Increase in reservations for the fourth

quarter

Regulatory News:

Groupe Pierre & Vacances-Center Parcs

(Paris:VAC):

1] Third quarter 2020/2021 revenue

Under IFRS standards, Q3 2020/2021 revenue totalled €172.5

million (€134.4 million for the tourism activities and €38.0

million for the property development activities).

The Group nevertheless continues to comment on its revenue and

the associated financial indicators, in compliance with its

operating reporting namely:

- with the presentation of joint undertakings

in proportional consolidation, - excluding the impact of IFRS16

application

Moreover, the operating and legal reorganisation implemented

since 1 February 2021 resulting in the regrouping of each of the

Group’s activities into distinct and autonomous Business Lines, has

led to a change in sectoral information in application of IFRS8.

The main consequence for communication of the Group’s revenue is

the presentation of the contribution from the Adagio operating

entity. The entity includes the contribution from leases taken out

by the PVCP Group and entrusted to the joint-venture Adagio SAS for

management, as well as the share of the contribution from Adagio

SAS held by the Group.

A reconciliation table presenting revenue stemming from

operating reporting and revenue under IFRS accounting is presented

in the appendix at the end of the press release.

€ millions

2020/2021

2019/2020

Change

vs. 2019/ 2020

2018/2019

Change

according to operating

reporting

according to operating

reporting

according to operating

reporting

vs. 2018/ 2019

Tourism

139.3

51.6

+169.6%

335.3

-58.5%

- Center Parcs Europe

90.8

32.0

+183.6%

202.0

-55.1%

- Pierre & Vacances Tourisme

Europe

31.6

12.6

+151.5%

81.2

-61.1%

- Adagio

16.9

7.1

+138.7%

52.1

-67.6%

o/w accommodation revenue

93.0

32.7

+184.1%

227.7

-59.1%

- Center Parcs Europe

61.5

22.7

+170.8%

135.8

-54.7%

- Pierre & Vacances Tourisme

Europe

17.7

4.9

+265.0%

47.5

-62.6%

- Adagio

13.8

5.2

+166.2%

44.4

-69.0%

Property development

65.4

58.0

12.8%

36.1

+81.0%

Total Q3

204.7

109.6

+86.7%

371.5

-44.9%

Tourism

304.3

599.1

-49.2%

878.8

-65.4%

- Center Parcs Europe

184.0

352.7

-47.8%

502.0

-63.3%

- Pierre & Vacances Tourisme

Europe

77.9

164.6

-52.7%

243.3

-68.0%

- Adagio

42.3

81.8

-48.2%

133.5

-68.3%

o/w accommodation revenue

201.3

399.8

-49.6%

595.2

-66.2%

- Center Parcs Europe

126.3

234.0

-46.0%

333.2

-62.1%

- Pierre & Vacances Tourisme

Europe

41.1

97.1

-57.6%

147.5

-72.1%

- Adagio

33.9

68.7

-50.7%

114.5

-70.5%

Property development

197.6

206.6

-4.3%

230.8

-14.4%

Total 9 months

501.9

805.7

-37.7%

1,109.6

-54.8%

Revenue generated by the tourism businesses in Q3 2020/2021 was

affected by a very low level of activity in April (closure of

virtually all sites in France and in Germany and reduced offer in

the Netherlands and Belgium), followed by a gradual reopening as of

May, compared with two months of no activity in the third quarter

of 2019/2020.

Revenue totalled €139.3 million, up sharply relative to the

year-earlier period, but down by 58.5% relative to the third

quarter of 2018/2019:

- Revenue at Center Parcs Europe (€90.8

million) was less than half of the level generated in the same

quarter during 2019 (55% decline vs -84% in 2020 vs 2019). More

than 60% of revenue was generated by the Dutch and Belgian domains

that were open over the entire quarter but with restrictions

(accommodation revenue down 31% relative to 2019), whereas most of

the German and French domains reopened between mid-May and early

June, resulting in a 72% plunge in accommodation revenue relative

to 2019;

- Revenue at Pierre & Vacances Tourisme

Europe totalled €31.6 million, down 61% relative to 2019 (vs -83%

in 2020), with virtually all residences closed until the start of

May (or almost one month more of operation than in 2020).

- Adagio continued to suffer from a lack of

business and international clients and incurred a deeper decline in

revenue relative to Q3 2019 compared with the other tourism

business lines, even though activity picked up relative to the

situation seen in Q3 2020. Revenue came in at €16.9 million, down

68% relative to Q3 2019 (vs. -88% in 2020).

In all, nine month 2020/2021 revenue from tourism activities

totalled €304.3 million, down 65.4% relative to the same period

during 2018/2019 and 49.2% relative to the year-earlier period

(after a first half down 69.9%).

