Goldman Sachs Malaysia Subsidiary Pleads Guilty in 1MDB Case -- 2nd Update

23 Octobre 2020 - 1:51AM

Dow Jones News

By Liz Hoffman

A unit of Goldman Sachs Group Inc. pleaded guilty on Thursday

morning to conspiring to violate U.S. antibribery laws, the first

step in an expected resolution of a long-running investigation into

its role in a Malaysian corruption scandal.

Lawyers for Goldman, appearing remotely in Brooklyn federal

court, said the bank's subsidiary in Malaysia would plead guilty to

violations of the Foreign Corrupt Practices Act, which bars U.S.

companies from paying bribes to government officials abroad.

The Wall Street firm also agreed to pay nearly $3 billion to

officials in four countries to end a yearslong probe into its

dealings with the 1Malaysia Development Bhd. investment fund, known

as 1MDB. That is on top of the $2.5 billion it agreed in July to

pay the government of Malaysia. Earlier Thursday, Hong Kong's

financial regulator fined Goldman $350 million for its role in the

scandal.

All in, the penalties exceed $5 billion, or about eight months

of profit for the Wall Street firm.

Prosecutors in the U.S. have accused an international cast of

characters -- including two former Goldman bankers -- of embezzling

billions of dollars from the fund, and U.S. officials had been

preparing a case that the bank ignored signs of fraud in pursuit of

fees.

A decade ago, Goldman looked to Malaysia as a place to do

business when the 2008 financial crisis slammed U.S. and European

markets. The Asian country had just launched the 1MDB fund to spur

economic development.

In 2012 and 2013, Goldman helped raise $6.5 billion for 1MDB by

selling bonds to investors. Prosecutors say much of that money was

stolen by an adviser to the fund named Jho Low, aided by two

Goldman bankers and associates in the Malaysian and Emirati

governments.

Goldman had long portrayed the bankers -- Timothy Leissner, who

has pleaded guilty, and Roger Ng, who has maintained his innocence

-- as rogue employees who hid their activities and Mr. Low's

involvement in the deals from their bosses. Mr. Low has denied the

allegations against him.

Critics have long said that the fees Goldman earned from 1MDB,

which were far higher than is typical for the kind of work it did,

should have been a warning sign that something wasn't right.

In its reprimand Thursday, Hong Kong's Securities and Futures

Commission said the nearly $600 million in fees Goldman generated

from the 1MDB bond deals was more than double the total revenue it

earned on 213 other bond offerings across Asia between 2011 and

2015.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

October 22, 2020 19:36 ET (23:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

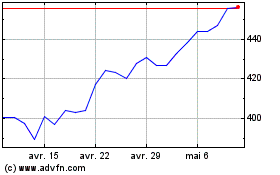

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

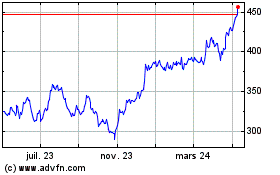

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024