Provisional sales 2019 - unaudited figures -

- Annual sales: €7,354m, +8,0% and +5.8% LFL*

- Q4 sales €2,240m, +2.5% and +0.9% LFL*

Regulatory News:

GENERAL COMMENTS ON GROUP REVENUE

Groupe SEB (Paris:SK) recorded sales of €7,354 million in 2019,

up 8.0%, including organic growth of 5.8%, a currency effect of

+1.0% (or +€71 million) and a scope effect of +1.2% (€75 million),

reflecting the consolidation of Wilbur Curtis on 11 months and

Krampouz on 3 months.

This solid business momentum arises from:

- Consumer sales growing firmly, up 5.2% like-for-like,

nurtured by all geographic areas and all product lines -

Professional activity which continued its fast development, up

12.1 % like-for-like, despite demanding 2018 comparatives.

This strong performance has been achieved in an overall

complicated and volatile environment. Representing the 6th

consecutive year of organic growth above 5%, it reflects the

relevance of the Group’s strategy.

Fourth-quarter sales totaled €2,240 million, up 2.5%. Organic

growth, of + 0.9%, would reach + 2.3% when adjusted for the

positive non-recurring events** in Brazil over the last 3 months of

2018. Sales momentum continued in Eurasia, in China (organic growth

exceeding 15%) and in Professional Coffee. However, business at the

end of the year finally proved less firm than anticipated in

Western Europe, especially in Germany and France.

* Like-for-like: at constant exchange rates and scope of

consolidation. ** recognition in revenue of tax receivables

OUTLOOK

Based on its provisional sales, Groupe SEB indicates that the

increase in its reported Operating Result from Activity should

be between 6% and 6.5% in 2019.

Furthermore, the total amount of non-recurring expenses

should reach approximately 80 M€. It will notably include the

provisions for the restructuring of WMF’s Consumer business,

previously announced. In addition, the investigations carried out

at Groupe SEB Deutschland and mentioned in our financial

communication of end-October, were continued and finalized. The

findings lead us to extend to previous financial years (mainly

2018) the accounting adjustments related to business practices that

derogated from the Group’s principles. The corresponding amount

should be close to €20 million.

DETAIL OF REVENUE BY REGION

Revenue in €M

2018

2019

Change 2019/2018

Q4 2019

Like-for-like

As reported

Like-for-like*

EMEA

Western Europe

Other countries

3,223

2,430

793

3,339

2,442

897

+3.6%

+0.5%

+13.1%

+3.3%

+0.3%

+12.4%

-1.1%

-4.8%

+10.7%

AMERICAS

North America

South America

887

547

340

915

589

326

+3.2%

+7.8%

-4.3%

+2.1%

+2.9%

+0.7%

-9.8%

-3.8%

-19.0%

ASIA

China

Other

countries

2,067

1,554

513

2,301

1,762

539

+11.3%

+13.3%

+5.1%

+9.4%

+12.2%

+1.2%

+9.9%

+15.4%

-2.6%

TOTAL Consumer

6,177

6,555

+6.1%

+5.2%

+0.4%

Professional business

635

799

+25.9%

+12.1%

+6.3%

GROUPE SEB

6,812

7,354

+8.0%

+5.8%

+0.9%

* Like-for-like: at constant exchange rates and scope Rounded

figures in €m % calculated in non-rounded figures

COMMENTS ON CONSUMER SALES BY REGION

WESTERN EUROPE

The Group recorded in 2019 a slight increase in its revenue,

stepping-up sales growth in e-commerce, achieving good performances

in its Home & Cook retail network and developing WMF’s

activity. However, business at the end of the year trended

materially down, with disparate situations across countries.

In France, annual sales were stable following a fourth quarter

which proved more complicated than expected, despite low 2018

comparatives. In a tense market impacted by the December strikes,

business activity was negatively affected by orders or restocking

purchases that were postponed by some retailers. The difficulties

were focused on SDA - despite the continued success of versatile

vacuum cleaners, automatic espresso coffee machines, garment

steamers, and Cake Factory - while our cookware sales benefitted

from very solid momentum in the fourth quarter, nurtured notably by

a loyalty program.