- Revenue from property development

Q3 2020/2021 property development revenue totalled €65.4

million, compared with €58.0 million in the year-earlier period,

stemming primarily from Senioriales residences (€16.5 million), the

Center Parcs Lot-et-Garonne domain (€13.2 million) and Center Parcs

renovation operations (€31.2 million).

Over the first nine months of the year, revenue from property

development businesses totalled €197.6 million (compared with

€206.6 million over the year-earlier period), of which €50.2

million from Seniorales residences, €30.1 million for the

development of the Center Parcs Lot-et-Garonne: and €97.1 million

from renovations of Center Parcs domains.

2] Outlook

Following numerous discussions with several representatives of

private landlords, the Group sent to its individual landlords a

draft amendment to their lease contracts in early July. This

amendment, which includes several compensatory measures and

commitments by the Group, proposes, under certain terms and

conditions, the payment of an amount representing 50% of the

contractual rent for the period from March 15, 2020 to June 30,

2021.

With regard to the continuation of rent payments as of July 1st,

2021, the draft amendment provides for two options for the owners

to choose from: (i) the payment of a fixed rent of 72.5% of the

contractual rent until December 31, 2021 and 100% after that date;

or (ii) the payment of a variable rent, with a minimum guarantee of

50% of the contractual rent over an 18-month period, from July 1st,

2021 to December 31st, 2022.

The resumption of rent payments to the landlords who have agreed

to sign the amendment will take place between July 2021 and

September 15, 2021, depending on the respective dates on which the

Group receives the signed amendment.

Discussions with the institutional landlords of the companies

included in the scope of the conciliation proceedings have

progressed in parallel, and several agreements have already been

finalized.

- Equity strengthening process

As announced in the press release of last June 24, the Group has

received several detailed expressions of interest from French and

foreign candidates with different profiles (financial investors,

strategic players or sector players) as part of the process of

seeking investors to strengthen its equity capital. Further

discussions with the candidates and the usual due diligence

procedures are being continued as part of this competitive

process.

Since the government announcements at the end of April setting

out the easing of restrictions and reopening of places closed to

the public, the Group has recorded an increase in weekly

reservation flows, especially for the summer season.

APPENDIX:

Reconciliation table between revenue stemming from operating

reporting and revenue under IFRS accounting.

€ millions

2020/2021

according to operating

reporting

Restatement

IFRS11

Impact

IFRS16

2020/2021

IFRS

Tourism

304.3

-11.8

292.5

- Center Parcs Europe

184.0

-3.0

181.0

- Pierre & Vacances Tourisme

Europe

- Adagio

77.9

42.3

0.6

-9.4

78.5

32.9

Property development

197.6

-8.0

-65.1

124.5

Total 9 months

501.9

-19.8

-65.1

417.0

€ millions

2019/2020

according to operating

reporting

Restatement

IFRS11

Impact

IFRS16

2019/2020

IFRS

Tourism

599.1

-28.9

570.2

- Center Parcs Europe

352.7

-12.1

340.6

- Pierre & Vacances Tourisme

Europe

- Adagio

164.6

81.8

0.0

-16.7

164.6

65.1

Property development

206.6

-7.8

-55.3

143.5

Total 9 months

805.7

-36.7

-55.3

713.7

IFRS11 adjustments: for

its operating reporting, the Group continues to integrate joint

operations under the proportional integration method, considering

that this presentation is a better reflection of its performance.

In contrast, joint ventures are consolidated under equity

associates in the consolidated IFRS accounts.

Impact of IFRS16:

The application of IFRS16 as of 1 October 2019 leads to the

cancellation, in the financial statements, of a share of revenue

and the capital gain for disposals undertaken under the framework

of property operations with third-parties (given the Group’s

right-of-use rights). See below for the impact on nine-month

revenue. Given that the Group’s business model is based on two

distinct businesses, as monitored and presented in its operating

reporting, adjustment for this would not measure and reflect the

underlying performance of the Group’s property business, and for

this reason in its financial communication, the Group continues to

present property development operations as they are recorded from

its operating monitoring.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210720005945/en/

Investor Relations and Strategic Operations Emeline Lauté

+33 (0) 1 58 21 54 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

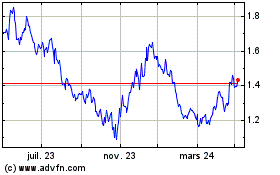

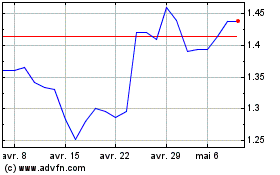

Pierre & Vacances (EU:VAC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pierre & Vacances (EU:VAC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024