Kaufman & Broad SA : TERMINATION AND IMPLEMENTATION OF A LIQUIDITY AGREEMENT

19 Octobre 2018 - 6:04PM

Paris, October 19th

2018

TERMINATION AND IMPLEMENTATION OF A

LIQUIDITY AGREEMENT

As of October 22nd, 2018 and for a

period of one year automatically renewable, Kaufman & Broad SA

requested the financial institution Rothschild Martin Maurel to

implement a liquidity contract in with the provisions of the legal

framework in force, and in particular the provisions of Regulation

(EU) No 596/2014 of the European Parliament and Council of 16 April

2014 especially its articles 5 and 13, the provisions of articles

L. 225-209 and following of the Commercial Code, as well as the

French Financial Market Autority (AMF) decision of March

21st, 2011.

As of October 19th, 2018, the

liquidity contract was terminated by the Company Kaufman &

Broad SA to Kepler Cheuvreux, contract signed originally on

August 1st ,2016.

To date, the following assets were

in the liquidity account:

For the implementation of this

contract, the following resources have been allocated to the

liquidity account:

It is recalled that at the last

biannual report (June 30th, 2018), the

following resources were in the liquidity account:

This press release

is available at www.kaufmanbroad.fr

Contacts

Chief Financial

Officer

Bruno Coche

01 41 43 44 73

infos-invest@ketb.com

|

Press Relations |

Media relations: Hopscotch Capital: Violaine Danet

01 58 65 00 77 / k&b@hopscotchcapital.fr

Kaufman & Broad: Emmeline Cacitti

06 72 42 66 24 / ecacitti@ketb.com |

About Kaufman

& Broad - Kaufman & Broad has been designing,

building, and selling single-family homes in communities,

apartments, and offices on behalf of third parties for 50 years.

Kaufman & Broad is one of the leading French

developers-builders due to the combination of its size and

profitability, and the strength of its brand.

The Kaufman &

Broad Registration Document was filed with the French Financial

Markets Authority ("AMF") under No. D.18 0226 on March 29,

2018. It is available on the AMF (www.amf-france.org) and Kaufman & Broad (www.kaufmanbroad.fr) websites. It contains a detailed description of Kaufman

& Broad's business activities, results, and outlook, as well as

the associated risk factors. Kaufman & Broad specifically draws

attention to the risk factors set out in Chapter 1.2 of the

Registration Document. The occurrence of one or more of these risks

may have a material adverse effect on the Kaufman & Broad

Group's business activities, net assets, financial position,

results, and outlook, as well as on the price of Kaufman &

Broad's shares.

This press release does not amount to, and cannot

be construed as amounting to a public offering, a sale offer or a

subscription offer, or as intended to seek a purchase or

subscription order in any country.

TERMINATION AND IMPLEMENTATION OF A

LIQUIDITY AGREEMENT

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Kaufman & Broad SA via Globenewswire

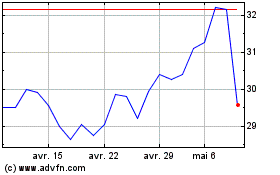

Kaufman and Broad (EU:KOF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kaufman and Broad (EU:KOF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024