Financing to support Spineway development strategy

Press

release

Ecully, 22 December 2020, 10 p.m.

Financing planNew

tranche of Negma convertible bonds

In keeping with its development

strategy, Spineway wishes to be in a position to take advantage of

any and all external-growth opportunities that could create value

and new synergies. To this end, Spineway decided to launch a new

subscription phase for Convertible Bonds with

warrants.

Background on the Negma financing

agreement:

In accordance with:

- the delegation of power granted by the Extraordinary General

Shareholders’ Meeting held by Spineway (the

“Company”) on 3 October 2019,

- the Company’s Board of Directors’ decision of 17 October 2019

approving the issue of 16 000 warrants (the “Tranche

Warrants”) the exercise of which gives access to the issue

of a maximum of 16 000 bonds convertible into new ordinary

shares (the “Convertible Bonds»”) with warrants

(the “Warrants”), representing a bond issue for a

maximum total par value of 40 000 000 euros, with

cancellation of the shareholders’ preferential subscription right

in favor of NEGMA GROUP LTD (the

“Investor”),1

two tranches of Convertible Bonds have thus been

subscribed to date:·1st tranche of €5.3M2 in two phases (24

December 2019 and 31 March 2020), corresponding to a total

of:o a cash contribution of €2.3M;o a bond

issue pursuant to the Commitment Fees representing

€1.45M;o settlement of all compensations as per the

contract terms and conditions amounting to €1.5M.

·2nd tranche initially planned for a maximum of

€6M, to be spread out into several phases from April to September

20203. Due to the public-health crisis, the scope and duration of

which could not be predicted at the time of this tranche’s launch,

the schedule was modified, and it ended in November 2020. Likewise,

the amount was slightly modified, resulting in a total amount of

€6.55M, as follows:o 1 120 Convertible Bonds,

i.e., €2.8M in compensation on 16 April 2020;o 300

Convertible Bonds, i.e., €0.75M via an all-cash contribution on 18

May 2020;o 800 Convertible Bonds, i.e., €2M via a cash

contribution of €1.3M, and €0.7M via the settlement of contractual

compensations on 7 September 2020;o 400 Convertible

Bonds, i.e., €1M, of which €0,.98M for contractual compensations,

on 13 November 2020.

·In addition, a capital increase of €4.6M

reserved for Negma took place on 26 May 20204 as settlement of a

portion of the contractual compensations resulting from the issue

of the first two tranches.

As a result of these first two tranches,

Spineway has therefore received a total of €4.4M in cash since

entering into this financing agreement with Negma. The additional

amounts of Convertible Bonds have been posted as financial costs

pursuant to the settlement of contractual compensations.

All the compensations that led to both the issue

of bonds and a reserved capital increase are indeed a result of the

agreement between Spineway and Negma, which provides for

indemnification if the market price of the share falls below its

par. As market trends in 2020 were very unfavorable for Spineway

stock, the exercise of tranches was accompanied by major

compensations. In order to protect this mechanism, Spineway lowered

the share’s par value twice during the financial year.

Overall, these compensations resulted in

a financial burden of €12M for 2020, with €10.6M recorded

for the first half of 20205. This financial cost

did not result in any cash outflow for the Group and was

financed entirely by Spineway shares.

Subscription of a new tranche of Convertible

Bonds:

In this context, where the risk of compensation

has been secured by the par-value decrease, Spineway is launching a

third tranche of subscription to Convertible Bonds that will

represent an estimated maximum of €6M by the end of Q1 2021. The

use of this estimated amount will be subject to the needs of

necessary projects, and only those.

The first phase of this issue therefore took

place on 22 December 2020, for a total of €1M, corresponding to 400

Convertible Bonds.

The Company would like to recall the

following:

- The Convertible Bonds have a par value of 2 500 euros each

and are subscribed at 100% of par.

- The Convertible Bonds have a maturity of 12 months from their

date of issuance. In the event of default6, a significant adverse

event7, a change in control or failure to deliver new shares in

accordance with the Issuance Agreement, the Convertible Bonds that

have not been converted shall be redeemed by the Company at par.

Upon maturity, the Convertible Bonds shall be converted by their

bearer into SPINEWAY shares. The Convertible Bonds shall not bear

interest.

- At its discretion, the Investor may, at any time, convert all

or any of the Convertible Bonds into new ordinary shares (a

“Conversion”). Upon a Conversion, the Investor

shall determine the number of Convertible Bonds to be converted and

the total par value to be converted (the “Conversion

Amount”).

- A compensation mechanism is applied if there is a difference

between the Conversion Amount and the last trading price.8

Please note that further information on the

characteristics of the Tranche Warrants, Convertible Bonds and

Warrants is available on the Company’s website and in the press

release dated 18 October 2019.

For reference, assuming the Company decides to

remit only new shares upon Conversion of the Convertible Bonds, the

impact of the issuance of the Convertible Bonds with Warrants

attached would be as follows:

