Klépierre S.A.

19 March 2018

THIS ANNOUNCEMENT CONTAINS INSIDE

INFORMATION

NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION

THIS ANNOUNCEMENT DOES NOT

CONSTITUTE AN ANNOUNCEMENT OF A FIRM INTENTION TO MAKE AN OFFER

UNDER RULE 2.7 OF THE CITY CODE ON TAKEOVERS AND MERGERS (THE

"CODE").

19 March 2018

Klépierre S.A.

("Klépierre")

Statement

regarding Hammerson plc ("Hammerson")

Klépierre notes the recent

speculation regarding a proposal made by Klépierre to

Hammerson.

Klépierre confirms that on 8 March

2018, Klépierre made a proposal on a non-adversarial basis to the

Board of Hammerson with the intention of engaging in a constructive

dialogue regarding a possible offer to acquire the issued and to be

issued share capital of Hammerson on a standalone basis at a value

of 615 pence per Hammerson ordinary share (the "Proposal").

The Proposal represents a premium

of approximately 40.7% to the closing price of 437.10 pence per

Hammerson ordinary share on 16 March 2018, and the consideration

would comprise a combination of cash and shares in Klépierre.

The Board of Hammerson rejected

the Proposal in less than 24 hours on 9 March 2018.

The Proposal does not constitute

an offer or impose any obligation on Klépierre to make an offer,

nor does it evidence a firm intention to make an offer within the

meaning of the Code. Accordingly, there can be no certainty that

any offer will be made.

A further announcement will be

made if and when appropriate.

Rule 2.6(a) of the Code requires

that Klépierre, by not later than 5.00 p.m. on 16 April 2018,

either announces a firm intention to make an offer for Hammerson in

accordance with Rule 2.7 of the Code or announces that it does not

intend to make an offer, in which case the announcement will be

treated as a statement to which Rule 2.8 of the Code applies. This

deadline can be extended with the consent of the Panel in

accordance with Rule 2.6(c) of the Code.

This announcement is being made

without the approval of Hammerson.

Klépierre reserves the following

rights:

-

To reduce the offer consideration by the amount

of any dividend or other distribution or return of capital which is

paid or becomes payable by Hammerson after the date of this

announcement, other than the 2017 final dividend of 14.8 pence per

Hammerson ordinary share payable on 26 April 2018 to Hammerson

shareholders on the register at the close of business on 16 March

2018;

-

To introduce other forms of consideration and /

or to vary the composition of the consideration;

-

To implement the transaction through or together

with a subsidiary of Klépierre or a company which will become a

subsidiary of Klépierre; and

-

To make an offer for Hammerson at any time on

less favourable terms:

Enquiries

Klépierre

Julien

Goubault

+33 (0) 1 40 67 51 85

Hubert

d'Aillières

+33 (0) 1 40 67 51 37

Goldman Sachs

International

Nick Harper

+44 (0) 20 7774 1000

Charlie Lytle (Corporate Broking)

Citigroup Global Markets

Limited

Jan Skarbek

+44 (0) 20 7986 4000

Robert Redshaw (Corporate Broking)

Brunswick Group LLP

Tim

Danaher

+44 (0) 20 7404 5959

Benoit

Grange

+33 (0) 1 53 96 83 83

A copy of this announcement will

be made available, subject to certain restrictions relating to

persons resident in restricted jurisdictions, on Klépierre's

website at www.klepierre.com by no later than noon (London time) on

the business day following this announcement. The content of this

website is not incorporated into and does not form part of this

announcement.

The closing prices for Hammerson

ordinary shares are the closing middle market quotations derived

from the London Stock Exchange Daily Official List.

Goldman Sachs International, which

is authorised by the Prudential Regulation Authority and regulated

by the Financial Conduct Authority and the Prudential Regulation

Authority in the United Kingdom, is acting for Klépierre and no one

else in connection with the matters described in this announcement

and will not be responsible to anyone other than Klépierre for

providing the protections afforded to clients of Goldman Sachs

International, or for giving advice in connection with the matters

described in this announcement or any matter referred to

herein.

Citigroup Global Markets Limited

("Citi"), which is authorised by the Prudential Regulation

Authority and regulated in the UK by the Financial Conduct

Authority and the Prudential Regulation Authority, is acting for

Klépierre and no one else in connection with the matters described

in this announcement and shall not be responsible to anyone other

than Klépierre for providing the protections afforded to clients of

Citigroup Global Markets Limited, or for giving advice in

connection with the matters described in this announcement or any

matter referred to therein.

Important

information for U.S. shareholders

Hammerson is a public limited

company incorporated in England. If an offer is made it will be

subject to disclosure requirements under English law, which are

different to those of the United States. In addition, if an offer

is made it will be subject to United States Federal securities laws

promulgated under Section 14(e) of the Securities Exchange Act of

1934, as amended but other rules applicable to certain US tender

offers made in the United States do not apply, including those

rules promulgated under Section 14(d) of the Securities Exchange

Act of 1934.

Klépierre and its affiliates or

brokers (acting as agents for Klépierre or its affiliates, as

applicable) may from time to time, and other than pursuant to any

offer for Hammerson that is commenced, directly or indirectly,

purchase, or arrange to purchase outside the United States, shares

in Hammerson or any securities that are convertible into,

exchangeable for or exercisable for such shares before or during

the period in which any offer remains open for acceptance, to the

extent permitted by, and in compliance with, Rule 14e-5 under the

U.S. Exchange Act and in compliance with the Code. These purchases

may occur either in the open market at prevailing prices or in

private transactions at negotiated prices. Information about any

such purchases or arrangements to purchase that is made public in

accordance with English law and practice will be available to all

investors (including in the United States) via the Regulatory News

Service on www.londonstockexchange.com.

