Euro Mixed After German ZEW Survey, Eurozone GDP Data

08 Juin 2021 - 10:00AM

RTTF2

The euro showed mixed trading against its major rivals in the

European session on Tuesday, after a slew of reports on German ZEW

economic sentiment for June, Eurozone GDP and employment for the

first quarter.

Survey data from the ZEW - Leibniz Centre for European Economic

Research showed that German economic sentiment weakened

unexpectedly in June but financial market experts' assessment of

current situation improved sharply.

The ZEW Indicator of Economic Sentiment dropped to 79.8 in June

from 84.4 in the previous month. The score was forecast to rise to

86.0.

Meanwhile, assessment of the current economic situation improved

significantly in June with the index rising to -9.1 from 40.1 a

month ago.

Revised data from Eurostat showed that the euro area economy

shrank less than previously estimated in the first quarter.

Gross domestic product fell 0.3 percent sequentially in the

first quarter, following a 0.6 percent drop in the fourth quarter.

The decline for the first quarter was revised down from -0.6

percent.

Year-on-year, GDP declined 1.3 percent versus a 4.7 percent fall

in the previous quarter.

Further, data showed that in the first quarter, 157.6 million

people were employed in the euro area. In relation to the COVID-19

pandemic, employment in persons was 3.4 million in the euro area

below the level of the fourth quarter of 2019.

Employment decreased 0.3 percent sequentially in the first

quarter and by 1.8 percent from the same period of last year.

The European Central Bank's monetary policy decision is due on

Thursday, with investors expecting it to keep key rates and

stimulus measures unchanged.

The ECB is likely to avoid any mention of tapering its purchases

under PEPP as policy makers want to see a sustained recovery from

the pandemic.

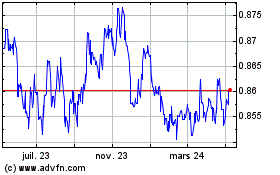

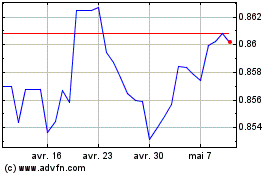

The euro climbed to a 5-day high of 0.8616 against the pound,

compared to Monday's close of 0.8593. The euro is likely to locate

resistance around the 0.88 level.

Data from the British Retail Consortium showed that UK retail

sales increased notably in May driven by the relaxation of

restrictions related to the coronavirus pandemic.

Total sales grew 10 percent year-on-year in May and

like-for-like sales climbed 23.7 percent.

The euro gained to 133.36 against the yen from yesterday's

closing value of 133.15. The currency may face resistance around

the 135 region.

Final data from the Cabinet Office showed that Japan's gross

domestic product contracted an annualized 3.9 percent on year in

the first quarter of 2021.

That exceeded expectations for a decline of 4.8 percent

following the 11.7 percent surge in the three months prior.

The single currency dropped to 1.2164 against the greenback and

was steady afterwards. If the euro slides further, 1.20 is likely

seen as its next support level.

The euro fell to 1.0913 against the franc, a level unseen since

February 23. The currency is seen locating support around the 1.06

region.

Looking ahead, U.S. and Canadian trade data for April will be

released in the New York session.

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024