Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

09 Mai 2019 - 2:59PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Number 333-230099

$1,500,000,000 Floating Rate Notes due 2021

$1,500,000,000 2.800% Notes due 2021

$2,750,000,000 2.850% Notes due 2022

$3,000,000,000 3.000% Notes due 2024

$3,000,000,000 3.300% Notes due 2026

$3,250,000,000 3.500% Notes due 2029

$2,000,000,000 4.150% Notes due 2039

$3,000,000,000 4.250% Notes due 2049

International Business Machines Corporation

May 8, 2019

Pricing Term Sheet

|

Issuer

|

|

International Business Machines Corporation

|

|

|

|

|

|

Issuer Ratings*

|

|

A1 / A / A (Moody’s/S&P/Fitch)***

|

|

|

|

|

|

Format

|

|

SEC Registered

|

|

|

|

|

|

Trade Date

|

|

May 8, 2019

|

|

|

|

|

|

Settlement Date**

|

|

May 15, 2019 (T+5)

|

|

|

|

|

|

Active Bookrunning Managers

|

|

J.P. Morgan Securities LLC

Goldman Sachs & Co. LLC

BNP Paribas Securities Corp.

Citigroup Global Markets Inc.

MUFG Securities Americas Inc.

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Mizuho Securities USA LLC

|

|

|

|

|

|

Passive Bookrunning Managers

|

|

Barclays Capital Inc.

HSBC Securities (USA) Inc.

RBC Capital Markets, LLC

Santander Investment Securities Inc.

SMBC Nikko Securities America, Inc.

Wells Fargo Securities, LLC

Commerz Markets LLC

Deutsche Bank Securities Inc.

TD Securities (USA) LLC

UniCredit Capital Markets LLC

Credit Suisse Securities (USA) LLC

ING Financial Markets LLC

SG Americas Securities, LLC

U.S. Bancorp Investments, Inc.

|

|

|

|

|

|

Co-Managers

|

|

Loop Capital Markets LLC

Banco Bradesco BBI S.A.

Lloyds Securities Inc.

Scotia Capital (USA) Inc.

ANZ Securities, Inc.

BBVA Securities Inc.

CIBC World Markets Corp.

Danske Markets Inc.

PNC Capital Markets LLC

RB International Markets (USA) LLC

Standard Chartered Bank

The Williams Capital Group, L.P.

|

|

|

|

Academy Securities, Inc.

Drexel Hamilton, LLC

Samuel A. Ramirez & Company, Inc.

Siebert Cisneros Shank & Co., L.L.C.

|

|

|

|

|

|

Minimum Denomination

|

|

$100,000 and multiples of $1,000 in excess thereof

|

|

|

|

|

|

Size

|

|

Floating Rate Notes: $1,500,000,000

2021 Notes: $1,500,000,000

2022 Notes: $2,750,000,000

2024 Notes: $3,000,000,000

2026 Notes: $3,000,000,000

2029 Notes: $3,250,000,000

2039 Notes: $2,000,000,000

2049 Notes: $3,000,000,000

|

|

|

|

|

|

Maturity

|

|

Floating Rate Notes: May 13, 2021

2021 Notes: May 13, 2021

2022 Notes: May 13, 2022

2024 Notes: May 15, 2024

2026 Notes: May 15, 2026

2029 Notes: May 15, 2029

2039 Notes: May 15, 2039

2049 Notes: May 15, 2049

|

|

|

|

|

|

Interest Payment Dates

|

|

Floating Rate Notes: Quarterly on February 13, May 13, August 13 and November 13

2021 Notes: Semi-annually on May 13 and November 13

2022 Notes: Semi-annually on May 13 and November 13

2024 Notes: Semi-annually on May 15 and November 15

2026 Notes: Semi-annually on May 15 and November 15

2029 Notes: Semi-annually on May 15 and November 15

2039 Notes: Semi-annually on May 15 and November 15

2049 Notes: Semi-annually on May 15 and November 15

|

|

|

|

|

|

First Interest Payment Date

|

|

Floating Rate Notes: August 13, 2019

2021 Notes: November 13, 2019

2022 Notes: November 13, 2019

2024 Notes: November 15, 2019

2026 Notes: November 15, 2019

2029 Notes: November 15, 2019

2039 Notes: November 15, 2019

2049 Notes: November 15, 2019

|

|

|

|

|

|

Coupon

|

|

Floating Rate Notes:

