IBM Poised for Another Sales Slide Despite Red Hat Deal: What to Watch

16 Octobre 2019 - 11:59AM

Dow Jones News

By Asa Fitch

International Business Machines Corp. is expected to report

third-quarter earnings after the market closes Wednesday. The

results, which follow a string of quarterly revenue declines, will

be the company's first since it closed its $34 billion purchase of

open-source software giant Red Hat. Here's what to look for:

EARNINGS FORECAST: IBM is expected to report adjusted earnings

per share of $2.67, down from $3.42 a share a year earlier,

according to analysts surveyed by FactSet. Net income should be

about $2.41 billion, around 10% lower than a year earlier,

according to analysts' expectations.

REVENUE FORECAST: IBM is set to report sales of $18.22 billion,

according to analysts' expectations, down 2.8% from a year earlier.

That would be the company's fifth straight quarterly revenue

decline.

WHAT TO WATCH:

RED HAT EFFECT: IBM completed its biggest-ever acquisition in

July, snapping up Red Hat--a Raleigh, N.C.-based company best known

for its custom version of the open-source operating system

Linux--in a bid to revive its fortunes. With the deal now closed,

investors are looking for early indications of how the combination

is progressing, even if the near-term impact of deal-related

revenue deferrals and stock adjustments will be a drag on IBM's

profit. In August, IBM cut its earnings per share outlook for the

full year to $12.80 or more from an earlier projection of at least

$13.90.

CLOUD GROWTH: IBM's pitch to investors has long centered on its

embrace of cloud computing, a model where companies rent out

computing power instead of using their own machines. Investors want

to know how that strategy is playing out after the company said

annual cloud revenue rose 5% in the second quarter. That is much

slower growth than Amazon.com Inc., which dominates the cloud

market, and Microsoft Corp. IBM also hasn't reached its own

aspirations for midteen-percentage-growth rates that Chief

Financial Officer James Kavanaugh discussed in April.

MAINFRAME REFRESH: The steam is running out on sales of IBM's

latest generation of mainframe computers. In the second quarter,

revenue in the division that includes mainframes fell nearly 20%

from a year earlier as the computers it introduced in 2017 lost

some of their early sales momentum. The spotlight now is on how

much further mainframe revenues might fall, as well as the rollout

of IBM's next generation of mainframes, which the company

introduced in September. It has yet to begin selling them.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

October 16, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

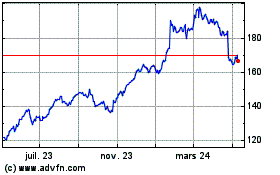

International Business M... (NYSE:IBM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

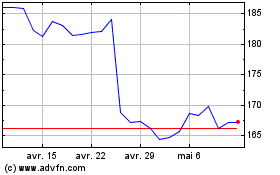

International Business M... (NYSE:IBM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024