Italy's UniCredit To Cut 8,000 Jobs, Launch Buybacks -- WSJ

04 Décembre 2019 - 9:02AM

Dow Jones News

By Giovanni Legorano and Pietro Lombardi

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 4, 2019).

LONDON -- Italy's largest bank, UniCredit SpA, ruled out

targeting big acquisitions as it pledged share buybacks and

dividend increases, part of a four-year plan that also includes

cuts in jobs and costs.

The bank said it would focus on growing organically amid a

challenging economic environment, after struggling to increase its

share price in comparison to peers in recent years, despite

progress under Chief Executive Jean Pierre Mustier.

UniCredit intends to cut roughly 8,000 jobs, or around 9% of the

total workforce, and close about 500 branches through 2023 as it

targets gross savings of EUR1 billion ($1.1 billion) in Western

Europe.

The plan offers an insight into the headwinds faced not just by

UniCredit but by fellow banks. Profits at Europe's largest lenders

have been dented by low rates, stringent regulation and greater

competition from U.S. rivals. Most of the region's banks are

downsizing, cutting costs or realigning their businesses as a

result.

UniCredit said it would return EUR8 billion to shareholders

through 2023, including a share buyback of EUR2 billion. This

corresponds to an increase of profit distribution to shareholders

of 40% in the next three years, rising to 50% in 2023.

Mr. Mustier said the bank prefers to use capital in this way

instead of buying other European banks. Speculation has mounted in

recent months that UniCredit was eyeing a tie-up with troubled

German lender Commerzbank AG or France's Société Générale SA

UniCredit has never commented on specific potential mergers, but

Mr. Mustier has often cast doubt on the viability of European

cross-border banking tie-ups, citing regulatory hurdles and likely

additional capital needs.

Instead, the bank prefers to buy back some of its shares, he

said Tuesday.

"In short, no M&A and that's it," he told reporters, saying

the bank would consider only "small bolt-on acquisitions" mainly in

central and Eastern Europe.

While Italian lenders have made considerable progress in

digesting the pile of bad loans accumulated during the financial

crisis, they are struggling to modernize their operations and make

their businesses leaner.

At the end of June, Italian banks owned EUR177 billion of bad

loans, or 8% of their total loans, compared with EUR350 billion, or

17% of total loans, at the end of 2016.

Their revenue is under pressure from negative rates. The

pressure to deploy liquidity induced by negative rates has

increased competition among banks to lend money. This in turn has

pushed down interest rates applied on new mortgages and company

loans.

Average interest rates charged on residential mortgages dropped

to 1.69% in August, from 2% on existing loans up to December last

year, according to estimates from consulting firm Oliver Wyman.

Interest rates on company loans dropped by 80 basis points to 1.26%

over the same period.

Lower rates on government bonds are also putting additional

pressure on banks' revenue.

Italian banks have tried in recent years to make more money

through fees and commissions on wealth and asset management, with

patchy results.

One of the few levers remaining is to cut costs. However,

Italian banks need to make large investments to improve the

digitization of their businesses and train their personnel. Oliver

Wyman estimates that almost half of Italian bank employees need to

be trained in new skills, as their business models change and the

use of new technology spreads.

UniCredit aims to increase its net profit to EUR5 billion for

2023, slightly higher than the EUR4.7 billion planned for this

year.

Earnings per share are projected to grow 12% a year, while

UniCredit aims for revenue to rise roughly 0.8% a year to EUR19.3

billion in 2023. Costs are expected to decline 0.2% a year and

reach EUR10.2 billion when the plan ends.

The bank said it doesn't plan any more large asset sales after

it agreed over the weekend to cut its stake in Turkish bank Yapi ve

Kredi Bankasi AS to below 32% from roughly 41%, aiming to simplify

its shareholding structure and boost its capital.

Over the past three years, UniCredit has sold several other

assets, including Polish lender Bank Pekao SA and asset management

firm Pioneer Investments. More recently, it sold its stakes in

online lender FinecoBank SpA and in Mediobanca SpA.

Write to Giovanni Legorano at giovanni.legorano@wsj.com and

Pietro Lombardi at Pietro.Lombardi@dowjones.com

(END) Dow Jones Newswires

December 04, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

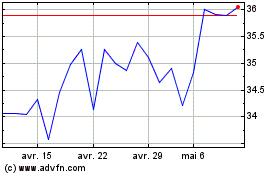

Unicredit (BIT:UCG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Unicredit (BIT:UCG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024