Franc Falls After SNB Maechler's Warning Over Premature Rate Hike

28 Mars 2018 - 11:04AM

RTTF2

The Swiss franc dropped against its major counterparts in the

European session on Wednesday, after the Swiss National Bank

Governing Board member Andrea Maechler cautioned that a premature

rate hike in Switzerland could be counterproductive to the economic

development.

Defending negative interest regime, Maechler said in an

interview with Handelszeitung that there would be a big risk of

endangering the favorable development, if the bank halts its

expansive monetary policy.

"If we now end the expansionary monetary policy, so there would

be a risk that we would endanger the favorable development."

The Swiss franc remained highly valued and the situation on the

foreign exchange market are still fragile, Maechler told.

The currency has been trading lower against its major rivals in

the Asian session, with the exception of the yen.

The Swiss currency weakened to more than a 2-month low of 1.3486

against the pound, from Tuesday's closing value of 1.3401, and held

steady thereafter. The franc is seen finding support around the

1.38 region.

The Distribution Trades Survey from the Confederation of British

Industry showed that UK retail sales are forecast to rebound in

April after declining for the first time since October 2017.

About 32 percent of retailers said that sales volumes were up in

the year to March, whilst 40 percent said they were down, giving a

balance of -8 percent.

The franc that ended Tuesday's trading at 0.9467 against the

greenback declined to a weekly low of 0.9524. The franc is likely

to find support around the 0.97 level.

The franc slipped to 1.1803 against the euro, a level unseen

since January 16. The next possible downside target for the franc

is seen around the 1.20 level.

Survey data from the market research group GfK showed that

German consumer confidence is set to improve in April.

The forward-looking consumer sentiment index rose unexpectedly

by 0.1 point to 10.9 in April. The score was forecast to fall to

10.7.

On the flip side, the franc bounced off to 111.62 against the

yen, from an early 2-day low of 110.92. On the upside, 114.00 is

seen as the next resistance level for the franc.

Switzerland's KOF Economic Institute upgraded its economic

outlook citing improved economic situation of major trading

partners and the depreciation of the Swiss franc against the

euro.

In the Spring Forecast, the think tank said gross domestic

product is forecast to grow 2.5 percent this year instead of 2.3

percent estimated in December.

Looking ahead, U.S. pending home sales for February are

scheduled for release in the New York session.

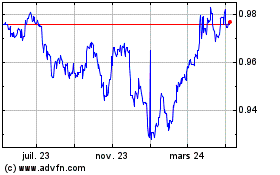

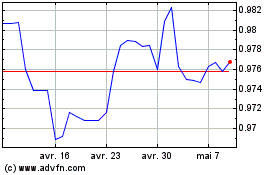

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024