customers and remain fully focused

on preserving cash. "

Safety and preventive measures to face

the pandemic

The Group remains fully committed to ensuring

safety in the workplace. At end-September 2020, the total

recordable injury rate (TRIR1) was 4.1 year to date, steadily down

-24% from 2019.

Regular reviews are conducted regarding the

health protocol, implemented on all of the Group’s sites, in an

effort to anticipate pandemic developments and to comply with the

recommendations of local authorities. Under these circumstances,

all our activities operated without any disruptions in Q3 2020.

Eramet group’s sales by

activity

|

(Millions of euros)1 |

Q3 2020 |

Q3 2019 |

Change2 (%) |

9m 2020 |

9m 2019 |

Change2 (%) |

| MINING &

METALS DIVISION |

|

|

|

|

|

|

|

Manganese BU |

|

420 |

427 |

-2% |

1,259 |

1,331 |

-5% |

|

Nickel BU |

|

216 |

216 |

- |

582 |

562 |

+4% |

|

Mineral Sands BU |

63 |

62 |

+2% |

202 |

201 |

+0% |

|

Division total |

699 |

705 |

-1% |

2,043 |

2,094 |

-2% |

|

HIGH-PERFORMANCE ALLOYS DIVISION |

|

|

|

|

|

A&D and Erasteel |

|

154 |

192 |

-20% |

499 |

615 |

-19% |

|

HOLDING COMPANY & ELIMINATIONS |

(3) |

(2) |

n/a |

(5) |

(6) |

n/a |

|

ERAMET GROUP |

850 |

895 |

-5% |

2,537 |

2,703 |

-6% |

1 Data rounded up to

nearest million.2 Data rounded up to higher or lower %.

N.B.: all changes in third-quarter 2020 (“Q3

2020”) performance are calculated in relation to third-quarter 2019

(“Q3 2019”), unless otherwise indicated. Similarly, year-to-date

changes relating to the first nine months of the year (“9m 2020”)

are calculated in relation to the previous year

(“9m 2019”).

The Group's Q3 2020 sales totalled €850m, down

-5%. Currency effects came to -3%, owing to the weakening of the US

dollar against the euro. At constant scope and exchange rates2,

sales were down by -2%, mainly due to the impact of the aerospace

crisis on activity at Aubert & Duval.

At 30 September 2020, the Group’s cash position

remains high.

A dividend of €8m was paid out in October to

Comilog’s minority shareholders for the 2019 financial

year.

Mining & Metals

Division

Manganese BU

Ore production in Gabon achieved a pace

of more than 6Mt per year in Q3 2020, with ore volume sales up

nearly +65%. Alloys volumes produced and sold were down, reflecting

the downturn in the steel sector. Despite a decline versus both Q3

2019 and H1 2020, ore prices levelled off at $4.2/dmtu on average

over the quarter.

Manganese BU sales, which accounted for slightly

over 49% of the Group’s total consolidated sales, came to €420m,

down very slightly (-1.6%) versus Q3 2020. Growth in ore sale

volumes offset price declines and the contraction in alloys

sales.

Market trends & prices

In Q3 2020, global production of carbon steel,

the main end-market for manganese, was up +0.9%3 ending at 475Mt.

Production in China, which represents c.57% of global production,

grew significantly (+9.6%3), mainly driven by the construction of

infrastructure to kick-start the economy. Record-breaking highs

were set in Q3. As for the rest of the world, production slowed

considerably (-9.6%3), owing to the decline in demand in Europe

(-20.8%3) and North America (- 22.5%3), which were hard hit by

the health crisis.

During the first nine months of the year, carbon

steel production reached 1.36 bn tonnes, down - 3.8%3 on the

same period in 2019.

Despite the contraction in demand, global

manganese ore production increased by +8.3% in Q3, boosted by solid

Q2 price levels and the increased contribution from South Africa,

following mine closures in Q2. The supply/demand balance thus

remained in surplus with Chinese port ore inventories totalling

6.6Mt4 at end-September 2020 (equivalent to approximately 11.5

weeks’ consumption versus 9 weeks’ consumption at end-June

2020).

The average CIF China 44% manganese ore price

stood at approximately $4.2/dmtu5 in Q3 2020, down c.-26%6,7 from

Q3 2019 ($5.7/dmtu6).

