Goldman Profit More Than Doubles, Powered by Trading -- 3rd Update

19 Janvier 2021 - 7:15PM

Dow Jones News

By Peter Rudegeair

For many Americans, 2020 was a year to forget. For Goldman Sachs

Group Inc., it was one for the record books.

Fueled by the markets' quick recovery from the worst of the

pandemic-induced recession, Goldman generated $44.56 billion in

annual revenue, the most since 2009, harking back to the last time

the bank successfully navigated a crisis and its aftermath. Trading

revenue for 2020 reached a 10-year high.

The $4.51 billion in fourth-quarter profit that the Wall Street

firm reported on Tuesday, or $12.08 per share, was more than double

Goldman's profit from the same quarter a year ago. Both quarterly

net income and quarterly revenue of $11.74 billion were much better

than the expectations of analysts polled by FactSet, who forecast

profit of $7.39 a share on revenue of $9.99 billion.

For the U.S. banking industry, 2020 was a roller-coaster year.

Markets plunged and economic activity declined in the spring as the

coronavirus spread across the country. With many businesses closed

and many consumers out of work, banks girded themselves for

widespread defaults. A robust federal spending program helped

forestall the worst-case economic scenario, and in earnings reports

last week, bank executives signaled the economy has held up better

than expected.

On Friday, JPMorgan Chase & Co. said fourth-quarter profit

soared 42% to a record $12.14 billion after the bank released $2.9

billion from its stockpile of funds previously set aside to cover

soured loans. On Tuesday, Bank of America Corp. said profit fell

22% but topped analysts' expectations after it released $828

million from its loan-loss reserves.

With its relatively small loan book and heavy exposure to

underwriting and trading securities, Goldman was better placed than

peers for the environment of the past several months. Initial

public offerings, corporate borrowing and major stock indexes hit

new records in 2020, all trends that Goldman capitalized on.

Trading revenue rose 23% from a year earlier to $4.27 billion,

and the firm's investment bankers brought in $2.73 billion in

revenue, a 49% increase from 2019's fourth quarter. The boom in

stock offerings, including IPOs of tech companies and so-called

blank-check companies, was particularly lucrative for Goldman: The

fees it earned in the fourth quarter from underwriting stocks were

a record and exceeded the fees it earned from advising on deals for

the first time.

Chief Executive David Solomon told analysts on a conference call

that some of the business Goldman won with top trading clients

should be more sustainable than 2009 given that they occurred in a

more competitive environment. In investment banking, Mr. Solomon

said he expected activity levels in 2021 to be below those in 2020,

due in part to investors starting to cool off on blank-check

companies, also known as special-purpose acquisition companies, or

SPACs.

"You have something here that is a good capital markets

innovation," Mr. Solomon said of SPACs. "But like many innovations,

there's a point in time as they start where they have a tendency

maybe to go a little bit too far and then need to be pulled back or

rebalanced."

Compared with its rivals, Goldman's profit was less affected by

large provisions for future expected charge-offs, given the

nascency of its corporate-banking and consumer-finance offerings.

Goldman held about $8 billion in consumer-loan balances, split

roughly equally between its personal-loan business and co-branded

credit card with Apple Inc., but performance has been better than

executives expected.

Like other banks, though, the profitability of Goldman's lending

and deposit-taking business has been crimped by low interest rates

and stricter loan-approval standards. Mr. Solomon said that Marcus,

as Goldman's consumer-banking division is known, is likely to

report a larger pretax loss in 2021.

Additionally, Mr. Solomon said that Goldman was continuing to

spend money to develop new Marcus products, including a

digital-investing platform that will debut in the first quarter and

an online checking account that will arrive later this year.

Shares in Goldman rose some 60% between the end of October and

mid-January, hitting an all-time high of $307.87 last week and

vaulting the bank's market value above $100 billion. The rally in

Goldman's stock followed news that the firm reached a $2.9 billion

settlement with the Justice Department over a yearslong

investigation into its role assisting a corrupt Malaysian

government fund known as 1MDB.

Shares slipped about 1% in midday trading Tuesday.

One big change at Goldman from the last time it reported revenue

this high is how much of it went into employees' pockets. In 2009,

the size of Goldman's bonus pool was a source of populist outrage.

For 2020, compensation expenses totaled $13.31 billion, or roughly

30% of revenue, a record low ratio, said Chief Financial Officer

Stephen Scherr.

Overall operating expenses in the fourth quarter were $5.91

billion, down 19% from the same period in 2019. Fourth-quarter

compensation expenses also fell 19% to $2.48 billion.

The bank's return on equity, a measure of how profitably it uses

shareholders' money, was 21.1% in the fourth quarter.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

January 19, 2021 13:00 ET (18:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

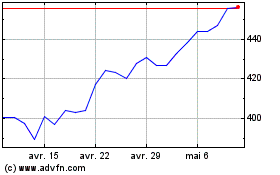

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

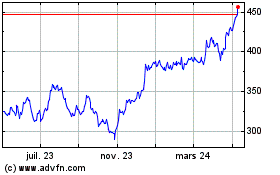

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024