Europe's Top Investment Banks Look to Tackle Decline with New Leadership

15 Novembre 2019 - 3:18PM

Dow Jones News

By Pietro Lombardi

The appointment of new top brass at Credit Suisse Group AG's

(CS) investment banking-and-capital markets division this week is

the latest in a series of high-level changes at Europe's leading

investment banks.

The reshuffles have come as regional lenders lose ground to U.S.

competitors and are hit by falling revenue, while facing the

challenges of new technology, regulation and geopolitical

tensions.

"Investment banks face structural headwinds that they cannot

avoid," Berenberg analysts said in a recent report on the industry.

"Many cling to the hope that higher volatility will be a silver

bullet, but recent experience suggests otherwise."

The leadership change at Credit Suisse--where veteran banker

David Miller replaced James Amine as head of investment banking and

capital markets--follows similar moves at some of the region's

financial powerhouses.

Deutsche Bank AG's (DBK.XE) investment bank chief Garth Ritchie

left in July, with Chief Executive Christian Sewing assuming

oversight of the unit. In March, Barclays PLC (BARC.LN) announced

the departure of its investment bank head, while Andrea Orcel left

UBS Group AG's (UBS) investment banking arm in late 2018.

Revenue at the 12 biggest investment banks in Europe and the

U.S. fell 11% on year in the first half of 2019 to $76.8 billion,

hitting a 13-year low, and headcount continued to fall across the

industry, according to Coalition, an industry data provider.

In this environment, European players continue to lose market

share to U.S. peers.

Since 2009, U.S. banks' share of global investment banking

revenue rose roughly 10 percentage points and now stands at about

53%, according to data provider Dealogic. In the same period, the

share of European banks declined more than 10 percentage points to

25%.

Investment banking operations in Europe compare poorly in terms

of costs and revenue with U.S. counterparts and generate an

operating profit before provisions that is 70% lower, according to

Berenberg.

The brokerage mentions several reasons, including a more

concentrated U.S. market that gives banks more pricing power and

U.S. banks' quicker reaction to the financial crisis.

"We believe that one of the key reasons that European banks

still underperform U.S. banks is that they never adequately dealt

with their balance sheet issues," it said.

In recent years, several European banks have restructured their

investment banking operations. Deutsche Bank is exiting its

global-equities sales and trading business and eliminating 18,000

jobs. In April, France's Societe Generale SA (GLE.FR) said it would

cut nearly 1,600 jobs after a slump in investment-banking revenue,

with the unit including fixed income and equity trading and

securities services bearing the brunt of the cuts. Credit Suisse

started a sweeping restructuring in 2015 to streamline its

investment-banking operations. Rival UBS launched a similar

overhaul years earlier.

Recent results highlight the challenges facing the restructured

banks.

Credit Suisse's investment banking-and-capital markets division

swung to a pretax loss in the third quarter, as fewer mergers and

acquisitions and IPOs contributed to a 21% decline in revenue. The

Swiss bank's global investment banking operations ranked seventh in

the first nine months of the year, down one rung from a year

earlier, according to Dealogic.

In the same quarter, Deutsche Bank posted a loss partly due to

restructuring costs and lower revenue at its fixed-income

operations. In comparison, Morgan Stanley, Barclays PLC and

JPMorgan Chase & Co. achieved double-digit growth in

fixed-income trading revenue in the period.

Troubles in Europe likely mean gains for U.S. competitors,

according to Berenberg.

"As European IBs continue to restructure their operations in

search of better returns, we believe U.S. IBs will continue to take

market share."

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

November 15, 2019 09:03 ET (14:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

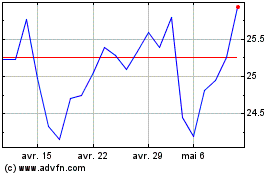

Societe Generale (EU:GLE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Societe Generale (EU:GLE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024