In Q3 2020, manganese alloy prices in Europe

recorded a marked decline, particularly for refined alloys

(medium-carbon ferromanganese at approximately €1,306/t6,

representing -12% from Q3 2019) but also for standard alloys

(silicomanganese at approximately €863/t6, i.e. -10%).

Activities

In Gabon, Comilog’s manganese ore production was

up +15% to 1.5Mt in Q3 2020 (4.3Mt year to date at end-September).

Transported ore volumes also increased (+24%), in line with the

record level delivered in Q2 2020. The mine’s and logistics’ good

performance reflects operational improvement achieved. The latter,

together with lower internal sales (to the Group’s manganese alloys

plants), led to an increase in external ore sales volumes of nearly

65%, ending at 1.5Mt in Q3 20 (3.9Mt year to date at

end-September).

Quarterly production at manganese alloys plants

continued to adapt to demand in a market affected by the sharp

slowdown in steel production in Europe and the United States. This

drove a -16% drop in production in Q3 2020 (511kt year to date at

end-September). However, sales volumes decreased more moderately to

162kt (-8%) over the same period.

Electrolysis activity used to produce metal

manganese in Gabon was definitively stopped in Q3. The

silico-manganese production activity is maintained.

Outlook

Taking account of the good end-September

performance, and thanks to the roll-out of the optimised, modular

manganese ore growth programme, the 2020 target is again raised to

5.8Mt of volumes produced (i.e. more than +20% versus 2019).

The opening of the new Okouma plateau in

October, and its start of production according to a modular and

flexible approach should enable a gradual ramp up with a targeted

capacity of 7 Mt in manganese ore by 2022.

Capital expenditure is estimated at

approximately €85m in 2020 to support this highly profitable growth

with a quick payback.

With respect to carbon steel production, a

continued strong activity in China, and a beginning of restart in

the rest of the world is expected in Q4 2020, albeit with

disparities in growth between geographies.

Nickel BU

The Nickel BU markets were strongly

affected by the sharp slowdown in the stainless steel industry over

the first nine months of the year, coupled with declining LME

nickel prices. Nonetheless, nickel ore export growth, both driven

by volumes and a substantial price increase, enabled the BU to post

stable turnover in Q3 2020.

SLN Q3 2020 sales were up slightly (+1%) to

€194m. Sandouville’s plant sales remained affected by the loss of

value-added markets in light of the pandemic, and decreased by -5%,

at €22m.

Market trends & prices

The stainless steel industry (2/3 of world

nickel demand) experiences a historic shock in 2020 with global

production down by -7.6%8 to 35.9Mt over the first nine months of

the year, despite a marginal drop in Q3 2020 (-1.6%8) thanks to

China. Chinese production, accounting for nearly 65% of global

output, recorded a substantial growth in Q3 2020 (+6.9%8),

influenced by government stimuli to support infrastructure,

transportation and construction. Conversely, the rest of the world

saw a very sharp decline over the period (-14.2%8). Indonesia

posted growth of 19.0%3 in Q3 2020, following the unprecedented

decline in H1 volumes.

Demand for primary nickel thus showed signs of

recovery in Q3 2020, with an increase of +1.2%8.

Global primary nickel production stood stable at

0.6 Mt8 in Q3 2020, bolstered by continued growth in nickel

ferroalloys production in Indonesia (+52.9%8), offsetting the

decline in traditional production.

On the basis of a nickel supply/demand balance

with a strong surplus in H1 2020, breakeven was almost achieved in

Q3. Nickel stocks at the LME9 and SHFE9 slightly increased compared

with end-June (+1.2%), standing at 266 kt at end-September 2020.

They now equal 8 weeks’ consumption10, which is still a low

level.

In Q3 2020, the average LME price was $6.45/lb

($14,213/t), down on Q3 2019 (-9%11), but up sharply from H1 2020

(+14%). Ferronickel prices decreased by -16.5% in Q3 2020. They

did, however, show improvement (+22%) on H1 2020. Given the upturn

in demand for stainless steel, quarterly ferronickel sales prices

were at a lower discount versus the LME than in H1.

Conversely, the average for nickel ore prices

(1.8% CIF China) came out at $81.1/wmt12, up significantly (+35%)

versus an average of $60.2/wmt12 in Q3 2019. This is attributable

to the effective ban on nickel ore exports from Indonesia since

January 2020, which constrains supply to China. Nickel ore stocks

in Chinese ports13, slightly up from end-June, totalled 8.8 Mwmt at

end-September 2020, corresponding to approximately 8 weeks’

consumption.

