Euro Mixed After Eurozone GDP Data

07 Décembre 2018 - 7:29AM

RTTF2

The euro was trading mixed against its major counterparts in the

early European session on Friday, after the release of Eurozone

gross domestic product data for the third quarter, which showed

slowest pace of growth in four years, matching preliminary

estimate.

Data from Eurostat showed that Eurozone GDP rose 0.2 percent in

the third quarter after rising 0.4 percent in the previous three

months. The reading matched flash estimate.

On a year-on-year basis, the GDP growth was revised down to 1.6

percent following a 2.2 percent rise in the second quarter. The

reading was originally reported as 1.7 percent.

Separate data showed that employment growth for the euro area

has been confirmed in the third quarter.

Eurozone employment increased by 0.2 percent in the third

quarter following a 0.4 percent rise in the preceding quarter.

The economy expanded 1.3 percent annually after logging a 1.5

percent growth in the second quarter.

European stocks bounced back after sharp losses the previous day

following the arrest of chief financial officer of Chinese tech

giant Huawei.

Investors drew some comfort from a firm dollar and a late Wall

Street recovery overnight, helped by hopes that the U.S. Federal

Reserve could pause its interest-rate hikes.

The focus remained on a key U.S jobs report due tonight, with

economists expecting employment to increase by 205,000 jobs in

November after an increase of 250,000 jobs in October. The jobless

rate is expected to hold at 3.7 percent.

The currency showed mixed trading against its major opponents in

the Asian session. While it rose against the pound and the yen, it

held steady against the franc and the greenback.

The euro advanced to a 2-day high of 128.44 against the yen and

held steady thereafter. The pair was valued at 128.14 when it ended

deals on Thursday.

Data from the Ministry of Internal Affairs and Communications

showed that Japan household spending fell 0.3 percent on year in

October, coming in at 290,396 yen.

That missed expectations for an increase of 1.1 percent

following the 1.6 percent decline in September.

The single currency pulled back to 1.1363 against the greenback,

from a high of 1.1383 seen at 3:45 am ET. The euro is likely to

find support around the 1.12 level.

Having climbed to a 2-day high of 0.8931 against the pound at

4:00 am ET, the euro reversed direction and retreated to 0.8902

following the data. The euro is seen finding support around the

0.88 area.

Survey data from the Bank of England showed that UK inflation

expectations for the coming year rose to their highest level in

five years.

Median expectations of the rate of inflation over the coming

year were 3.2 percent, compared to 3.0 percent in August.

The euro reversed from an early low of 1.1284 against the franc,

rising to 1.1303. If the euro rises further, 1.16 is possibly seen

as its next resistance level.

Looking ahead, U.S. and Canadian jobs data for November,

University of Michigan's preliminary consumer sentiment index for

December, U.S. wholesale inventories and consumer credit for

October are scheduled for release in the New York session.

At 12:00 pm ET, Federal Reserve Governor Lael Brainard will

speak about financial stability at the Peterson Institute in

Washington DC.

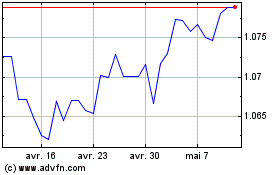

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024