For Luxury Retail Real Estate, Paris Retains Its Je Ne Sais Quoi

02 Juillet 2018 - 1:29PM

Dow Jones News

By Isobel Lee

One of the few bright spots in retail real estate these days is

on the so-called "high streets" of major cities, where luxury

brands are still willing to pay stratospheric rents to promote

their designer clothes, accessories, shoes and other goods.

Nowhere is the luxury high street stronger today than in

Paris.

The French capital saw more luxury store openings than any other

city in the world last year, accounting for 5.6% of total global

designer store launches, according to real-estate firm Savills.

In October, Louis Vuitton opened its new flagship on Place

Vendôme, in a historic property near the Ritz hotel that was

originally built by the architect behind Versailles. Designed by

Peter Marino, the store is a maze of art-lined rooms, with space

for private appointments as well as for Instagrammers looking to

snap the latest products from creative director Nicolas

Ghesquière.

Nearby, luxury rival Chanel has slowly been acquiring smaller

premises around its historic home at 31 Rue Cambon over the past

decade, with plans to create the brand's largest store in Paris, if

not Europe. Set to open later this year, the revamped flagship will

include offices, showrooms and museum spaces, as well as workshops

for customizing goods.

The decision by both Vuitton and Chanel to buy property instead

of renting reflects a long-term commitment to physical stores, said

Faustine Godbert, an associate in Savills' retail real-estate unit

in Paris. "Luxury brands are ready to pay huge amounts to own the

building, because they know that they will stay there for a long

time," she said.

The investments reflect the diverging paths of retail brands,

with luxury labels buoyed by Chinese consumers even as the sector

overall remains under siege from online competition. While sales at

some high-end stores may not be enough to justify their high

real-estate costs, retailers still consider the locations

invaluable for marketing and branding purposes.

For Paris, a position atop the high-street heap underscores the

city's re-emergence as a fashion and tourist mecca nearly three

years after terrorist attacks caused visitor numbers to plummet,

decimating retail turnover.

"When the hotels are full, so are the boutiques," said Ms.

Godbert. "International tourism is a more important driver of

luxury retail sales now than ever before. And the fashion houses

are ready to welcome them in a big way."

Asian shoppers, in particular, have been helping the city's

retailers. "Paris welcomes more Chinese overnight visitors than any

other European city," says Marie Hickley, director of Savills

European retail research. They come for cheaper prices than they

can find in their home markets, and to be certain they're not

acquiring fake goods, she said.

Landlords are reaping the benefits. Prime high-street Paris

rents grew about 9% a year between 2013 and 2017, according to Rob

Wilkinson, chief executive of AEW Europe SA, a unit of asset

manager AEW Global. "But it's very much bifurcated between high-end

luxury and the more basic retail that's been impacted by

e-commerce," he added.

Some investors have been taking advantage of the high prices to

put properties up for sale. New York-based Thor Equities LLC, which

has accumulated a half-dozen Paris properties in recent years, sold

two flagship spaces on Rue de Rennes last week. It also recently

sold a designer arcade on the Croisette in Cannes, leased to

Burberry, Bottega Veneta and Saint Laurent, among others.

Not all high streets are experiencing the same boom. In New

York, rents along the toniest section of Fifth Avenue fell to

$3,700 a square foot in the first quarter of 2018, down 0.5% from

the same period a year earlier, according to CBRE Group Inc.

And while luxury brands have proved more resistant to online

competition than their peers, that could change. By 2025, as much

as 25% of luxury goods could be sold online, according to a report

from Bain & Co.

Paris, or course, has been a fashion and retail hub for

centuries. Louis XIV's finance minister, Jean-Baptiste Colbert,

famously quipped in 1665 that "fashion is to France what the gold

mines of Peru are to Spain." But in the past quarter-century, the

look of and feel of luxury shopping in the French capital has

changed.

Luxury brands have colonized new arrondissements -- perhaps most

successfully in the Marais, says Veronique Nocquet, head of retail

services JLL France. And famed shopping streets have been updated,

with Hermès converting a 1930s swimming pool into a cavernous store

in Saint-Germain-des-Prés seven years ago, and Kering's Balenciaga

and LVMH Moët Hennessy Louis Vuitton's Dior recently opening new

stores on Avenue Montaigne.

"The look of the new flagships has become almost as important as

the product," says Ms. Godbert, of Savills. "And they're an

essential part of a multichannel strategy."

(END) Dow Jones Newswires

July 02, 2018 07:14 ET (11:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

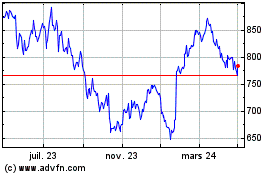

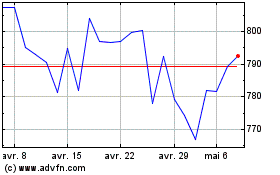

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024