Activities

In New Caledonia, SLN’s Q3 2020

mining production rose +20% to 1.6Mwmt14 (3.8Mwmt year to date at

end-September, up +15%).

Q3 2020 low-grade nickel ore exports ended at

0.6 Mwmt, up +6% on Q3 2019. Based on September’s figure, annual

exports grow at a pace of more than 3.5Mwmt per year. Nine-month

total volumes of exported ore were 1.7Mwmt year to date (+61% from

the same period in 2019).

Q3 2020 ferronickel production jumped +15% to

13kt (+5% to 37kt year to date over a nine-month period). Q3 2020

sales volumes also rose +10% to 13kt (+9% to 39kt year to date at

end-September).

The increase in nickel ore exports and the

positive impact of external factors resulted in a significantly

improved cash cost. The latter averaged $5.24/lb in Q3 2020, down

from $5.65/lb in H1 2020 and $5.76/lb in Q3 2019. Cash cost should

continue to improve in Q4, mainly thanks to the considerable

increase in ore prices. To date, ore prices recorded an additional

upswing of more than +20% from the Q3 average15.

Achieving all the objectives of the rescue plan

remains a necessary condition for the sustainability of SLN, in

particular obtaining the authorisation from the government of

New-Caledonia to export an additional 2Mwmt of low-grade ore

(increasing from 4Mwmt to 6Mwmt of annual exports).

In Normandy,

after being particularly affected by the health crisis in H1, the

Sandouville plant saw its production and sales fell again in Q3

2020 compared with Q3 2019, notably due to the technical stop of

production in July, in a still-deteriorated market environment.

In Indonesia, the fast ramp-up of the mining

operations and of the low-grade nickel ferroalloys production is a

success. Since its opening in October 2019, the mine has produced

close to 2.3Mwmt of ore. Chinese customers purchased an initial

load from Eramet offtake agreement, which was shipped in September.

The plant is now operating at optimised capacity (35 kt Ni per

year). Year to date production volumes amounted to 13 kt Ni at

end-September, with a highly competitive production cash cost.

Outlook

SLN’s nickel ore export volume target is

confirmed at 2.5Mwmt. Similarly, ferronickel production at the

Doniambo plant should reach nearly 50kt in 2020.

2020 production at the Weda Bay Nickel mine and

plant is expected to deliver respectively more than 2.5Mwmt and

20kt of low-grade nickel ferroalloys (Ni content).

Stainless steel production (and thus demand for

nickel in stainless steel) should remain sustained in the coming

months, thanks to the various recovery plans for the global

economy, especially in China.

Mineral Sands BU

The Mineral Sands BU reported Q3 2020

sales up +1.6% to €63m, faced with an unfavourable market

environment.

In a deteriorated price environment, Grande Côte

(GCO) sales in Senegal fell -21% to €27m, while those of the TTI

plant in Norway increased by +32% to €37m on the low level recorded

in Q3 2019.

Market trends & prices

Ceramics, the main end-product for zircon16,

were hard hit by the pandemic. Moreover, industrial demand for

zircon was still low in all sectors and geographies. Global demand

for zircon was down in Q3 2020 but showed a slight rebound on Q2

2020.

Despite a decrease in production from main

producers, the zircon supply/demand balance should thus be in

surplus in 2020. The subsequent average zircon price increased to

$1,320/t17 in Q3 2020. It was down by -3% on H1 2020 and

-17%18 from Q3 2019.

Global demand for TiO2 pigments, the main

end-market for titanium-based products19,20, also saw a sharp

slowdown in H1 2020, notably impacted by the pandemic (construction

industry shut down for several weeks, automotive sector declining).

Demand improved in Q3 2020. At the same time, the titanium-based

products supply should also decrease in 2020, allowing the

supply/demand balance for titanium-based products to show a very

slight surplus in 2020.

The average price of high value-added CP21

titanium dioxide slag fell by -3% to $770/t22 in Q3 2020

versus H1 2020. At the same time, it drove a +1%18 increase

compared to Q3 2019. Improving demand for TiO2 pigments observed in

Q3 2020, mainly in China, has indeed driven demand for

sulphate-grade titanium dioxide slag.

