GE Hit by Steep Decline in Jet-Engine Business--Update

29 Juillet 2020 - 2:08PM

Dow Jones News

By Thomas Gryta

General Electric Co. posted a roughly $2 billion quarterly loss

as revenue tumbled 24%, hurt by a steep decline in a jet-engine

business that has been hobbled by the coronavirus pandemic.

The aviation business, once a profit engine for GE, swung to a

loss in the June quarter as both revenue and orders plunged. The

unit produces engines for Boeing Co. and Airbus SE planes but has

had to cut production and jobs as airlines delay orders.

However, GE reported it burned through less cash in the June

quarter than it had previously warned. The company reported

adjusted negative cash flow from industrial operations of $2.1

billion, compared with its projection of negative $3.5 billion to

$4.5 billion in May. Analysts were expecting negative cash flow of

$3.29 billion, according to FactSet.

"We're working through a still-difficult Covid-19 environment,"

said CEO Larry Culp, adding that he still expected a prolonged

recovery for the commercial-aviation business. "Still, based on

what we see today and the actions we've taken, sequential

improvement in earnings and cash in the second half of the year is

achievable."

GE also said it expects a return to positive cash flow in 2021.

The measure is closely watched by investors after troubles in

generating cash forced the company to slash its dividend and sell

off business units. In May, it sold off its century-old GE Lighting

unit, its last link to consumers.

The conglomerate has been revamping itself under Mr. Culp with a

focus on cutting debt and generating more cash but has been hit

hard by the coronavirus crisis, leading it to pull its full-year

financial outlook in April.

GE said it has cut its debt by $9.1 billion this year and had

$41 billion in cash at the end of June. On Wednesday, GE said it

planned to sell its remaining stake in oil-and-gas company Baker

Hughes over three years.

Profits and sales declined in the latest quarter from a year ago

across GE's main operating units. Revenue fell 44% at the aviation

unit, 3% in renewable energy and 11% in its power segment, which

makes turbines for power plants. All three posted operating losses.

Revenue fell 21% in its health-care unit, which makes hospital

equipment and was the only industrial unit to generate an operating

profit.

Overall, GE posted a net loss attributable to common

shareholders of $2.18 billion compared with a loss of $61 million a

year ago. Revenue was $17.75 billion. The year-ago results include

GE's biopharma business, which it sold earlier this year, and its

former controlling stake in Baker Hughes.

GE booked more than $2.3 billion in charges in the latest

quarter, writing down the value of several assets, including its

industrial 3-D printing business, its GE Capital jet-leasing

business and some long-term service contracts. The charges were

partly offset by investment gains on its Baker Hughes stake.

Excluding items, GE reported an adjusted loss of 15 cents a

share, compared with Wall Street's estimate of a 10-cent-a-share

loss.

The aviation business was GE's biggest and most profitable in

recent years as it benefited from a booming aerospace market and

investments, including the launch of GE's most advanced engine to

power Boeing Co.'s MAX jet. But with the MAX grounded and airlines

canceling flights, GE said quarterly orders for new equipment fell

41% and for services fell 67% from a year ago.

American Airlines Group Inc. and Southwest Airlines Co. this

month said they were tempering expectations for an air-travel

recovery, as the pandemic surges in parts of the U.S.

GE, which started the year with about 205,000 workers, has

already announced plans to cut a quarter of its aviation unit,

which had 52,000 employees. The company said it cut 5,400 aviation

workers in the quarter.

GE shares were little changed in premarket trading Wednesday, up

11 cents to $7.01. Since the start of the year, the shares had

fallen about 40%. The stock tumbled in 2017 and 2018 after GE

disclosed deep problems in its power unit and capital arm that

forced it to slash its dividend and sell off business. GE hired Mr.

Culp as CEO in October 2018 and he had made progress in

streamlining operations before the pandemic hit.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

July 29, 2020 07:53 ET (11:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

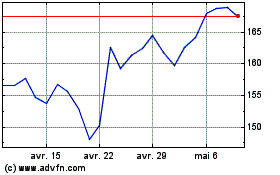

GE Aerospace (NYSE:GE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

GE Aerospace (NYSE:GE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024