Goldman Fined $350 Million by Hong Kong Regulator Over 1MDB Scandal

22 Octobre 2020 - 1:12PM

Dow Jones News

By WSJ staff

A Hong Kong regulator fined a local unit of Goldman Sachs Group

Inc. $350 million for the investment bank's role in a

multibillion-dollar scandal involving Malaysian investment fund

1MDB.

The Securities and Futures Commission said Thursday it is fining

Goldman Sachs (Asia) LLC for what it described as the unit's

"serious regulatory failures" related to the misappropriation of

$2.6 billion from 1MDB bond offerings in 2012 and 2013.

The regulator said Goldman Sachs Asia lacked adequate controls

to monitor staff and detect misconduct, and allowed the 1MDB bond

offerings to proceed when numerous red flags surrounding the

offerings had not been properly scrutinized.

It said the unit had received about 37% of the total revenue of

$567 million generated from the bond offerings--the largest share

among various Goldman entities involved in the deal.

Goldman said it would release a statement on the matter in due

course.

The fine comes as the Wall Street bank is finalizing a

settlement with the U.S. Department of Justice in which it will pay

about $2.8 billion and admit wrongdoing to end a bribery probe

related to 1Malaysia Development Bhd., or 1MDB, The Wall Street

Journal reported earlier this week.

U.S. prosecutors have accused an international cast of

characters--including two Goldman bankers--of embezzling billions

of dollars from 1MDB, and U.S. officials had been preparing a case

alleging that the bank ignored signs of fraud in pursuit of

fees.

In July, the bank agreed to pay the Malaysian government at

least $2.5 billion to resolve a parallel investigation there.

(END) Dow Jones Newswires

October 22, 2020 06:57 ET (10:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

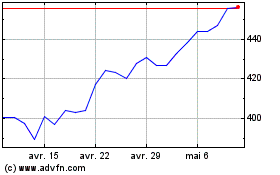

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

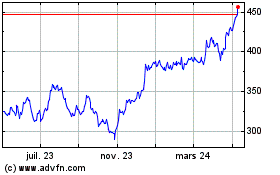

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024