Spread to LIBOR: + 40 bps

Designated LIBOR Page: Reuters Screen LIBOR01 Page

Index Maturity: 3 Months

Interest Reset Period: Quarterly

Interest Reset Dates: February 13, May 13, August 13 and November 13

Initial Interest Rate: Three month LIBOR plus 40 bps, determined on May 9, 2019

2021 Notes: 2.800%

2022 Notes: 2.850%

2024 Notes: 3.000%

2026 Notes: 3.300%

2029 Notes: 3.500%

2039 Notes: 4.150%

2049 Notes: 4.250%

|

|

|

|

|

|

Benchmark Treasury

|

|

Floating Rate Notes: N/A

2021 Notes: 2.250% due April 30, 2021

2022 Notes: 2.250% due April 15, 2022

2024 Notes: 2.250% due April 30, 2024

|

|

|

|

2026 Notes: 2.375% due April 30, 2026

2029 Notes: 2.625% due February 15, 2029

2039 Notes: 3.375% due November 15, 2048

2049 Notes: 3.375% due November 15, 2048

|

|

|

|

|

|

Benchmark Treasury Yield

|

|

Floating Rate Notes: N/A

2021 Notes: 2.303%

2022 Notes: 2.269%

2024 Notes: 2.283%

2026 Notes: 2.380%

2029 Notes: 2.480%

2039 Notes: 2.885%

2049 Notes: 2.885%

|

|

|

|

|

|

Spread to Benchmark Treasury

|

|

Floating Rate Notes: N/A

2021 Notes: T + 50 bps

2022 Notes: T + 60 bps

2024 Notes: T + 80 bps

2026 Notes: T + 95 bps

2029 Notes: T + 105 bps

2039 Notes: T + 130 bps

2049 Notes: T + 145 bps

|

|

|

|

|

|

Yield to Maturity

|

|

Floating Rate Notes: N/A

2021 Notes: 2.803%

2022 Notes: 2.869%

2024 Notes: 3.083%

2026 Notes: 3.330%

2029 Notes: 3.530%

2039 Notes: 4.185%

2049 Notes: 4.335%

|

|

|

|

|

|

Make-Whole Call

|

|

2021 Notes: T + 10 bps

2022 Notes: T + 10 bps

2024 Notes: T + 15 bps

2026 Notes: T + 15 bps

2029 Notes: T + 20 bps

2039 Notes: T + 20 bps

2049 Notes: T + 25 bps

|

|

|

|

|

|

Special Mandatory Redemption

|

|

If the Issuer’s Agreement and Plan of Merger (the “Merger Agreement”) with Red Hat, Inc. is not consummated on or prior to April 28, 2020 or if the Merger Agreement is terminated any time prior to such date other than as a result of consummating the proposed acquisition, then the Issuer will be required to redeem the 2021 Notes, 2022 Notes and 2026 Notes (the “Special Mandatory Redemption Notes”) on the special mandatory redemption date at a redemption price equal to 101% of the aggregate principal amount of the Special Mandatory Redemption Notes plus accrued and unpaid interest thereon to but excluding the special mandatory redemption date. The Notes (other than the Special Mandatory Redemption Notes) are not subject to the special mandatory redemption.

|

|

|

|

|

|

Price to Public

|

|

Floating Rate Notes: 100.000%

2021 Notes: 99.994%

2022 Notes: 99.946%

2024 Notes: 99.618%

2026 Notes: 99.814%

2029 Notes: 99.749%

2039 Notes: 99.529%

2049 Notes: 98.581%

|

|

|

|

|

|

Underwriting Discount

|

|

Floating Rate Notes: 0.10%

2021 Notes: 0.10%

2022 Notes: 0.15%

2024 Notes: 0.25%

|

|

|

|

2026 Notes: 0.30%

2029 Notes: 0.40%

2039 Notes: 0.60%

2049 Notes: 0.75%

|

|

|

|

|

|

Day Count

|

|

Floating Rate Notes: Actual/360, Modified Following Business Day

2021, 2022, 2024, 2026, 2029, 2039 and 2049 Notes: 30/360

|

|

|

|

|

|

CUSIP / ISIN

|

|

Floating Rate Notes: 459200KD2 / US459200KD25

2021 Notes: 459200JW2 / US459200JW25

2022 Notes: 459200JX0 / US459200JX08

2024 Notes: 459200JY8 / US459200JY80

2026 Notes: 459200JZ5 / US459200JZ55

2029 Notes: 459200KA8 / US459200KA85

2039 Notes: 459200KB6 / US459200KB68

2049 Notes: 459200KC4 / US459200KC42

|

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

**We expect that delivery of the notes will be made to investors on or about May 15, 2019, which will be the fifth business day following the date of this final term sheet (such settlement being referred to as “T+5”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes on the date of the prospectus supplement or the next two succeeding business days will be required, by virtue of the fact that the notes initially settle in T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the notes who wish to trade the notes on the date of the prospectus supplement or the next two succeeding business days should consult their advisors.

***Moody’s under review for downgrade from A1 to A2 pending closing of the Issuer’s acquisition of Red Hat Inc.; Fitch Rating Watch Negative; and S&P outlook negative.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling

J.P. Morgan Securities LLC at

1-212-834-4533

, Goldman Sachs & Co. LLC at 1-212-902-1171, BNP Paribas Securities Corp. at 1-212-841-2871, Citigroup Global Markets Inc. at 1-800-831-9146,

MUFG Securities Americas Inc. at 1-877-649-6848, Merrill Lynch, Pierce, Fenner & Smith Incorporated at 1-800-294-1322 or Mizuho Securities USA LLC at 1-866-271-7403.

This pricing term sheet supplements the preliminary form of prospectus supplement issued by International Business Machines Corporation on May 8, 2019 relating to its Prospectus dated March 6, 2019.

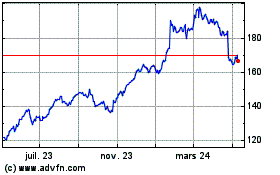

International Business M... (NYSE:IBM)

Graphique Historique de l'Action

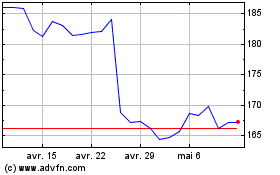

De Mar 2024 à Avr 2024

International Business M... (NYSE:IBM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024