French Retailer Carrefour Denies Takeover Talks With Rival Casino -- 6th Update

24 Septembre 2018 - 3:59PM

Dow Jones News

By Nick Kostov

French grocer Carrefour SA on Monday denied claims from rival

Casino Guichard-Perrachon SA that it had approached its smaller

competitor about a possible merger to create one of the world's

largest retail giants.

Casino said Carrefour had contacted the company in recent days

about a possible deal but that its board had unanimously rejected

the approach and would now take all necessary action to defend its

interests.

"Casino thus intends to take all necessary action to defend the

group's corporate interest, and its structural integrity, a key

factor for the success of its strategy," the company said.

However, Carrefour denied soliciting Casino, accusing its rival

of "untimely, misleading and groundless communications." Carrefour

said it was "surprised that Casino's board of directors would have

been submitted a merger proposal that does not exist."

In response, a spokesman for Casino said it stood behind "every

word and every comma" of its press release. "There was a meeting

between the two CEOs on the morning of September 12 at 8:30 a.m. in

Paris. Both sides then hired lawyers to advise them and they also

talked."

A Carrefour spokesman confirmed the meeting, but said it was

initiated by Casino.

"The Carrefour group has never solicited Casino and has never

initiated any merger project," the spokesman said. "Carrefour is

determined to put an end to these unacceptable insinuations."

Both Casino and Carrefour have struggled to preserve once

reliable profit margins in France's cutthroat grocery market amid

competition from online shopping, discounters and meal-delivery

services. Both also have lately been investing heavily in their

e-commerce offerings to ward off mounting competition from

Amazon.com Inc. and other rivals.

A Casino-Carrefour merger would face regulatory issues in both

Brazil and France, analysts at Jefferies said in a note Monday.

Together, the two companies would have a market share of more than

50% of modern retail in Brazil, which excludes small local

convenience stores. In France that proportion would be almost a

third, according to the U.S. bank.

"We await further clarifications before concluding how these

extraordinary events have come to be," Jefferies said.

Last summer, Carrefour named Alexandre Bompard as chief

executive, tapping someone who had gone toe-to-toe with Amazon.com

Inc. when he was at the helm of book, music and electronics

retailer Fnac Darty to help close its e-commerce gap. Mr. Bompard

announced a five-year growth strategy in January that included a

pledge to invest EUR2.8 billion ($3.28 billion) in digital commerce

by 2022, and a target of EUR5 billion in sales in food e-commerce

in five years -- a sixfold increase over last year.

Casino's share price has fallen 29% since the beginning of 2018,

in part because of investor concerns about the company's debt.

Casino also has been a target of hedge funds who have shorted the

stock. Earlier this month, Casino's debt rating was cut further

into junk territory by ratings firm Standard & Poor's, who

cited the drop in share price and the widening of credit spreads at

both Casino and its holding company Rallye.

On Sunday, Casino "acknowledged the barriers, in France and in

Brazil, to a combination with Carrefour, especially in terms of

competition and employment."

Casino, which reported net sales of EUR37.8 billion in 2017, is

a household name in France and owns the GPA brand in Brazil, which

counts over 100,000 employees and a network of over 1,100 stores.

The company, with a market value of EUR4 billion, was founded in

1898 by Geoffroy Guichard. Mr. Naouri initially bought a minority

stake alongside the founding family, and then converted it to a

majority stake in 1998.

During the following years, he took small stakes in struggling

companies. But all the acquisitions left Casino heavily in debt.

Casino launched a deleveraging plan worth about EUR4 billion in

2016, which included selling its stake in a Thai supermarket as

well as Vietnam retail assets, following an attack from short

seller Carson Block. His research firm Muddy Waters alleged Casino

used accounting gimmicks and financial engineering to hide a

sharply declining core business, which the company has denied.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

September 24, 2018 09:44 ET (13:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

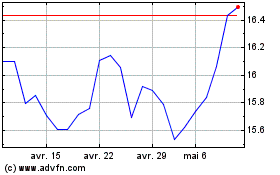

Carrefour (EU:CA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

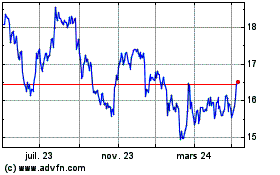

Carrefour (EU:CA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024