J&J Opposes Former Talc Supplier's Bankruptcy Plan to Resolve Cancer Claims

13 Janvier 2021 - 2:35AM

Dow Jones News

By Peg Brickley

Imerys SA is pressing ahead in an effort to get out from under

lawsuits over its U.S. mining operation, Imerys Talc America Inc.,

over the protests of health-care company Johnson & Johnson.

The Imerys talc-mining business, which supplied talc for

Johnson's Baby Powder, had been hit with lawsuits claiming the

product caused cancer. It was placed into chapter 11 protection in

2019 and sold in 2020 for $223 million, with the proceeds earmarked

for a trust to pay cancer claims. It is now trying to win court

permission to seek creditor approval of its bankruptcy repayment

plan.

Johnson & Johnson, which has denied liability and is

fighting the lawsuits, says Imerys Talc's bankruptcy is an improper

effort to immunize the mining company's French parent, and make it

easier for cancer victims to sue Johnson & Johnson.

"J&J believes in the safety of its products," said Ronit

Berkovich, a lawyer for Johnson & Johnson.

Imerys SA didn't respond to a request for comment.

Imerys Talc is putting sale proceeds, insurance policies and

funds from settlements into a trust that will pay claims for

cancer.

Victims won't get much from Imerys, court papers say. Under the

Imerys Talc plan, some ovarian cancer victims can expect to collect

only about 5% of the value that has been assigned to their claim,

for example.

Johnson & Johnson says the bankruptcy plan allowed cancer

victims to set the amount of their damages without opposition,

setting a precedent for collecting the rest of the money from

Johnson & Johnson.

Advocates of Imerys Talc's chapter 11 plan "have essentially

stolen a blank check from the purse of J&J," thanks to the way

Imerys Talc set up its bankruptcy trust, Ms. Berkovich said at a

hearing Tuesday in the U.S. Bankruptcy Court in Wilmington,

Del.

Judge Laurie Selber Silverstein presided Tuesday over the first

day of an expected series of hearings on the chapter 11 plan. She

is being asked to approve voting materials that will go to

creditors. Hearings will continue Friday.

New Brunswick, N.J.-based Johnson & Johnson, known for its

health-care and medical-device operations, said last year it would

stop selling baby powder made with talc in the U.S. and Canada, but

it remains exposed to damage claims over its talc products.

Some of the money for the proposed Imerys Talc trust is coming

by way of settlements that were reached in bankruptcy with former

owners of the mine, including Cyprus Mines Corp. and Rio Tinto

PLC.

Insurers and splinter groups of cancer victims also are

objecting to Imerys Talc's chapter 11 plan voting materials, saying

the papers have insufficient detail to allow those affected by it

to evaluate what it does to their rights.

Assuming Imerys Talc ultimately wins permission to poll

creditors on its bankruptcy plan, it would have to return to court

to get a judge's approval of the plan.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

January 12, 2021 20:20 ET (01:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

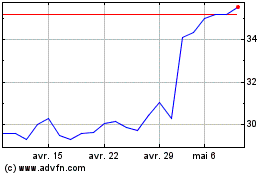

Imerys (EU:NK)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

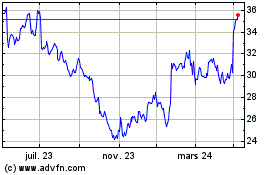

Imerys (EU:NK)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024