Falling Chinese Imports Hold Back Oil

08 Novembre 2017 - 1:00PM

Dow Jones News

By Christopher Alessi

LONDON--Oil prices were mainly flat Wednesday morning after weak

Chinese data and receding geopolitical risk factors.

Brent crude, the global benchmark, was up 0.11%, at $63.76 a

barrel on London's Intercontinental Exchange. On the New York

Mercantile Exchange, West Texas Intermediate futures were trading

down 0.14% at $57.12 a barrel.

Chinese customs data released Wednesday morning showed oil

imports at roughly 7.3 million barrels a day in October, down from

9 million barrels a day the month prior--the "weakest monthly

imports seen since October 2016," according to Dutch bank ING

Groep.

Giovanni Staunovo, a commodities analyst at UBS Wealth

Management, called China's import contraction surprising.

"Considering that China was one of the countries removing excess

production from the market, there is a concern if this trend

continues," he said.

At the same time, the market appeared to consolidate some of the

record gains of recent days, as concerns over political turmoil in

Saudi Arabia faded.

Crude prices earlier in the week hit two-year highs--with Brent

nearly breaching $65 a barrel--after Saudi Crown Prince Mohammed

bin Salman had more than five dozen princes, ministers and

prominent businessmen detained in an alleged corruption crackdown

over the weekend.

But the upheaval is "not affecting oil production" and there is

"no change on the oil policy side," Mr. Staunovo said, suggesting

Saudi Arabia would continue to abide by an OPEC-led agreement to

curb production.

The market also cooled in response to an updated forecast

Tuesday from the U.S. Energy Information Administration, upping its

supply growth projection to 720,000 barrels a day for 2018. U.S.

crude production is now expected to average 9.95 million barrels a

day next year.

"The U.S. shale machine is poised to shift up a gear as

producers make hay amid the improving price backdrop," said Stephen

Brennock, an analyst at brokerage PVM Oil Associates Ltd.

Oil market participants will be watching for inventory data

Wednesday from the EIA to assess whether the amount of crude oil in

storage has continued to decline. Traders and analysts surveyed by

The Wall Street Journal on average expect crude stockpiles to have

fallen by 2.1 million barrels in the week ended Nov. 3.

Among refined products, Nymex reformulated gasoline

blendstock--the benchmark gasoline contract--was down 0.19%, at

$1.81 a gallon. ICE gasoil, a benchmark for diesel fuel, changed

hands at $563.75 a metric ton, up 0.09% from the previous

settlement.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

November 08, 2017 06:45 ET (11:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

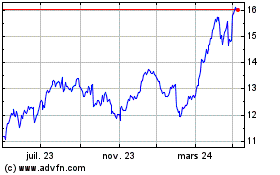

ING Groep NV (EU:INGA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

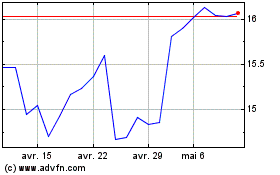

ING Groep NV (EU:INGA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024