European Corporate Roundup for Friday

20 Octobre 2017 - 11:00AM

Dow Jones News

European corporate news is in focus Friday, with auto makers

Daimler and Volvo reporting mixed profit updates.

---

German auto maker Daimler, which produces the Mercedes-Benz

brand of luxury cars, reported a sharp fall in quarterly profit as

its flagship car was hammered by airbag-related recalls and the

cost of fixing emissions controls on diesel vehicles.

Net income fell 17% to EUR2.27 billion ($2.69 billion) in the

three months to Sept. 30 from EUR2.73 billion the prior year,

slammed by costs linked to the diesel fix and currency

fluctuations.

Earnings before interest and taxes--the measure most closely

watched by investors--fell to EUR3.46 billion from EUR4.04 billion

the previous year, pulled lower by a 22% drop at Mercedes and

despite a strong rise in truck earnings.

Earnings were also hit by costs from the launches of Mercedes'

new flagship S-Class model, X-Class light-utility vehicles and the

company's first electric heavy truck.

The biggest impact on earnings, however, came from mounting

costs related to the industry's diesel-emissions woes.

"Around 60% of the vehicles affected in Germany have been

updated," Chief Finance Officer Bodo Uebber told reporters on a

conference call.

---

Swedish truck maker Volvo reported a forecast-beating increase

in third-quarter net profit, boosted by rising truck orders and a

continued rebound in its construction-equipment unit.

Overall demand was stellar during the quarter, with truck orders

up 32% on the year and construction equipment orders up by 45%.

---

Sweden's Ericsson said that net loss widened sharply in the

third quarter amid increasing restructuring charges and provisions

as the company continued to navigate tough markets and a huge

strategic shakeup.

The supplier of wireless-communications gear reported a net loss

for the three months ended Sept. 30 of 4.45 billion Swedish kronor

($547.5 million) compared with a loss of SEK233 million a year

earlier, missing analysts' expectations for a loss of SEK1.35

billion, according to a FactSet poll. Revenue was down 6.4% at

SEK47.8 billion.

---

Metro, the German wholesale and food retail company, said that

sales in the fourth quarter rose modestly on a like-for-like basis

due to positive acquisition effects and a strong online

business.

Sales in the fourth quarter rose 0.5% to 9.2 billion euros

($10.88 billion) compared with EUR9.1 billion last year. This rise

was offset by currency effects, with sales in the local currency

increasing by 1.6%.

---

TomTom reported a swing to a loss for the three months ended

Sept. 30 and said that it has reduced its revenue guidance for the

year.

The Dutch company posted a net loss of 5.3 million euros ($6.3

million) for the third quarter, compared with a net profit of

EUR595,000 a year earlier, citing a one-off charge of EUR15.4

million related to the restructuring of its consumer-sports

division.

(END) Dow Jones Newswires

October 20, 2017 04:45 ET (08:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

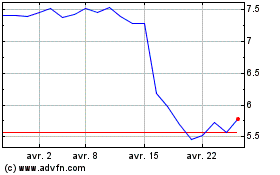

Tomtom NV (EU:TOM2)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

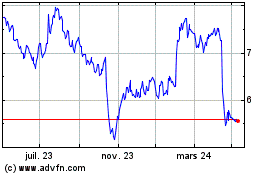

Tomtom NV (EU:TOM2)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024