Europe's Most Valuable Tech Company Can Help the Chip Shortage--Heard on the Street

21 Avril 2021 - 5:09PM

Dow Jones News

By Stephen Wilmot

Good news for anyone looking for a new car: The microchip

industry is mustering faster than expected to solve today's

crippling shortages.

ASML, which competes with Applied Materials to sell

semiconductor-manufacturing gear to the likes of Intel and Taiwan

Semiconductor Manufacturing, on Wednesday more than doubled its

growth forecast for the year and said it was increasing production

capacity for 2022 -- a reassuring sign for any business that needs

chips to make its products and any consumer waiting for them. The

stock jumped 4%.

The Dutch manufacturer has grown to become Europe's most

valuable technology company, with a market value of $257 billion.

That compares to just $118 billion for Applied Materials, even

though the U.S. company has slightly higher revenue. One reason is

ASML's near-monopolistic position in a cutting-edge chip-making

technology called extreme ultraviolet (EUV) lithography. Intel's

new chief executive, Pat Gelsinger, last month said the company

erred in not embracing EUV earlier.

ASML's EUV revenue will grow 30% this year -- that hasn't

changed -- but it is working with its supply chain to ramp up

output for next year ahead of its previous plans. The company also

said it was looking at boosting capacity in more standard deep

ultraviolet (DUV) lithography. Given that the current shortage

seems to be affecting basic chips as much as advanced ones,

concrete steps here would be welcome.

That said, ASML's DUV business will manage nicely this year with

just existing capacity. Following big capital-spending

announcements by TSMC, Intel and Samsung, the company expects to

increase revenues by 30% in 2021, led by DUV machines. Its previous

guidance implied growth of around 12%. Meanwhile, ASML's

first-quarter results were boosted by a more immediate response to

the shortage as chipmakers bought software upgrades that increase

the output of existing machines.

At 47 times prospective earnings, ASML is an expensive stock,

both relative to peers and its own record. One question hanging

over that valuation is geopolitical. CEO Peter Wennink sees ASML as

a potential beneficiary of the "capital inefficiency" that might

result from greater U.S. autonomy in chip manufacturing. Yet China

accounted for 15% of ASML's first-quarter revenue -- business that

is vulnerable to U.S. moves to limit Chinese access to cutting-edge

chip technology.

The nosebleed valuation might deter stockpickers, but it is in

part an expression of confidence in ASML's ability to help fix the

great chip shortage.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

April 21, 2021 10:54 ET (14:54 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

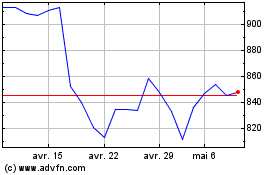

ASML Holding NV (EU:ASML)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

ASML Holding NV (EU:ASML)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024