In Germany, 2019 revenue was down, penalized by the adjustment

of Groupe SEB Deutschland’s business practices to the Group’s

principles. That said, in a tense market, business remained stable

thanks to cookware, Optigrill, Cook4me…

In other European countries, the three last months showed

contrasted performances: sharp drop in the Netherlands on high

comparatives (LP in 2018), despite the strong rise in revenue of

vacuum cleaners and automatic espresso machines; flat in Spain,

notwithstanding buoyant sales in coffee partnerships and personal

care; growth in the United Kingdom as well as in Italy, where the

momentum was mainly fueled by linen care and Optigrill. Robust

growth in Belgium, thanks to a loyalty program featuring Lagostina

cookware.

OTHER EMEA COUNTRIES

Groupe SEB achieved a very good year in the region, with organic

sales growth of 12.4% (+10.7% in the fourth quarter), driven by

almost all countries.

Capitalizing on the sharp ramp-up in demand, the Group pursued

its vigorous development policy, combining solid product dynamic

(new launches, extension of the range), strong partnerships with

large key accounts, increased presence in e-commerce as well as the

development of Group Retail and WMF. Our progress materialized into

further market share gains in Eurasia.

While all product lines contributed to business momentum, the

main growth drivers were innovations and flagship products,

including versatile vacuum cleaners (Air Force Flex) and robots,

Optigrill, automatic espresso coffee machines (including the

Evidence model), garment steamers and IXEO range, and Ingenio

cookware.

Russia was the most powerful growth engine in the region, fueled

by all product categories, leading to strengthened leadership

position in small electrical appliances. Simultaneously, dynamic

remained outstanding in Central Europe, notably in Poland as well

as in Ukraine, where the Group became the leading player in

SDA.

In Turkey, in what remains a highly volatile environment, we

have been maintaining overall our market positions, primarily by

leveraging our successes in cookware (Titanium, Ingenio).

Nevertheless, undemanding 2018 comparatives allowed us to post

double-digit organic growth in the fourth quarter.

Finally, in the Middle-East, the Group restored growth in

Saudi-Arabia after two very tough years and has made further

inroads in Egypt.

NORTH AMERICA

Rising 2019 sales were bolstered by an overall favorable

monetary environment for the three currencies in the region since

the beginning of the year. Following decline in fourth quarter

sales (down 3.8% LFL), yearly organic growth stands at 2.9% with

contrasting situations across the three countries of the area.

In the United States, in a still tough retail environment,

business has been almost flat over the year, while down in the

fourth quarter, like-for-like. The upswing in revenue in linen care

was mainly driven by the enlarged distribution of Rowenta products,

initiated in the third quarter. Yet it failed to offset the drop in

cookware sales at year-end. However, over the year, in a difficult

market, the Group posted satisfactory performances, strengthening

its competitive positions in both cookware and linen care. Mention

should be made that the signing of an initial trade agreement with

China has partly alleviated the increases in customs tariffs

implemented since September for cookware and small electrical

appliances.

In Canada, as in the United States, the retail and consumption

context remained tense throughout the year. Nevertheless, sales

have been bolstered by the continuation of a specific deal

initiated in the third quarter.

In Mexico, the Group posted record sales in the fourth quarter,

nurtured by the core business as well as a loyalty program

(cookware and utensils) with one of our key accounts.

SOUTH AMERICA

As a reminder, the presentation of changes in sales in the

region is impacted by the recognition of tax receivables in Brazil,

amounting to €32 million in fourth-quarter 2018 and €8 million in

third-quarter 2019. Excluding these non-recurring items, organic

sales growth in South America would come out at 8.7% in the fourth

quarter and 8.3% for the full-year. On a reported basis, sales in

the area remain negatively impacted by the continued depreciation

of the Brazilian real and the Colombian and Argentinian pesos.

In Brazil, excluding the above-mentioned positive effect, the

Group achieved organic growth of almost 5% in the fourth quarter

and over 10% year-on-year. Over the three last months, business

dynamic was driven by cookware (with a good performance for

pressure cookers in particular), and by some electrical appliance

families, including oil-less fryers, grills, Dolce Gusto, washing

machines, and fans.

In Colombia, the Group ended the year with solid momentum,

fueled notably by cookware -thanks to strong marketing activation

in points of sales-, fans and the continued roll-out of oil-less

fryers.

