ING 1Q Profit Plunged as Bad Loans Provisions Tripled

08 Mai 2020 - 7:52AM

Dow Jones News

By Pietro Lombardi

ING Groep NV's first-quarter net profit fell sharply as the

bank's provisions to cover potential soured loans more-than tripled

and revenue slipped.

The Dutch bank added 661 million euros ($714.2 million) to its

provisions for bad loans. For the same period last year, the figure

was EUR207 million.

The higher provisions were compounded by lower revenue, which

led to a 40% decline in quarterly net profit to EUR670 million.

Revenue fell 1.4% to EUR4.51 billion. Net interest income edged

up 0.5%, while fees and commissions grew 16%. However, investment

income collapsed, falling 86%.

ING's common equity Tier 1 ratio--a key measure of balance sheet

strength--was 14.0% at the end of the quarter compared with 14.6%

in December.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 08, 2020 01:37 ET (05:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

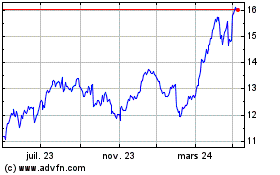

ING Groep NV (EU:INGA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

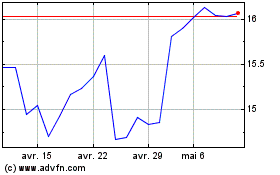

ING Groep NV (EU:INGA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024