FedEx to End U.S. Express Business With Amazon -- 3rd Update

07 Juin 2019 - 11:47PM

Dow Jones News

By Paul Ziobro

FedEx Corp. is ending its air-shipping contract with Amazon.com

Inc. in the U.S., deciding it will no longer fly packages for an

online retailer that is developing its own delivery network.

In a surprise move Friday, FedEx said it won't renew the

domestic contract, which runs through June 30, for its Express

unit. It will still have other shipping contracts with Amazon,

including through its ground network and international

services.

Amazon ships millions of packages a day, though it spreads the

orders among FedEx, United Parcel Service Inc. and the U.S. Postal

Service, as well as its own growing delivery operations. FedEx said

Amazon represented 1.3% of FedEx's total revenue in 2018, or less

than $1 billion.

FedEx said it is severing its air relationship with the

e-commerce leader to focus on serving a broader array of retailers,

including large chains such as Walmart Inc., Target Inc. and

Walgreens Boots Alliance Inc.

"After much discussion, FedEx has made the strategic decision to

not renew that contract," FedEx executives wrote in an internal

memo announcing the change to staff.

"While Amazon has been a longstanding customer of FedEx, we have

carefully managed our capacity for many years," and there is

opportunity to grow with other e-commerce shippers, the memo

said.

Amazon has been building up its own logistics and delivery

network, including leasing cargo jets to fly products from

overseas, hiring semi trucks to ship goods in Amazon-branded

trailers and contracting with local delivery firms to bring

packages to homes. The company has 42 Amazon-branded aircraft in

the U.S. and expects the fleet will grow to about 50 planes by the

end of the year.

"We respect FedEx's decision and thank them for their role

serving Amazon customers over the years," Amazon said.

Last month, Amazon broke ground on its own air-cargo hub in

Hebron, Ky., which is near large air hubs run by UPS in Louisville,

Ky., and FedEx in Memphis, Tenn. The Amazon facility is expected to

open in 2021. Meanwhile, Deutsche Post AG's DHL is handling Amazon

Air packages at its hub in Hebron. The company's goal is to

eventually haul and deliver packages for itself as well as other

retailers, the Journal has reported.

FedEx and UPS have sought to play down the competitive threat of

Amazon in recent years, as analysts and investors have questioned

their exposure to the large online retailer and risks posed by the

Seattle-based company delivering more packages on its own.

"The level of global investment in facilities, sorting,

aircraft, vehicles, people to replicate the service we provide, or

our primary competitor provides, is just daunting, and frankly, in

our view, unrealistic," FedEx Chief Financial Officer Alan Graf

told the Journal in 2016.

The latest move suggests FedEx has taken a different view of

Amazon, Citi transportation analyst Christian Wetherbee wrote in a

research note Friday. "This is a fairly bold pronouncement from

FedEx to move away from Amazon, which we believe the company views

as a long-term threat to its business," Mr. Wetherbee said.

He said Amazon's business likely comes at a lower margin to

FedEx than other shippers, since larger customers can negotiate

lower rates. And Amazon delivering more packages itself is a more

worrying for sign for UPS, which Citi estimates generates a mid- to

high-single-digit percent of revenue from Amazon.

A UPS spokesman declined to comment on its shipping contract

with Amazon.

In recent quarters FedEx's business has been under pressure,

with lower revenue in its Express unit and higher costs in its

ground business forcing the company to lower its profit targets.

The Express unit has switched leaders twice in recent months, and

the ground business said it would start home delivery seven days a

week next year. Earlier this week, FedEx said it wouldn't pay

bonuses this year.

FedEx has been more closely aligning itself with traditional

retailers, which are increasingly shipping from stores instead of

far-off distribution centers. It has been using its Express

network, which traditionally carries packages long distances by

plane, to ferry packages shorter distances without leaving the

ground. The carrier has developed a service where it picks up

online orders from stores, brings them to its Express unit's

sorting hubs and delivers them to homes the next day.

Jennifer Smith contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

June 07, 2019 17:32 ET (21:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

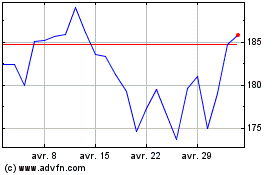

Amazon.com (NASDAQ:AMZN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

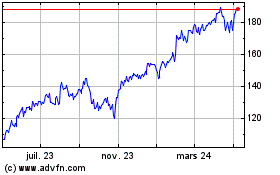

Amazon.com (NASDAQ:AMZN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024