India Is New Front on Retail War -- WSJ

21 Septembre 2018 - 9:02AM

Dow Jones News

By Corinne Abrams

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 21, 2018).

MUMBAI -- Amazon.com Inc. has upped the ante in its battle with

Walmart Inc. in India, by teaming up with a local private-equity

firm that is acquiring one of the largest retail chains in the

South Asian nation for more than $500 million.

The deal could give Amazon a claim to the more than 500 stores

of Aditya Birla Retail, which runs the More chain of supermarkets

and hypermarkets. It comes just months after Walmart paid $16

billion for a 77% stake in Flipkart, one of India's top e-commerce

sites.

Amazon said it had joined with India-based Samara Capital to

invest in Witzig Advisory Services Pvt., a company that focuses on

training and providing facilities staff.

Witzig, which is controlled by Samara, has bought a 99.99% stake

in Aditya Birla Retail, according to an announcement at the Mumbai

stock exchange Wednesday. The deal had an enterprise value of about

42 billion rupees ($583 million), a person familiar with the matter

said.

"Both Samara and Amazon see significant growth potential in the

area of facilities support and management and valued-added services

in the coming years," an Amazon spokeswoman said in a

statement.

The Amazon spokeswoman declined to comment on the financial

terms of the deal or how the company would work with More

supermarkets.

Local regulations would restrict Amazon from owning 51% or more

of a local retailer.

The deal could give Amazon an important foothold in one of the

world's last great untapped retail markets. Access to More's

customers, data and outlets could help it better understand and

deliver to India's population of around 1.3 billion people.

The Indian e-commerce market is set to exceed $100 billion by

2022, according to a report from PwC India and the National

Association of Software & Services Companies. In the groceries

market, e-commerce companies face competition from other big Indian

supermarket chains as well as millions of mom-and-pop stores that

most Indians use for their everyday needs.

Aditya Birla Retail's revenue was 41.94 billion rupees for the

year ended March 31, 2017, up from 35.09 billion rupees a year

earlier, the latest balance sheets filed with the country's

Ministry of Corporate Affairs show. The company lost 990 million

rupees in that period, compared with a loss of 1.68 billion rupees

a year earlier.

Samara executives declined or didn't respond to requests for

comment.

Amazon founder Jeff Bezos has pledged to invest $5 billion in

India, and the company looks set to go head-to head with Walmart

both online and off.

The investment in the firm that bought Aditya Birla Retail could

provide Amazon with much-needed physical space and access to an

established supply chain. It also complements the 5% stake the

Seattle-based company took in Indian department-store chain

Shoppers Stop Ltd.

"Amazon is going to be open on all the retail opportunities in

India," said Abneesh Roy, an analyst at Mumbai-based Edelweiss

Securities. "This is part of the omnichannel strategy of

Amazon."

Despite the country's large population and growing middle class,

India has long been known as a tough place to make money for global

retailers. Government restrictions, overburdened infrastructure and

surprisingly expensive retail rents make it difficult for even the

retail giants here.

The companies investing in India -- IKEA just opened its first

outlet in India last month, for example -- see it as a long-term

bet on the eventual emergence of a new consumer class and room to

grow in mobile adoption and online retail.

--Debiprasad Nayak and Rajesh Roy contributed to this

article.

Write to Corinne Abrams at corinne.abrams@wsj.com

(END) Dow Jones Newswires

September 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

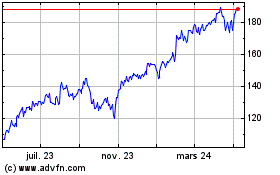

Amazon.com (NASDAQ:AMZN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

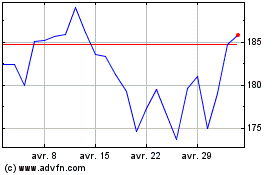

Amazon.com (NASDAQ:AMZN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024