Hunter Douglas Shares Soar on 3G Capital's $7.1 Billion Deal to Buy Controlling Stake -- Update

31 Décembre 2021 - 1:42PM

Dow Jones News

By Olivia Bugault

Shares in Hunter Douglas NV rose sharply Friday after the Dutch

maker of window coverings said that 3G Capital will buy a 75% stake

in the company in a deal that implies an enterprise value of

roughly $7.1 billion.

At 1312 GMT, Amsterdam-listed shares in Hunter Douglas were up

69.8% at EUR172.20.

New York-based investment group 3G Capital entered into a

definitive agreement with Ralph Sonnenberg, the executive chairman

and controlling shareholder of Hunter Douglas, for the transfer of

the controlling interest at a price of 175 euros ($198.23) per

ordinary share, a 73% premium to the closing price on Dec. 30,

Hunter Douglas said late Thursday. Compared with Hunter Douglas's

all-time high closing share price of EUR106.40, it is a 64%

premium, it said.

The Sonnenberg family will still hold a 25% stake in Hunter

Douglas after completion of the deal, the company said.

Joao Castro Neves, currently a senior partner at 3G Capital, is

set to take over as the new chief executive officer of Hunter

Douglas once the deal is completed, the company said. He also sits

on the board of Restaurant Brands International Inc. and Kraft

Heinz Co.

David Sonnenberg, co-CEO of Hunter Douglas, will take his

father's position as executive chairman of the company after

completion of the deal, it said.

"The board of directors of Hunter Douglas, represented only by

its independent directors, unanimously supports the transaction and

has entered into a separate agreement with 3G Capital and Ralph

Sonnenberg to facilitate and secure a cash exit for all minority

shareholders based on the same price per ordinary share," it

said.

The deal is expected to close in the first quarter of 2022.

Hunter Douglas said that for the fourth quarter, it expects

sales to be similar to that of the third quarter, and sees earnings

before interest, taxes, depreciation, and amortization in the range

of $195 million and $205 million.

For 2022, Hunter Douglas forecasts that sales and Ebitda will

grow by a mid-single-digit percentage on year, excluding the

effects of acquisitions, divestments and if markets conditions

remain unchanged. The Ebitda margin should be more than 18%, it

said.

Hunter Douglas posted sales of $3.54 billion for 2020, which was

lower than the previous year. "The 3.9% sales decrease reflects a

4.6% volume decrease, 0.4% negative currency impact, 2.8% increase

from acquisitions and 1.7% decrease from divestments," it said at

the time of the results. Ebitda, however, was up 5.4% on year at

EUR530.7 million.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

December 31, 2021 07:27 ET (12:27 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

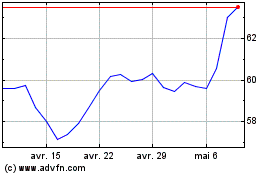

Anheuser Busch Inbev SA NV (NYSE:BUD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Anheuser Busch Inbev SA NV (NYSE:BUD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024