Activities

In Senegal, mineral sands

production23 grew +13% to 183kt in Q3 2020 (+3% to 554kt year to

date at end-September), reflecting the good operational

performance. Q3 2020 zircon sales volumes dropped -5% to 13 kt,

owing to logistics shipping delays recorded in Q4.

In Norway, quarterly titanium

slag production ran at a normal level, up +40% to 52kt, factoring

in the low Q3 2019 comparative basis. Sales volumes also increased

by 49% to 51kt.

Outlook

The annual 2020 target for mineral sands

production amounts to 730kt, in line with 2019.

The agreement for the sale of TiZir’s Norwegian

plant to Tronox remains subject to the satisfaction of regulatory

approvals. This process is currently underway.

Mineral sands markets are closely correlated to

global GDP, as the use of pigments and ceramics is linked to the

dynamics of urbanisation and modernisation of economies. In the

coming months, the various stimulus packages should sustain demand

for mineral sands.

High-Performance Alloys

division

The collapse of the aerospace sector and

the steep downturn in the automotive sector continued to weigh

heavily on the High-Performance Alloys division in Q3 2020. The

division’s sales were down -20% to €154m (-36% over two

years).

Aubert & Duval’s (“A&D”)24 sales

declined by -18% to €122m over the period, while Erasteel’s sales

were down -26% to €32m.

Market trends & prices

The aerospace sector, which represents

approximately 70% of A&D’s sales, is very hard hit by the

Covid-19 crisis, with an extremely marked slowdown in air

transport. The impacts on the aerospace supply chain are of an

unprecedented scale. Boeing has reported that the market will

require a ten-year recovery period following the pandemic.

Commercial aircraft deliveries have reached an

all-time low this year, and the outlook from industry analysts

points to a possible further deterioration in the coming months. In

particular, at end-September, Airbus announced that it had

delivered 341 aircraft since the beginning of the year. This

accounts for a near -40% reduction compared with the same period in

2019 (571 aircraft deliveries).

The defence, energy and nuclear markets are

stable, particularly thanks to public investment programs.

The automotive industry, which accounts for

nearly half of Erasteel’s sales, remained very depressed over the

quarter, with the exception of a marked rebound in China.

Activities

In this context, A&D’s aerospace turnover

amounted to €81m. Sales fell by -31% in Q3 2020 and -21% year to

date over the first nine months of the year, compared with an

already low level in the previous year, representing -37% over two

years.

Excluding the aerospace sector, sales

significantly increased (+31%), notably those of disks for

land-based turbines.

Over the quarter, A&D adjusted the level of

production site by site thanks to labour measures in force. Thus,

the objective is to aim for a level of activity adjusted to the

order book for each product line, workshop by workshop.

The French government approved a request for a

long-term part-time work agreement (“APLD”), effective 1 October.

It should allow to significantly reduce working hours over the next

six months.

Erasteel’s production and sales were also

penalised by the continuing depressed market environment.

Production set-up was also thoroughly adjusted to meet customers’

needs.

Outlook

Based on low 2019 comparatives, the drop in

A&D’s 2020 sales could amount to approximately - 15%. Over

two years, this decline should reach almost -34% in total.

Aircraft manufacturers continue to adjust their

production rate to demand. The impacts could be deeper and more

extended for the wide-body aircraft.

A return to 2019 activity levels in the

aerospace sector is forecasted for 2025.

The rebound could take place as early as next

year for the automotive sector.

Against this new backdrop, the Group is

continuing the strategic review of A&D. All options are being

considered, including a divestment. The top priority is to find the

best solutions for the subsidiary’s activity, a strategic company

for the aerospace sector.

Outlook

In the second half of the year, the level of

manganese ore and nickel ore production, together with related

operational improvements, should further improve the Group's

intrinsic performance.

Forecast EBITDA is expected to strongly improve

in the second half of 2020 compared to the first half.

Nevertheless, it will be significantly lower on a full-year

basis.

As a result of the global crisis, the market and

price environment are still however particularly uncertain and

volatile.

Calendar

16/02/2021: Publication of 2020 annual results

26/04/2021: Publication of 2021 first-quarter sales

ABOUT ERAMET

Eramet, a global mining and metallurgical group,

is a key player in the extraction and valorisation of metals

(manganese, nickel, mineral sands) and the elaboration and

transformation of alloys with a high added value (high-speed

steels, high-performance steels, superalloys, aluminium and

titanium alloys).

