Fintech Firm GreenSky Explores Possible Sale

06 Août 2019 - 6:19PM

Dow Jones News

By Peter Rudegeair

Online lender GreenSky Inc. said Tuesday that it is exploring a

range of strategic alternatives, a humbling turn for a high-growth

financial-tech company that made a splashy debut on public markets

just over a year ago.

Shares in the Atlanta-based company fell as much as 34% to $6.81

in morning trading following the announcement of a potential sale

or merger in addition to a second-quarter earnings report that

missed analysts' expectations. GreenSky said that profit fell 4% to

$39.2 million, or 19 cents a share, from a year earlier on revenue

of $138.7 million.

GreenSky makes technology that allows Home Depot Inc. and more

than 16,000 merchants to offer consumers loans to fund

home-improvement projects and medical procedures. Unlike

LendingClub Corp. and other online lenders, GreenSky has been

profitable for years and generates the bulk of its revenue from

fees it charges merchants.

Though it positions itself as a technology company, GreenSky

depends on a small number of banks to fund nearly all its loans.

One of those banks, Regions Financial Corp., said during the second

quarter that it wouldn't renew a funding commitment to GreenSky,

spooking investors.

"We believe that the company's current market value does not

reflect the company's intrinsic value," Chairman and CEO David

Zalik said on a conference call with analysts. Valued at more than

$4 billion at its May 2018 public listing, GreenSky shares had

plunged by two-thirds through late morning Tuesday.

GreenSky said it retained FTP Securities LLC and J.P. Morgan

Securities LLC as its financial advisers, and Cravath, Swaine &

Moore LLP and Troutman Sanders LLP as its legal advisers.

Other online lenders are also falling out of favor among

investors. Shares in On Deck Capital Inc. fell as much as 23% one

day in late July after the online lender said that JPMorgan Chase

& Co. was winding down a three-year-old small-business lending

partnership.

--Michael Dabaie contributed to this article.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

August 06, 2019 12:04 ET (16:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

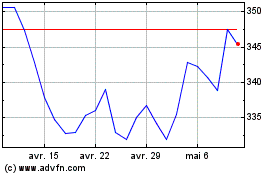

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024