Kaufman & Broad SA :DIVIDEND OF €2.10 PER SHARE TO BE PROPOSED TO THE GENERAL MEETING OF SHAREHOLDERS FOR 2017

08 Mars 2018 - 6:27PM

Press Release

PARIS, 8th of March

2018

Dividend of €2.10 per share to be

proposed

to the general meeting of shareholders

for the financial year ended 30 November 2017

The meeting of the Board of

Directors of Kaufman & Broad held on the March the 7th 2018 and

chaired by Nordine Hachemi, approved the financial statements for

the financial year ended 30 November 2017 and the payment of a

dividend of €2.10 per share to the shareholder's general meeting to

be held on 3 May at 9 am, at the hotel Hilton Paris La Défense, 2

place de La Défense, 92053 Paris La Defense.

It will be proposed to this

general meeting of shareholders to grant an option to the

shareholders of Kaufman & Broad between (i) a payment of the

whole dividend in cash, (ii) a payment of the whole dividend in new

shares or (iii) a payment of one half of the dividend in cash (i.e.

1.05 euro per share) and the other half in new shares (i.e. 1.05

euro per share). The shareholders will be entitled to only one of

the above options.

The exercise period of the option

will begin on 9 May 2018, which is the ex-dividend date, and will

end on 22 May 2018 inclusive. The dividend will be paid on 30 May

2018.

The notice of meeting will be

published in the BALO on 26 March 2018 and the draft resolutions

will be posted on the Company's website the latest on 12 April

2018.

This release is

available on the www.kaufmanbroad.fr website

Contacts

Chief Financial Officer

Bruno Coche

01 41 43 44 73

Infos-invest@ketb.com

|

Media Relations: |

Hopscotch Capital: Violaine Danet

01 58 65 00 77/ k&b@hopscotchcapital.fr

Kaufman & Broad: Emmeline

Cacitti

06 72 42 66 24 / ecacitti@ketb.com |

About Kaufman

& Broad - Kaufman & Broad has been designing,

building, and selling single-family homes in communities,

apartments, and offices on behalf of third parties for 50 years.

Kaufman & Broad is one of the leading French Property

Development & Construction companies due to the combination of

its size and profitability, and the strength of its brand.

The Kaufman &

Broad Registration Document was filed with the French Financial

Markets Authority ("AMF") under No. D.17.0286 on March 31, 2017. It

is available on the AMF (www.amf-france.org)

and Kaufman & Broad (www.kaufmanbroad.fr)

websites. It contains a detailed description of Kaufman &

Broad's business activities, results, and prospects, as well as of

the related risks factors. Kaufman & Broad specifically draws

attention to the risk factors set out in Chapter 1.2 of the

Registration Document. The materialization of one or several of

these risks may have a material adverse impact on the Kaufman &

Broad Group's business activities, net assets, financial position,

results, and outlook, as well as on the price of Kaufman &

Broad's shares.

This press release does not amount to, and cannot

be construed as amounting to a public offering, a sale offer or a

subscription offer, or as intended to seek a purchase or

subscription order in any country.

DIVIDEND OF €2.10 PER SHARE TO BE

PROPOSED TO THE AGM

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Kaufman & Broad SA via Globenewswire

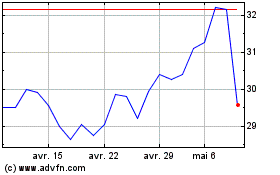

Kaufman and Broad (EU:KOF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kaufman and Broad (EU:KOF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024