Describing 2019 as 'reset year,' executives forecast weak cash

flow from operations

By Thomas Gryta

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 15, 2019).

General Electric Co. warned investors of another year of lower

profits and weak cash flow from its core industrial operations, but

the forecast was in keeping with the conglomerate's recent

cautionary outlook.

In a conference call Thursday, GE executives called 2019 a

"reset year" and detailed their plans to cut costs and debt. There

were few surprises for GE investors, many of whom have braced for a

difficult year. GE shares gained 28 cents, or 2.8%, to $10.30 in

Thursday trading. The stock has rallied from below $7 in December

but is still down from about $30 two years ago.

Larry Culp, who took over as chief executive in October, had

previously declined to provide detailed financial targets for GE as

he spent time reviewing the company. Last week he gave a hint of

the struggles ahead by revealing that GE's portfolio of industrial

businesses will fail to produce cash this year.

Mr. Culp reiterated Thursday that he expects the company's core

industrial operations to generate cash in 2020 and beyond.

"I have confidence that our industrial businesses in aggregate

should yield cash on sales more than double last year's levels over

the long term," Mr. Culp said on the conference call. "But there is

a lot of ground to cover before we get there."

GE forecast on Thursday that its industrial operations could

burn up to $2 billion more cash than they generate in 2019, and set

earnings targets for the year that were below Wall Street's

forecasts. The financial projections follow two difficult years in

which the conglomerate has reported falling profits and slashed its

dividend.

For 2019, GE expects adjusted earnings of 50 cents to 60 cents

per share, compared with the 70 cents forecast by analysts. In

2018, GE reported a per-share profit of 65 cents and positive cash

flow of $4.5 billion from its industrial operations.

The negative cash flow is a consequence of the troubled power

business and the costly restructuring it needs to adjust to market

demand. GE has excess capacity after buying the limping power

business of Alstom SA in 2015. The deal caused GE to take a $22

billion accounting charge last year.

"We need to improve and we need to deliver, and over time that

is the best contribution we can make to the debate," Mr. Culp said

in an interview.

Melius Research analyst Scott Davis expects Mr. Culp will fix

the industrial businesses within two years, adding that the company

"just laid out a multiyear plan that investors have to decide

whether they find credible or not."

"In any event, this is the first time that GE stock has gone up

on a guidance call in several years," he said. "And guidance was

pretty terrible -- so that does tell us something."

GE said adjusted cash flow in its power unit would be down in

2019 with "significant improvement" in 2020 and turn positive in

2021. The division had negative cash flow of $2.7 billion in

2018.

The company said it planned to further reduce costs in the power

division, which employs about 60,000 people around the globe

producing and servicing turbines used in gas and coal-fueled power

plants. GE said it expects to reduce costs in the division by $800

million over two years.

GE declined to give details on the number of jobs eliminated in

the division, but said it has cut 34% of headcount at its large

power manufacturing locations in Schenectady, N.Y., and Greenville,

S.C.

GE's cost cuts don't yet include closing any major facilities,

but there will be more restructuring, Mr. Culp said. "We are

respectful of the processes ahead of us in 2019 and 2020 in both

the U.S. and Europe," he said.

John Inch, an analyst with Gordon Haskett Research Advisors and

an outspoken bear on GE's stock for almost two years, conceded that

GE had "framed out a period of perceived stability for the coming

few quarters, " but still asserted the stock remains

overvalued.

"GE investors had better hope that the economy does not turn

down over the next two years given little room for error," he said,

citing the company's financial projections and high levels of

debt.

The conglomerate, which also has large aviation and health-care

divisions, aims to get costs at its corporate operations -- which

oversees the individual businesses -- to below $700 million in 2021

from $1.2 billion last year.

GE said it has cut about 10,000 workers from corporate staff,

which had more than 28,000 people at the end of 2017. GE employed

283,000 people world-wide at the end of 2018.

David Joyce, head of the aviation unit, said the division

planned to move 1,000 engineering jobs to the U.S. military by the

end of 2020. In addition to jet engines for planes made by Boeing

Co. and Airbus SE, GE makes engines and other systems for military

jets and helicopters.

Regarding the grounding of Boeing's 737 MAX airliners after a

recent crash by Ethiopian Airlines, Mr. Culp said GE is working

closely with authorities but declined to discuss any impact for GE

before the situation is more clear.

GE's CFM joint venture with Safran SA makes the jet engines for

the jet. In addition, GE's large airplane leasing operation owned

22 of the planes as of the end of January, according to UBS data,

and has another 154 on backlog for delivery.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

March 15, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

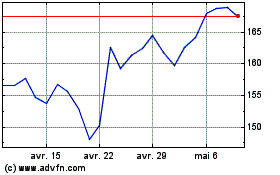

GE Aerospace (NYSE:GE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

GE Aerospace (NYSE:GE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024