The Group supports the energy transition by

developing activities with high growth potential. These include

lithium extraction and refining, and recycling.

Eramet positions itself as the privileged

partner of its customers in sectors that include carbon and

stainless steel, aerospace, pigments, energy, and new battery

generations.

Building on its operating excellence, the

quality of its investments and the expertise of its employees, the

Group leverages an industrial, managerial and societal model that

is virtuous and value-accretive. As a contributive corporate

citizen, Eramet strives for a sustainable and responsible

industry.

Eramet employs around 13,000 people in more than

20 countries, with sales of approximately €4 billion in 2019.

For further information, go to www.eramet.com

| INVESTOR

CONTACT Executive VP Strategy and Innovation -

Investor Relations Philippe GundermannT.

+33 1 45 38 42 78 Investor Relations Manager

Sandrine Nourry-DabiT. +33 1 45 38 37 02

|

PRESS

CONTACT Communications Director

Pauline Briand T. +33 1 45 38 31 76

pauline.briand@eramet.com Image 7

Marie ArtznerT. +33 1 53 70 74 31 | M. +33 6 75 74

31 73martzner@image7.fr |

APPENDICES

Appendix 1: Sales

|

In millions of euros (€ million)1 |

Q3 2020 |

Q2 2020 |

Q1 2020 |

Q4 2019 |

Q3 2019 |

Q2 2019 |

Q1 2019 |

|

MINING & METALS DIVISION |

|

|

|

|

|

|

|

|

Manganese BU |

420 |

480 |

359 |

434 |

427 |

470 |

434 |

|

Nickel BU |

216 |

215 |

151 |

216 |

216 |

182 |

164 |

|

Mineral Sands BU |

63 |

69 |

70 |

85 |

62 |

80 |

59 |

|

HIGH-PERFORMANCE ALLOYS DIVISION |

|

|

|

|

|

|

|

|

A&D and Erasteel |

154 |

149 |

196 |

232 |

192 |

206 |

217 |

|

GROUP |

|

|

|

|

|

|

|

|

Holding company & eliminations |

(3) |

0 |

(2) |

1 |

(2) |

(3) |

(1) |

|

Eramet group published IFRS financial

statements2 |

850 |

913 |

774 |

968 |

895 |

935 |

873 |

1 Data rounded up to

the nearest million.2 Application of IFRS standard 11 “Joint

Arrangements”.

