India's Central Bank Maintains Status Quo

05 Avril 2018 - 10:33AM

RTTF2

India's central bank kept its key interest rates unchanged for

the fourth straight meeting, on Thursday, and downgraded its

inflation projections

At the first bi-monthly monetary policy session, the Monetary

Policy Committee of the Reserve Bank of India decided to hold the

repo rate at 6.00 percent, the lowest since 2010.

The reverse repo rate was retained at 5.75 percent. The bank had

lowered the rates by 25 basis points at its meeting in August

2017.

Five members including Governor Urjit Patel voted to keep rates

on hold, while Michael Patra sought a quarter point rate hike. The

MPC reiterated its commitment to keep headline inflation at 4

percent.

The central bank also slapped a ban on banks from providing

services to cryptocurrency investors. Further, the bank asked banks

to end their existing relationship with individuals and firms

dealing in cryptocurrencies within three months.

On the growth front, the bank said several factors are expected

to accelerate the pace of economic activity in 2018-19.

Citing revival in investment activity and global demand, GDP

growth is projected to strengthen to 7.4 percent in 2018-19 - in

the range of 7.3-7.4 percent in the first half and 7.3-7.6 percent

in the second half. The economy had expanded 6.6 percent in

2017-2018.

The bank revised down its inflation forecast for the first half

of 2018-19 to 4.7-5.1 percent from 5.1-5.6 percent and the outlook

for the second half to 4.4 percent from 4.5-4.6 percent.

According to the RBI, food inflation should remain under check

on the assumption of a normal monsoon and effective supply

management. On current assessment, domestic demand is expected to

strengthen during the course of the year.

With growth strengthening and core price pressures rising,

Shilan Shah at Capital Economics, said policy tightening will

commence in the second half of this year. The repo rate will be

hiked by 75 basis point to 6.75 percent over the next 12 months,

the economist said.

The central bank cautioned that rising trade protectionism and

financial market volatility could derail the ongoing global

recovery.

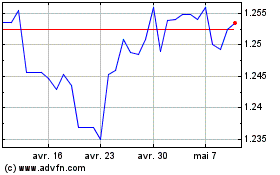

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

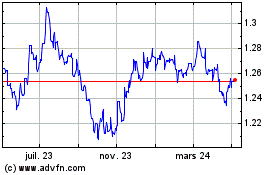

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024