CHINA

2019 was characterized by a more moderate Chinese economic

growth and the trade war with the United States.

In a context of slower consumption, Supor maintained solid sales

momentum against demanding comparatives: on a like-for-like basis,

sales rose 12.2% in full-year 2019 and 15.4% in the fourth quarter.

Last quarter’s dynamic can be attributed to sustained core business

and sell-in ahead of the Chinese New Year (25 January 2020). It

helped Supor to continue to outperform the market and reinforce its

competitive positions across the vast majority of product

lines.

This was the case in cookware and kitchen accessories, where

growth remained firm, primarily driven by woks (new models)

saucepans and isothermal mugs (further range extension and enlarged

product offering to attract new consumer targets).

This was also the case in small electrical appliances, where

Supor continued to gain market shares overall. The acceleration in

growth in the fourth quarter was fueled by electrical cooking, with

rice cookers, high-speed blenders, health pot kettles, grills, and

baking pans proving particularly buoyant. In new product

categories, ongoing brisk momentum stemmed mainly from garment

steamers, vacuum cleaners and air purifiers. In large kitchen

appliances, vigorous business activity was underpinned by very

rapid revenue development in water purifiers.

OTHER ASIAN COUNTRIES

In Asia excluding China, full-year revenue was slightly up

like-for-like, yet following a decline in sales in the fourth

quarter (down 2.6%, organically).

The Group posted a good year in Japan, with sales in yen

progressing solidly. However, as expected, business activity in the

fourth quarter slowed due to advance purchases prior to the

increase in VAT on October 1. Excluding this effect, performance

continued to be driven by flagship products (including cookware,

kettles, and garment steamers) and by the continued development of

the proprietary store network. At end-2019, following the opening

of two new T-Fal stores, the Group had a total of 39 stores in the

country.

In South Korea, revenue decreased in 2019 owing to a tough

consumer environment, marked by the trade dispute with Japan. The

Group nevertheless succeeded in stabilizing sales in the fourth

quarter on the back of firm business in cookware, vacuum cleaners,

and garment steamers, mainly via e-commerce.

In the other Asian countries, the situation was contrasted:

restored growth in Australia was confirmed, although business was

heavily penalized by fires in December; ongoing buoyant momentum in

Thailand; stepped-up development in Malaysia; mixed performances in

Singapore and Hong Kong, and marked sales decrease in

Vietnam...

COMMENTS ON PROFESSIONAL BUSINESS ACTIVITY

With organic growth of 12.1%, the Group’s professional business

posted another very dynamic year, even against high comparatives

(+14% in 2018). As a reminder, beyond this robust organic growth,

the business includes a €71 million contribution from Wilbur Curtis

in 2019, a US company specialized in professional filter coffee

machines, consolidated since February 8th, 2019. Its integration

leads to a reported sales growth of 25.9% over the year.

In Professional Coffee Machines (PCM), 2019 activities were

marked by a very different sales phasing compared to 2018. As a

matter of fact, deliveries of major contracts signed with fast-food

chains, coffee shops and local stores in the United States and Asia

were concentrated in the second half of 2018. The execution of

these contracts continued until June 2019. Consequently,

WMF-Schaerer coffee machine revenue grew strongly in the first half

of 2019, against regular 2018 comparatives, and increased at a more

modest pace in the second half, against demanding 2018

comparatives. Despite the non-repeat of these major deals, the

fourth quarter, up 7.8%, reflected brisk core business at the end

of the year.

At the same time, the integration of Wilbur Curtis continued,

materializing in operational terms. In 2019, the Group implemented

a new organization dedicated to the PCM business, Seb Professional,

in order to optimize its development strategy on the North American

market.

