Home Depot Lowers Sales Outlook, Shares Fall -- Update

19 Novembre 2019 - 7:43PM

Dow Jones News

By Patrick Thomas

Home Depot Inc.'s third-quarter results fell short of Wall

Street expectations, as the expected benefits of an online overhaul

are taking longer than planned to materialize.

The home-improvement retailer trimmed its sales forecast for the

year and now expects fiscal 2019 sales growth to increase by 1.8%,

down from its previous guidance of 2.3%. Same-store sales are

projected to grow by about 3.5%, lower than its previous forecast

of 4%.

Third-quarter sales at the Atlanta company rose 3.5% from a year

ago to $27.22 billion, slightly lower than the $27.53 billion Wall

Street was expecting, according to FactSet. Sales at stores open at

least a year were up 3.6% for the period, below the 4.7% analysts

were anticipating.

Home Depot and its followers were betting in the latest quarter

that its investments in technology to better align its online

business with its 2,290 brick-and-mortar stores would have resulted

in greater sales gains. The company now says that it is going to

take more time.

"Our sales performance was below our expectations," Chief

Executive Craig Menear said on a call with analysts. "Our rollout

is largely on track and we are realizing benefits, it's just taking

a little longer than our original assumptions."

Shares of the company were off about 5% to $226.43. The

company's stock has rallied more than 30% this year.

Finance Chief Richard McPhail said in an interview that while

the company is taking its time with its re-engineering efforts,

overall consumer spending is still healthy. "The consumer is alive

and well," he said. "It was one of the most balanced quarters we've

had in a long time."

The number of customer transactions during the third quarter was

up 1.5% from a year ago, while the amount of money customers spent

per visit rose 1.9%. Big-ticket transactions, or the number of

comparable transactions over $1,000, climbed 4.8% from a year

earlier.

Lower lumber prices continued to weigh on the company in the

third quarter, resulting in about $175 million in lost revenue from

a year ago, Mr. McPhail said. In August, the company reported

weaker than expected second-quarter results and cut its sales

outlook as a result.

"The numbers are much stronger than last quarter's rather anemic

growth which shows both that Home Depot is returning to a better

trajectory and, most importantly, that the consumer economy is not

in a state of distress," said Neil Saunders, a managing director of

GlobalData Retail, a research firm.

Overall, the company posted net income of $2.77 billion, or

$2.53 a share for the period ended Nov. 3, compared with $2.87

billion, or $2.51 a share, a year ago. Analysts surveyed by FactSet

were expecting earnings of $2.52 a share.

Write to Patrick Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

November 19, 2019 13:28 ET (18:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

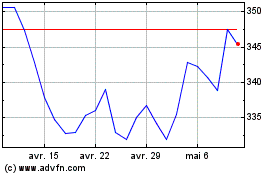

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024