JPMorgan Chase's Profit Boosted by Consumer Unit -- 2nd Update

16 Juillet 2019 - 3:50PM

Dow Jones News

By David Benoit

JPMorgan Chase & Co. said Tuesday that second-quarter profit

rose 16%, with the strong performance of its consumer businesses

offsetting a slowdown across its other operations.

The nation's largest bank reported a profit of $9.65 billion, or

$2.82 a share. Analysts polled by FactSet had expected earnings of

$2.50 a share. A year earlier, the bank reported a profit of $8.32

billion, or $2.29 per share. The quarter included a large gain on

taxes that amounted to 23 cents per share.

Revenue rose to $28.83 billion from $27.75 billion a year ago,

in line with analysts' expectations for $28.84 billion.

The bank's net profit on its lending operations rose 7% to $14.4

billion, tailing off the growth in recent quarters that had been

spurred by rising interest rates.

Higher rates allow banks to charge more on loans, and the

possibility of a Federal Reserve rate cut this year has tempered

bank stocks. JPMorgan executives will be pressed later this morning

on their plans and profitability expectations if interest rates

fall, including whether aggressive spending plans will be

curtailed.

Jennifer Piepszak, the bank's new finance chief, said the

JPMorgan is now predicting three rate cuts from the Fed this year

and lowered its expectations for the lending operations. On a

conference call, she said the bank expects around $57.5 billion in

net-interest income for the full year, down from a prior estimate

of more than $58 billion, and warned the number could go lower if

there is more than one cut.

Chief Executive James Dimon said Fed rate cuts wouldn't affect

the bank's expansion plans, including branch openings and

technology spending.

JPMorgan shares were flat in premarket trading at $113.90 after

the results were announced. The stock had risen nearly 17% through

Monday, better than the KBW Bank Index but trailing the S&P

500's 20% gain.

Revenue in its non-lending businesses grew a smaller 1% to $14.4

billion as the investment-banking operations failed to keep up with

a record from last year's second quarter, falling 3%. Wall Street

executives have warned of a weak quarter for trading due to low

volatility in the markets.

JPMorgan's trading revenue was flat, but that included a

one-time gain on the bank's stake in a trading platform. Without

that gain, JPMorgan's core trading revenue declined 6% from a year

ago. Profit in the investment-banking unit fell 8%.

Consumer bank profit rose 22% to $4.17 billion, with a 38% gain

in card revenue.

The commercial bank earned $996 million, down 8%, and asset

management operations earned $719 million, down 5%.

JPMorgan's mortgage originations rose 14%, though revenue in

home lending fell.

Return on equity, a key measure of profitability, was 16% in the

second quarter, compared with 14% a year ago.

Expenses at JPMorgan have been on the rise due to the bank's

expansion its branch network and investments in technology. Total

expenses rose 2% to $16.3 billion.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

July 16, 2019 09:35 ET (13:35 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

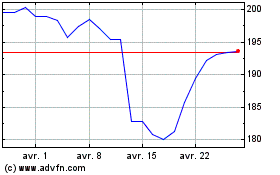

JP Morgan Chase (NYSE:JPM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

JP Morgan Chase (NYSE:JPM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024