-

Impact of the issuance on the consolidated net assets per share

(based on the shareholders’ equity as at 30 June 2020, plus the

various capital transactions that might have taken place in the

meantime, i.e., €3.75M and the number of shares making up the

Company’s share capital as at 22 December 2020, i.e.,

12 632 759 445 shares):

|

|

Consolidated net assets per share (non-diluted basis) |

Consolidated net assets per share (fully diluted basis)(a) |

|

Before issuance |

€0.0009 |

€0.0010 |

|

After issuance of a maximum of 1 111 111 111 ordinary new

shares upon conversion of Convertible Bonds alone (400

third-tranche Convertible Bonds) |

€0.0009 |

€0.0010 |

|

After issuance of a maximum of 1 216 111 111 ordinary new

shares upon conversion of Convertible Bonds and exercise of the

Warrants attached to the second tranche (400 third-tranche

Convertible Bonds) |

€0.0009 |

€0.0010 |

|

After issuance of a maximum of 6 000 000 000 ordinary new

shares (for 2 400 Convertible Bonds), upon conversion of only a

portion of the Convertible Bonds in accordance with the applicable

ceiling |

€0.0009 |

€0.0010 |

|

After issuance of a maximum of 6 000 000 000 ordinary new shares

(for 2 400 Convertible Bonds), upon conversion of only a portion of

the Convertible Bonds and without exercise of the attached

Warrants, for all tranches in accordance with the applicable

ceiling |

€0.0009 |

€0.0010 |

|

(a) assuming the exercise/conversion of all the dilutive

instruments existing to date that could result in the creation of a

theoretical maximum of 812 683372 including the exercise of the 137

805 Warrants issued pursuant to the issuance of ORNANE with

Warrants in favor of the YA II PN, LTD investment fund and the 80

916 666 Warrants issued pursuant to the issuance of OCEANE with

Warrants in favor of the European High Growth Opportunities Manco S

investment fund, as well as the 731 628 901 Warrants issued

pursuant to the issuance of Convertible Bonds with Warrants in

favor of the Park Capital investment fund. Such dilution is without

prejudice to either the final number of shares to be issued or

their issue price, which shall be set based on the market price in

accordance with the terms and conditions set forth above. |

-

Impact of the issuance on the situation of a shareholder currently

owning 1% of the Company’s capital, based on the number of shares

making up the Company’ share capital as at 22 December 2020, i.e.,

12 632 759 445 shares):

|

|

Consolidated net assets per share (non-diluted basis) |

Consolidated net assets per share (fully diluted basis)(a) |

|

Before issuance |

1% |

1% |

|

After issuance of a maximum of 1 111 111 111 ordinary new

shares upon conversion of Convertible Bonds alone (400

third-tranche Convertible Bonds) |

0.92% |

0.92% |

|

After issuance of a maximum of 1 216 111 111 ordinary new

shares upon conversion of Convertible Bonds and exercise of the

Warrants attached to the second tranche (400 third-tranche

Convertible Bonds) |

0.91% |

0.91% |

|

After issuance of a maximum of 6 000 000 000 ordinary new

shares (for 2 400 Convertible Bonds), upon conversion of only a

portion of the Convertible Bonds in accordance with the applicable

ceiling |

0.64% |

0.65% |

|

After issuance of a maximum of 6 000 000 000 ordinary new shares

(for 2 400 Convertible Bonds), upon conversion of only a portion of

the Convertible Bonds and without exercise of the attached

Warrants, for all tranches in accordance with the applicable

ceiling |

0.64% |

0.65% |

|

(a) assuming the exercise/conversion of all the dilutive

instruments existing to date that could result in the creation of a

theoretical maximum of 812 683372 including the exercise of the 137

805 Warrants issued pursuant to the issuance of ORNANE with

Warrants in favor of the YA II PN, LTD investment fund and the 80

916 666 Warrants issued pursuant to the issuance of OCEANE with

Warrants in favor of the European High Growth Opportunities Manco S

investment fund, as well as the 731 628 901 Warrants issued

pursuant to the issuance of Convertible Bonds with Warrants in

favor of the Park Capital investment fund. Such dilution is without

prejudice to either the final number of shares to be issued or

their issue price, which shall be set based on the market price in

accordance with the terms and conditions set forth above. |

SPINEWAY IS ELIGIBLE FOR THE PEA-PME

(EQUITY SAVINGS PLANS FOR SMES)Find out all about Spineway

at www.spineway.com

This press release has been prepared in both

English and French. In case of discrepancies, the French version

shall prevail.

Spineway

designs, manufactures and markets innovative implants and surgical

instruments for treating severe disorders of the spinal

column.Spineway has an international network of

over 50 independent distributors and 90% of its revenue comes from

exports.Spineway, which is eligible for investment

through FCPIs (French unit trusts specializing in innovation), has

received the OSEO Excellence award since 2011 and has won the

Deloitte Fast 50 award (2011). Rhône Alpes INPI Patent Innovation

award (2013) – INPI Talent award (2015). ISIN:

FR0011398874 - ALSPW

Contacts:

|

SPINEWAY Shareholder-services

lineAvailable Tuesday through Thursday(10 a.m. – 12

p.m.)+33 (0)811 045 555 |

Eligible PEA / PMEALSPWEuronext Growth |

AELIUM Finance & Communication Investor

relationsSolène Kennisspineway@aelium.fr |

1 Cf. press release dated 18 October 2019

2 Cf. press release dated 24 December 2019

3 Cf. press release dated 16 April 2020

4 Cf. press release dated 20 May 2020

5 Cf. press release dated 24 October 2020

6 Events of default include, in particular, the

suspension of the listing of the SPINEWAY shares, the announcement

of a takeover of the Company and any significant adverse

change.

7 Any and all events or circumstances

constituting a significant adverse change affecting the assets or

the Company’s financial or commercial situation, subject to such

change being considered materially adverse only if it had or could

reasonably have an unfavorable net impact on the Company’s

financial situation or assets exceeding 1 000 000

euros.

8 In accordance with clause 8.3 of the Negma

financing agreement.

- SPW_CP_Levee_nouvelle_tranche_OC GB

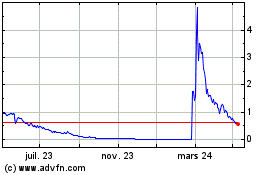

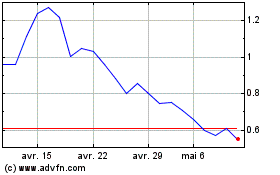

Spineway (EU:ALSPW)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Spineway (EU:ALSPW)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024