Appendix 2: Productions and

shipments

|

In thousands of tonnes |

Q3 2020 |

Q2 2020 |

Q1 2020 |

Q4 2019 |

Q3 2019 |

Q2 2019 |

Q1 2019 |

9m 2020 |

9m 2019 |

| |

|

|

|

|

|

|

|

|

|

|

MANGANESE BU |

|

|

|

|

|

|

|

|

|

|

Manganese ore and sinter production |

1,537 |

1,475 |

1,288 |

1,309 |

1,340 |

1,112 |

1,004 |

4,300 |

3,456 |

|

Manganese ore and sinter

transportation1 |

1,615 |

1,620 |

1,242 |

1,306 |

1,303 |

1,022 |

996 |

4,478 |

3,321 |

|

External manganese ore sales |

1,492 |

1,418 |

1,000 |

1,322 |

911 |

861 |

776 |

3,910 |

2,548 |

|

Manganese alloys production |

170 |

146 |

196 |

163 |

201 |

185 |

191 |

511 |

577 |

|

Manganese alloys sales |

162 |

165 |

181 |

190 |

175 |

193 |

175 |

508 |

543 |

| |

|

|

|

|

|

|

|

|

|

|

NICKEL BU |

|

Nickel ore production (in thousands of wet

metric tonnes) |

|

|

|

|

|

|

|

|

|

|

SLN |

1,603 |

1,286 |

918 |

1,356 |

1,331 |

1,096 |

872 |

3,806 |

3,299 |

|

Weda Bay Nickel (100%) |

579 |

827 |

397 |

470 |

0 |

0 |

0 |

1,803 |

0 |

|

Ferronickel production - SLN |

12.8 |

11.7 |

12.1 |

12.5 |

11.1 |

11.6 |

12.2 |

36.6 |

34.9 |

|

Low grade nickel ferroalloys production - Weda Bay

Nickel (kt of Ni content – 100%) |

8.4 |

4.5 |

0 |

0 |

0 |

0 |

0 |

12.9 |

0 |

|

Nickel ore sales (in thousands of wet metric

tonnes) |

589 |

760 |

331 |

578 |

556 |

254 |

235 |

1,680 |

1,045 |

|

SLN |

|

Weda Bay Nickel (100%) |

182 |

0 |

0 |

0 |

0 |

0 |

0 |

182 |

0 |

|

Ferronickel sales - SLN |

12.8 |

14.3 |

11.6 |

11.4 |

11.6 |

12.0 |

12.0 |

38.7 |

35.6 |

|

Low grade nickel ferroalloys production - Weda Bay

Nickel/Off-take Eramet (kt of Ni content – 100%) |

0.8 |

0 |

0 |

0 |

0 |

0 |

0 |

0.8 |

0 |

|

Nickel salts and high purity nickel

production |

1.6 |

2.2 |

1.5 |

0.8 |

2 |

2.3 |

1.8 |

5.2 |

6.1 |

|

Nickel salts and high purity nickel

sales |

1.3 |

2.1 |

1.6 |

1.1 |

1.6 |

2.4 |

1.6 |

5.0 |

5.6 |

| |

|

|

|

|

|

|

|

|

|

|

MINERAL SANDS BU |

|

Mineral Sands production |

183 |

183 |

188 |

195 |

162 |

207 |

171 |

554 |

540 |

|

Zircon production |

14 |

15 |

14 |

15 |

12 |

16 |

15 |

43 |

43 |

|

Titanium dioxide slag production |

52 |

50 |

48 |

51 |

37 |

48 |

53 |

150 |

138 |

|

Zircon sales |

13 |

16 |

17 |

15 |

14 |

16 |

13 |

46 |

43 |

|

Titanium dioxide slag sales |

51 |

48 |

52 |

49 |

34 |

58 |

39 |

150 |

131 |

1 Produced and

transported

Appendix 3: Price and index

|

|

Q3 2020 |

H1 2020 |

H2 2019 |

Q3 2019 |

H1 2019 |

Chg. Q3 2020/Q3 20196 |

Chg.Q3 2020/H1 20206 |

| |

|

|

|

|

|

|

|

|

MANGANESE BU |

|

Mn CIF China 44% (USD/dmtu)1 |

4.21 |

4.98 |

4.85 |

5.66 |

6.42 |

-25.7% |

-15.5% |

|

Ferromanganese MC - Europe (EUR/t) 1 |

1,306 |

1,422 |

1,417 |

1,479 |

1,551 |

-11.7% |

-8.1% |

|

Silico-manganese - Europe (EUR/t) 1 |

863 |

949 |

921 |

955 |

976 |

-9.6% |

-9.1% |

| |

|

|

|

|

|

|

|

|

NICKEL BU |

|

Ni LME (USD/lb)2 |

6.45 |

5.65 |

7.03 |

7.08 |

5.59 |

-8.9% |

14.1% |

|

Ni LME (USD/t) 2 |

14,213 |

12,455 |

15,489 |

15,606 |

12,315 |

-8.9% |

14.1% |

|

Ni ore CIF China 1.8% (USD/wmt)3 |

81.1 |

68.5 |

66.3 |

60.2 |

50.7 |

34.7% |

18.4% |

| |

|

|

|

|

|

|

|

|

MINERAL SANDS BU |

|

Zircon (USD/t) 4 |

1,320 |

1,355 |

1,565 |

1,585 |

1,585 |

-16.7% |

-2.6% |

|

CP grade titanium dioxide (USD/t) 5 |

770 |

798 |

758 |

761 |

746 |

1.2% |

-3.4% |

1 Quarterly average

for market prices, Eramet calculations and analysis2 LME (London

Metal Exchange) prices3 CNFEOL (China FerroAlloy Online), “Other

mining countries” in Q3 2020 and SMM (Shanghai Metals Market)

“Philippines” in 2019 and H1 20204 TZMI, Eramet analysis (premium

zircon)5 Market analysis, Eramet analysis6 Eramet calculation

(based on CRU monthly price index for manganese ore and alloys

only), rounded to the nearest decimal

Appendix 4: Financial

glossary

Consolidated performance indicators

The consolidated performance indicators used for

the financial reporting of the Group’s results and economic

performance and presented in this document are restated data from

the Group’s reporting and are monitored by the Executive

Committee.

