KBC Group: Second-quarter result of 745 million euros

08 Août 2019 - 7:00AM

KBC Group: Second-quarter result of 745 million euros

Press ReleaseOutside trading hours - Regulated information

Brussels, 8 August 2019 (07.00 a.m. CEST)

KBC Group: Second-quarter result of 745 million euros

|

KBC Group - overview (consolidated, IFRS) |

2Q2019 |

1Q2019 |

2Q2018 |

1H2019 |

1H2018 |

| Net result (in millions

of EUR) |

745 |

430 |

692 |

1 175 |

1 248 |

|

Basic earnings per share (in EUR) |

1.76 |

0.98 |

1.61 |

2.75 |

2.91 |

| Breakdown of the net

result by business unit (in millions of EUR) |

|

|

|

|

|

| Belgium |

388 |

176 |

437 |

564 |

680 |

| Czech

Republic |

248 |

177 |

145 |

425 |

316 |

| International

Markets |

104 |

70 |

163 |

175 |

299 |

|

Group Centre |

4 |

7 |

-53 |

11 |

-48 |

|

Parent shareholders’ equity per share (in EUR, end of period) |

42.8 |

43.1 |

39.9 |

42.8 |

39.9 |

We generated a net profit of 745 million euros in the second

quarter of 2019. This is a good result, which – compared to the

previous quarter – benefited from increased net fee and commission

income, higher non-life insurance results, the seasonal uptick in

dividends received, lower costs (due to most of the bank taxes

being recorded in the first quarter of the year) and lower loan

loss impairment charges. On the one hand, the quarter benefited

from a number of positive one-off items, the bulk of which

concerned the 82-million-euro gain related to the acquisition of

the remaining 45% stake in the Czech building savings bank, ČMSS

(see further). On the other hand, trading and fair value income was

heavily impacted by several factors, including lower

long-term interest rates. On a comparable scope basis, our loans to

customers increased by 4% year-on-year, and deposits including debt

certificates were roughly stable (excluding debt certificates,

deposits were up 3%). Sales of our non-life and life insurance

products went up year-on-year, each by 8%. Our solvency position,

which does not include the profit for the first half of 2019,

remained strong too, with a common equity ratio of 15.6%. If we had

included the profit for the first half of the year, taking into

account the 59% dividend payout ratio of last year, our common

equity ratio would have amounted to 15.9%. Lastly, in line with our

dividend policy, we decided to pay an interim dividend of 1 euro

per share on 15 November 2019 as an advance payment on the total

dividend for 2019.

From this solid position, we are at the same

time also preparing for the future. With more and more customers

opting for digital channels, we are gradually aligning our

omni-channel distribution network with this changing customer

behaviour. As already announced, we are in the process of

converting a number of smaller branches into unstaffed ones and

closing some of the existing unstaffed branches in Flanders. At the

same time, we continue to invest in our full-service branches, in

KBC Live and in our digital channels. We also optimised our

group-wide governance model at management level and we are in the

process of further improving operational efficiency throughout the

entire organisation in order to take customer service to an even

higher level. This adaptation is essential in response to the new

environment in which organisations are expected to be more agile,

take decisions more quickly and thus continue to meet the

expectations of customers and society.

In the quarter under review, we finalised two

deals that we had announced in the previous quarter. We completed

the sale of our Irish subsidiary’s legacy portfolio of performing

corporate loans worth roughly 260 million euros, which means that

KBC Bank Ireland is now in a position to fully concentrate on its

core retail and micro SME customers. That deal had a negligible

impact on our profit and capital ratios. We also closed the

acquisition of the remaining 45% stake in the Czech building

savings bank ČMSS, for 240 million euros. That had an impact of

-0.3 percentage points on our common equity ratio. Due to the

revaluation of our existing 55% stake in ČMSS, we were able to book

a one-off gain of 82 million euros in the second quarter*. Our

Czech group company ČSOB now owns 100% of ČMSS and is thus

consolidating its position as the largest provider of financial

solutions for housing purposes in the Czech Republic.

I’d like to wrap up by repeating that we are

truly grateful for the trust that our customers place in our

company. The fact that we were named ‘Best Bank in Western Europe’

by Euromoney a few weeks ago is a clear illustration that we are

the reference in the financial sector. Rest assured that we will

remain fully committed and focused in our efforts to continue to be

the reference in customer-centric bank-insurance in all our core

countries.

Johan ThijsChief Executive Officer

Full press release en quarterly report

attached.

- 2Q2019_pb_20190808_en

- 2Q2019_Quarterly_Report_en

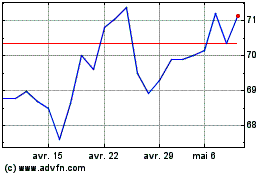

KBC Groep NV (EU:KBC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

KBC Groep NV (EU:KBC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024