APPENDICE

REVENUE BY REGION – FOURTH QUARTER

Revenue in €M

Q4

2018

Q4

2019

Change 2019/2018

As reported

Like-for-like*

EMEA

Western Europe

Other countries

1,171

894

277

1,159

856

303

-1.0%

-4.2%

+9.5%

-1.1%

-4.8%

+10.7%

AMERICAS

North America

South America

314

190

124

285

190

95

-9.5%

-0.5%

-23.4%

-9.8%

-3.8%

-19.0%

ASIA

China

Other countries

523

362

161

586

423

163

+12.0%

+16.8%

+1.1%

+9.9%

+15.4%

-2.6%

TOTAL Consumer

2,008

2,030

+1.1%

+0.4%

Professional Business

176

210

+18.8%

+6.3%

GROUPE SEB

2,184

2,240

+2.5%

+0.9%

* Like-for-like: at constant exchange rates and scope Rounded

figures in €m % calculated on non-rounded figures

GLOSSAIRE

On a like-for-like basis (LFL) - Organic

The amounts and growth rates at constant exchange rates and

consolidation scope in a given year compared with the previous year

are calculated:

- using the average exchange rates of the previous year for the

period in consideration (year, half-year, quarter),

- on the basis of the scope of consolidation of the previous

year.

This calculation is made primarily for sales and Operating

Result from Activity.

Operating Result from Activity (ORfA)

Operating Result from Activity (ORfA) is Groupe SEB’s main

performance indicator. It corresponds to sales minus operating

costs, i.e. the cost of sales, innovation expenditure (R&D,

strategic marketing and design), advertising, operational marketing

as well as commercial and administrative costs. ORfA does not

include discretionary and non-discretionary profit-sharing or other

non-recurring operating income and expense.

Loyalty program (LP)

These programs, led by distribution retailers, consist in

offering promotional offers on a product category to loyal

consumers who have made a series of purchases within a short period

of time. These promotional programs allow distributors to boost

footfall in their stores and our consumers to access our products

at preferential prices.

SDA

Small Domestic Appliances: Kitchen Electrics, Home and Personal

care

PCM

Professional Coffee Machines

----------

This press release may contain certain forward-looking

statements regarding Groupe SEB’s activity, results and financial

situation. These forecasts are based on assumptions which seem

reasonable at this stage, but which depend on external factors

including trends in commodity prices, exchange rates, the economic

environment, demand in the Group’s large markets and the impact of

new product launches by competitors. As a result of these

uncertainties, Groupe SEB cannot be held liable for potential

variance on its current forecasts, which result from unexpected

events or unforeseeable developments. The factors which could

considerably influence Groupe SEB’s economic and financial result

are presented in the Annual Financial Report and Registration

Document filed with the Autorité des Marchés Financiers, the French

financial markets authority.

Conference call with management on January 22

at 6:00 p.m. CET

Numbers: From France: +33 (0) 1 72 72 74 03 -

PIN: 40864029# From other countries: +44 20 7194 3759 - PIN:

40864029

Listen to the audiocast and the presentation on

our website on January 22 from 9:00 p.m.: www.groupeseb.com or

click here

Next key dates - 2020

February 27 | before market opens

2019 sales and results

April 27 | after market closes

Q1 2020 sales and financial data

May 19 | 3:00 p.m.

Annual General Meeting

July 23 | before market opens

H1 2020 sales and results

October 26 | after market closes

9-month 2020 sales and financial

data

Find us on www.groupeseb.com

World reference in small domestic equipment, Groupe SEB operates

with a unique portfolio of 30 top brands including Tefal, Seb,

Rowenta, Moulinex, Krups, Lagostina, All-Clad, WMF, Emsa, Supor,

marketed through multi-format retailing. Selling more than 350

million products a year, it deploys a long-term strategy focused on

innovation, international development, competitiveness and client

service. Present in over 150 countries, Groupe SEB generated sales

of €7.3 billion in 2019 and has more than 34,000 employees

worldwide.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200122005617/en/

Investor/Analyst Relations

Groupe SEB Financial Communication and Investor Relations

Isabelle Posth Raphaël Hoffstetter comfin@groupeseb.com Phone:+33

(0) 4 72 18 16 04

Media Relations

Groupe SEB Corporate Communication Dept Cathy Pianon

com@groupeseb.com Phone: . +

33 (0) 6 33 13 02 00

Image Sept Caroline

Simon Claire Doligez Isabelle Dunoyer de Segonzac

caroline.simon@image7.fr cdoligez@image7.fr isegonzac@image7.fr

Phone:+33 (0) 1 53 70 74 70

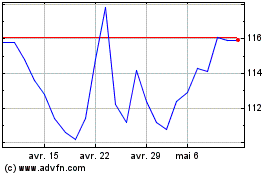

SEB (EU:SK)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

SEB (EU:SK)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024