Sales at constant scope and exchange rates

Sales at constant scope and exchange rates

corresponds to sales adjusted for the impact of the changes in

scope and the fluctuations in the exchange rate from one year to

the next.

The scope effect is calculated as follows: for

the companies acquired during the financial year, by eliminating

the sales for the current period and for the companies acquired

during the previous period by integrating, in the previous period,

the full-year sales; for the companies sold, by eliminating the

sales during the period considered and during the previous

comparable period.

The exchange rate effect is calculated by

applying the exchange rates of the previous year to the sales for

the year under review.

EBITDA (“Earnings before interest,

taxes, depreciation and amortisation”)

Earnings before financial revenue and other

operating expenses and income, income tax, contingencies and loss

provision, and amortisation and impairment of property, plant and

equipment and tangible and intangible assets.

SLN’s cash-cost

SLN’s cash-cost is defined as all production and

fixed costs (R&D including exploration geology, administrative

expenses, logistical and commercial expenses), net of by-products

credits and local services, which cover all the stages of

industrial development of the finished product until delivery to

the end customer and which impact the EBITDA in the company's

financial statements, over tonnage sold.

SLN break-even cost

The break-even cost of SLN is defined as SLN’s

cash-cost as defined above, plus capex (projected capex for the

current year versus the projected tonnage for the current year)

non-recurring income and charges and financial expenses (recognised

in SLN’s corporate financial statements).

Appendix 5: Sensitivities of Group EBITDA

|

Sensitivities |

Change |

Impact on EBITDA (+/-) |

|

Manganese ore prices (CIF China 44%) |

+$1/dmtu |

c.€185m1 |

|

Manganese alloy prices |

+$100/t |

c.€60m1 |

|

Nickel prices (LME) |

+$1/lb |

c.€100m1 |

|

Nickel ore prices (CIF China 1.8%) |

+$10/wmt |

c.€20m1 |

|

Exchange rates |

-$/€0.1 |

c.€145m |

|

Oil price per barrel (Brent) |

+$10/bbl |

c.€(20)m1 |

1 For an exchange rate of $/€1.13

1 TRIR (total recordable injury

rate) = number of lost time and recordable injury

accidents for 1 million hours worked (employees and

subcontractors)2 See Financial glossary in Appendix 43 Eramet

forecasts based on World Steel Association (WSA) production data 4

Source: CNFEOL (China FerroAlloy Online)5 Quarterly average market

prices, Eramet calculations and analysis6 Manganese ore: CRU CIF

China 44% spot price; Manganese alloys: CRU Western Europe spot

price

7 Adjusted for unfavourable currency effects (appreciation of

the euro versus the US dollar), the decline in price in euros was

-29% on a comparable quarterly basis 8 International Stainless

Steel forum (ISSF) and Eramet estimations

9 LME: London Metal Exchange; SHFE: Shanghai Futures Exchange10

Including producers’ stocks11 Restated for the favourable currency

effect, the price increase in euros was 13% on a comparable

quarterly basis12 CIF China price 1.8% “Other mining countries” in

Q3 2020 (CNFEOL) and “Philippines” in 2019 and H1 2020 (SMM)13

Stocks excluding Inland China (Mysteel 12 ports)

14 Mwmt: millions of wet metric tonnes; kwmt: thousands of wet

metric tonnes

15 1.8% CIF China prices “Other mining countries” (CNFEOL)16

c.50% of Zircon’s end-products.17 Source Zircon premium:

FerroAlloyNet.com, Eramet analysis

18 Given the favourable currency effect, price increases in

zircon and CP grade titanium dioxide slag were down -21% and -4%

respectively on a comparable quarterly basis 19 Titanium dioxide

slag, ilmenite, leucoxene and rutile

20 c.90% of titanium-based end-products21 For the manufacture of

chloride pigments (“CP slag”)

22 Source: Market consulting, Eramet analysis 23

Zircon and titanium ore (ilmenite, leucoxene and rutile)24 Aubert

& Duval, EHA and others

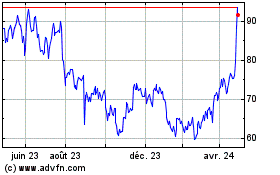

Eramet (EU:ERA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

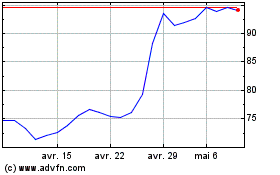

Eramet (EU:ERA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024