If any offer for Hammerson is

consummated, the transaction may have consequences under U.S.

federal income tax and applicable U.S. state and local, as well as

foreign and other, tax laws. Each shareholder is urged to consult

his or her independent professional adviser regarding the tax

consequences of any offer.

Disclosure

requirements of the Code

Under Rule 8.3(a) of the Code, any

person who is interested in 1% or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the offer period and, if later, following the

announcement in which any securities exchange offeror is first

identified. An Opening Position Disclosure must contain details of

the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s). An Opening

Position Disclosure by a person to whom Rule 8.3(a) applies must be

made by no later than 3.30 pm (London time) on the 10th business

day following the commencement of the offer period and, if

appropriate, by no later than 3.30 pm (London time) on the 10th

business day following the announcement in which any securities

exchange offeror is first identified. Relevant persons who deal in

the relevant securities of the offeree company or of a securities

exchange offeror prior to the deadline for making an Opening

Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any

person who is, or becomes, interested in 1% or more of any class of

relevant securities of the offeree company or of any securities

exchange offeror must make a Dealing Disclosure if the person deals

in any relevant securities of the offeree company or of any

securities exchange offeror. A Dealing Disclosure must contain

details of the dealing concerned and of the person's interests and

short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s), save to the extent that these

details have previously been disclosed under Rule 8. A Dealing

Disclosure by a person to whom Rule 8.3(b) applies must be made by

no later than 3.30 pm (London time) on the business day following

the date of the relevant dealing.

If two or more persons act

together pursuant to an agreement or understanding, whether formal

or informal, to acquire or control an interest in relevant

securities of an offeree company or a securities exchange offeror,

they will be deemed to be a single person for the purpose of Rule

8.3.

Opening Position Disclosures must

also be made by the offeree company and by any offeror and Dealing

Disclosures must also be made by the offeree company, by any

offeror and by any persons acting in concert with any of them (see

Rules 8.1, 8.2 and 8.4).

Details of the offeree and offeror

companies in respect of whose relevant securities Opening Position

Disclosures and Dealing Disclosures must be made can be found in

the Disclosure Table on the Takeover Panel's website at

www.thetakeoverpanel.org.uk, including details of the number of

relevant securities in issue, when the offer period commenced and

when any offeror was first identified. You should contact the

Panel's Market Surveillance Unit on +44 (0)20 7638 0129 if you are

in any doubt as to whether you are required to make an Opening

Position Disclosure or a Dealing Disclosure.

Forward looking

statements

This announcement (including

information incorporated by reference in this announcement), oral

statements made regarding the Proposal, and other information

published by Klépierre may contain statements which are, or may be

deemed to be, "forward-looking statements". Forward-looking

statements are prospective in nature and are not based on

historical facts, but rather on current expectations and

projections of the management of Klépierre about future events, and

are therefore subject to risks and uncertainties which could cause

actual results to differ materially from the future results

expressed or implied by the forward-looking statements. Any

forward-looking statements contained in this announcement include

statements relating to the expected effects of the Proposal on

Klépierre and Hammerson, the expected timing and scope of the

Proposal and other statements other than historical facts. Often,

but not always, forward-looking statements can be identified by the

use of forward-looking words such as "plans", "expects" or "does

not expect", "is expected", "is subject to", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "should", "would", "might" or "will" be taken, occur or be

achieved. Although Klépierre believes that the expectations

reflected in such forward-looking statements are reasonable,

Klépierre can give no assurance that such expectations will prove

to be correct. By their nature, forward looking statements involve

risk and uncertainty because they relate to events and depend on

circumstances that will occur in the future. There are a number of

factors that could cause actual results and developments to differ

materially from those expressed or implied by such forward-looking

statements. Such forward-looking statements should therefore be

construed in the light of such factors. Neither Klépierre nor any

of its associates or directors, officers or advisers, provides any

representation, assurance or guarantee that the occurrence of the

events expressed or implied in any forward-looking statements in

this announcement will actually occur. You are cautioned not to

place undue reliance on these forward-looking statements. Other

than in accordance with their legal or regulatory obligations,

Klépierre is under no obligation, and Klépierre expressly disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

No statement in this announcement

is intended as a profit forecast or profit estimate.

Inside

information

Pursuant to the commission

implementing regulation (EU) 2016/1055 of 29 June 2016 laying down

implementing technical standards with regard to the technical means

for appropriate public disclosure of inside information and for

delaying the public disclosure of inside information in accordance

with Regulation (EU) No 596/2014 of the European Parliament and of

the Council, this press release may contain inside information and

has been sent to the authorized broadcaster of Klépierre on 19

March 2018 at 8.00am CET.

Rule 2.9 of the

Code

For the purposes of Rule 2.9 of

the Code, Klépierre confirms that it has in issue 314,356,063

shares of €1.40 each. The ISIN for the shares is FR0000121964.

Klépierre_Hammerson_Announcement_20180319_EN

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Klépierre via Globenewswire

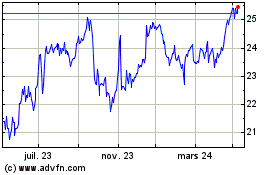

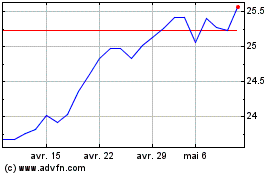

Klepierre (EU:LI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Klepierre (EU:LI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024